Get the free FASB (Financial Accounting Standard Board) - institutionalmemory iu

Show details

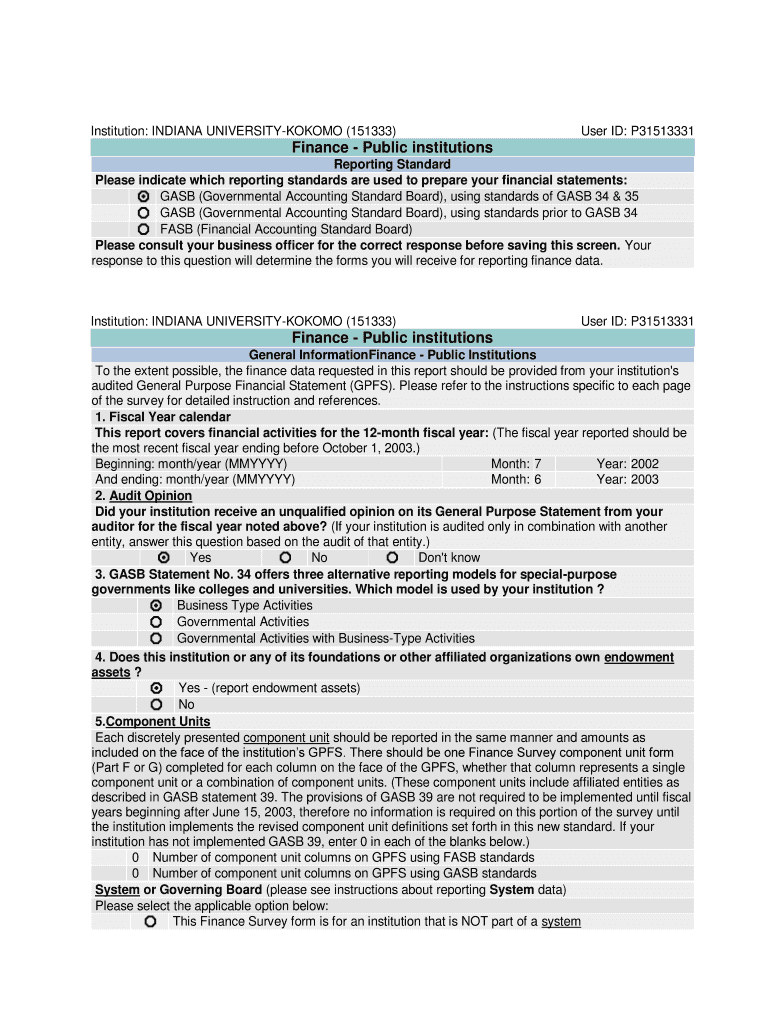

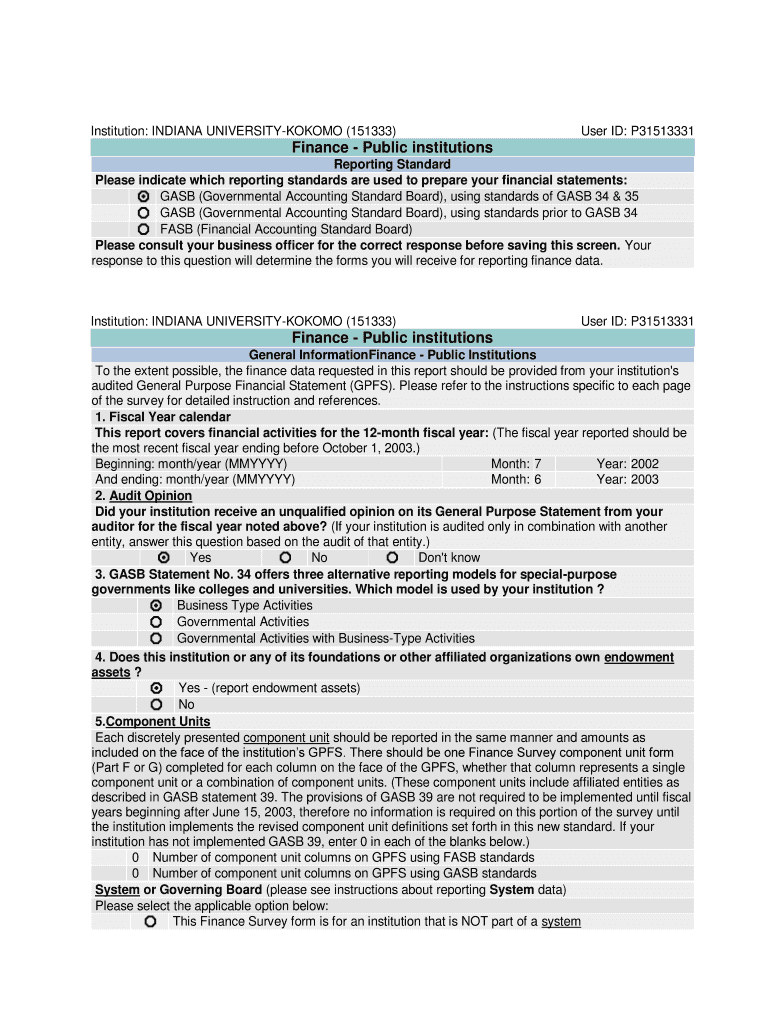

Institution: INDIANA UNIVERSITY-KOKOMO (151333) User ID: P31513331 Finance Public institutions Reporting Standard Please indicate which reporting standards are used to prepare your financial statements:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fasb financial accounting standard

Edit your fasb financial accounting standard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fasb financial accounting standard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fasb financial accounting standard online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fasb financial accounting standard. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fasb financial accounting standard

How to fill out fasb financial accounting standard?

01

Familiarize yourself with the specific FASB financial accounting standard you need to fill out. Understand its purpose, scope, and requirements.

02

Gather all the relevant financial information and documents that are necessary to complete the standard. This may include balance sheets, income statements, cash flow statements, and other financial records.

03

Review the instructions provided by FASB regarding the completion of the standard. Pay close attention to any specific guidelines or templates that need to be followed.

04

Begin filling out the standard by providing accurate and relevant information in the designated sections. Ensure that all the required fields are completed and double-check for any errors or omissions.

05

If there are any calculations or computations involved, make sure they are done accurately. Utilize proper accounting principles and techniques to ensure the integrity of the data provided.

06

Provide any necessary supporting documentation or explanations as required by the standard. This can include footnotes, disclosures, or additional information that helps clarify the financial information provided.

07

Review the completed form before submission. Cross-reference it with the instructions and guidelines to ensure compliance and accuracy.

08

If necessary, seek assistance or guidance from accounting professionals or experts to ensure the correct completion of the FASB financial accounting standard.

Who needs FASB financial accounting standard?

01

Publicly traded companies: FASB standards are designed to ensure transparency and accuracy in financial reporting. Publicly traded companies are required to adhere to these standards to provide reliable financial information to shareholders, investors, and regulatory authorities.

02

Financial institutions: Banks, credit unions, insurance companies, and other financial institutions that deal with monetary transactions rely on FASB standards to maintain consistent and standardized accounting practices.

03

Non-profit organizations: Even though non-profit organizations may not have shareholders or investors, they still need to maintain proper financial records. FASB standards help non-profit organizations demonstrate accountability and fulfill reporting requirements to donors, grantors, and other stakeholders.

04

Government entities: Various governmental agencies and departments need to follow FASB standards to maintain transparency and accuracy in their financial operations. This ensures that taxpayers' money is managed appropriately and accounted for correctly.

05

Professional accountants and auditors: Accountants and auditors use FASB standards as a reference to assess the financial statements and records of different entities. They need to be familiar with these standards to provide accurate advice, guidance, and auditing services to their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fasb financial accounting standard directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fasb financial accounting standard along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I sign the fasb financial accounting standard electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your fasb financial accounting standard in seconds.

How do I complete fasb financial accounting standard on an Android device?

Use the pdfFiller app for Android to finish your fasb financial accounting standard. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is fasb financial accounting standard?

The FASB (Financial Accounting Standards Board) financial accounting standard is a set of guidelines and rules that govern how financial statements are prepared and presented.

Who is required to file fasb financial accounting standard?

All public companies in the United States are required to follow FASB financial accounting standards.

How to fill out fasb financial accounting standard?

FASB financial accounting standards can be filled out by following the guidelines provided in the standard itself, as well as any additional instructions or interpretations issued by the FASB.

What is the purpose of fasb financial accounting standard?

The purpose of FASB financial accounting standards is to ensure that financial reporting is transparent, reliable, and comparable across different companies.

What information must be reported on fasb financial accounting standard?

Information such as assets, liabilities, equity, income, expenses, and cash flows must be reported on FASB financial accounting standards.

Fill out your fasb financial accounting standard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fasb Financial Accounting Standard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.