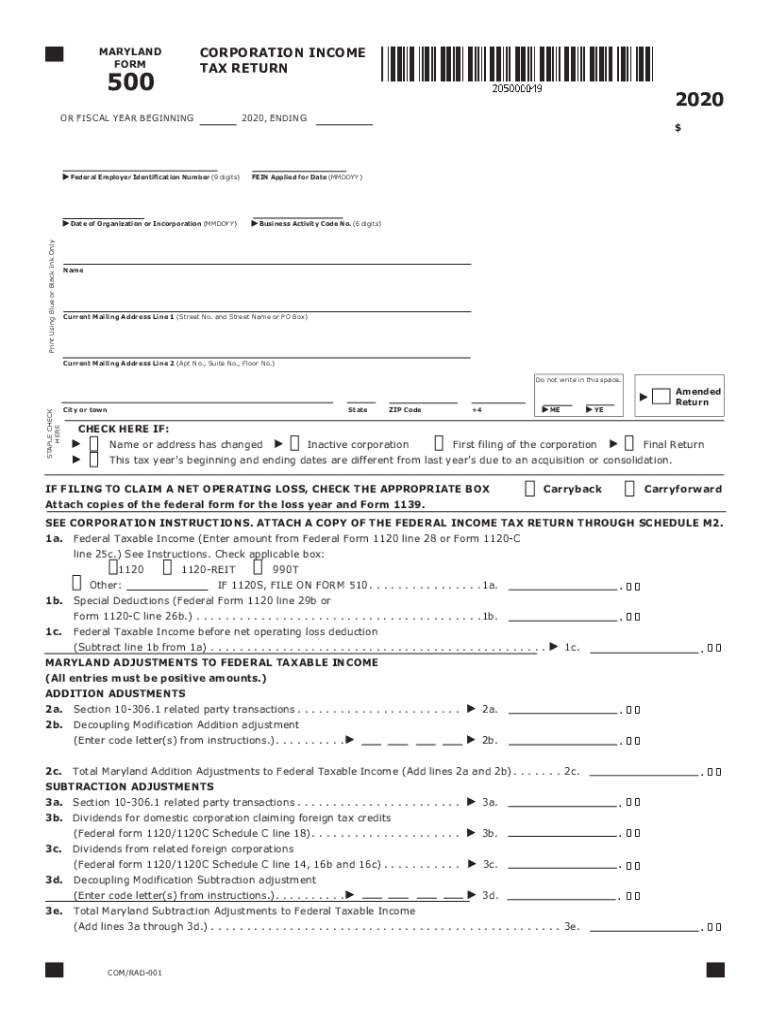

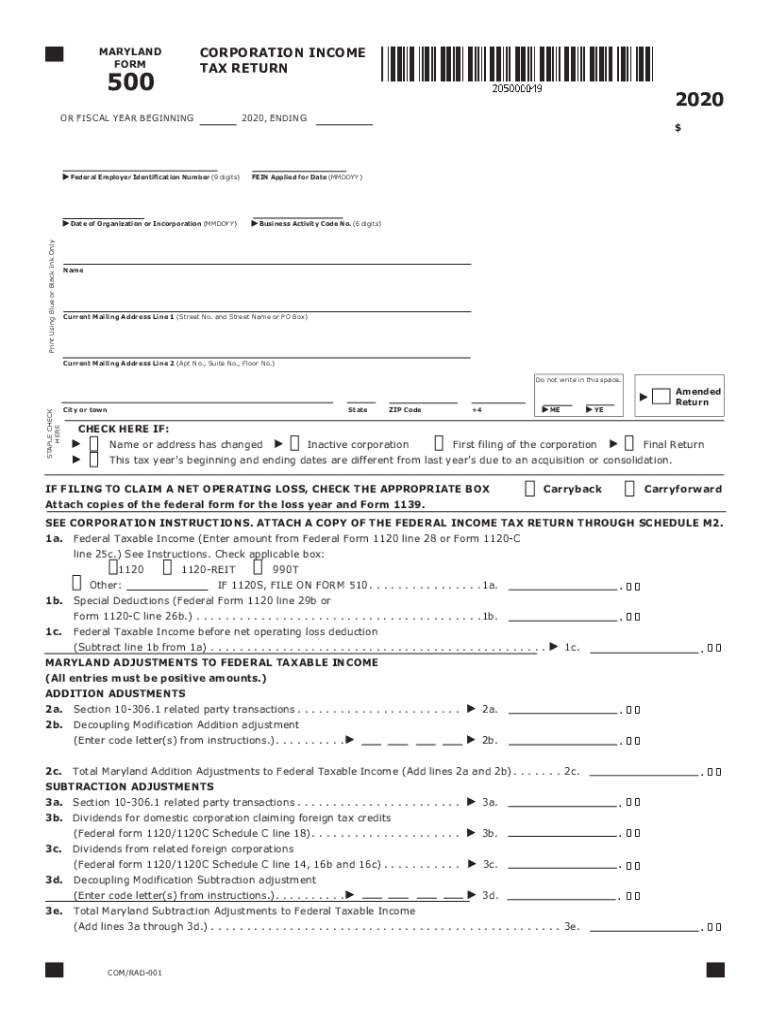

MD Form 500 2020 free printable template

Get, Create, Make and Sign 2020 md form 500

Editing 2020 md form 500 online

Uncompromising security for your PDF editing and eSignature needs

MD Form 500 Form Versions

How to fill out 2020 md form 500

How to fill out MD Form 500

Who needs MD Form 500?

Instructions and Help about 2020 md form 500

Laws dot-com legal forms guide form 500 individual income tax return those who owe income tax to Georgia as full year or part year residents or as non-residents can file using a form 500 you should first consult the qualifications for the short form 500 easy documents to see if you are eligible to use that form instead both documents are found on the website of the Georgia Department of Revenue step 1 at the top of the form enter the beginning and ending dates of your fiscal year if you do not file on a calendar year basis step 2 give your name and social security number as well as that of your spouse if filing a joint return step 3 give your full address and check the box if this has changed since your last return step 4 in box 4 enter 1 if a full year resident — if a part year resident and 3 if a non-resident part year residents should enter the dates of their residency in the state part year residents and non-residents cannot complete lines 9 through 14 below and must complete Schedule C on the 6th page and transfer the results from there to line 15 step 5 indicate your filing status on line 5 steps 6 enter the number of exemptions claimed on line 6 step 7 in section 7 give the name social security number and relationship to you of all dependents total your dependents on line 7a add these to the exemptions on line 6 and enter the total on line 7b step 8 follow instructions on lines 8 through 10 to determine your state adjusted gross income step 9 standard deductions are claimed on line 11 while itemized deductions are claimed on line 12 whichever you claim subtracted from line 10 and enter the difference on line 13 step 10 follow instructions on lines 14 through 36 to calculate your balance owed or refund do step 11 sign and date the bottom of the third page and provide your telephone number to watch more videos please make sure to visit laws comm

People Also Ask about

Who must file Maryland form 510?

Why would I get a letter from the Comptroller of Maryland?

What is Maryland Form 510?

What is form 500 for with Maryland?

What is the Maryland minimum filing requirement?

Who must file a Maryland state tax return?

What is Maryland Form 515?

How do I get my Maryland state tax transcript?

Who must file a Maryland non resident tax return?

Where do I mail my MD Form 500?

Do I need to file a Maryland nonresident return?

What is Maryland Schedule K 1 510?

Who must file Maryland Form 510?

What is a MD form 515?

What is a Maryland 502 form?

Who is subject to Maryland income tax law?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2020 md form 500 directly from Gmail?

How can I send 2020 md form 500 for eSignature?

How can I fill out 2020 md form 500 on an iOS device?

What is MD Form 500?

Who is required to file MD Form 500?

How to fill out MD Form 500?

What is the purpose of MD Form 500?

What information must be reported on MD Form 500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.