Get the free than $250 , 000 at the end of the ear

Show details

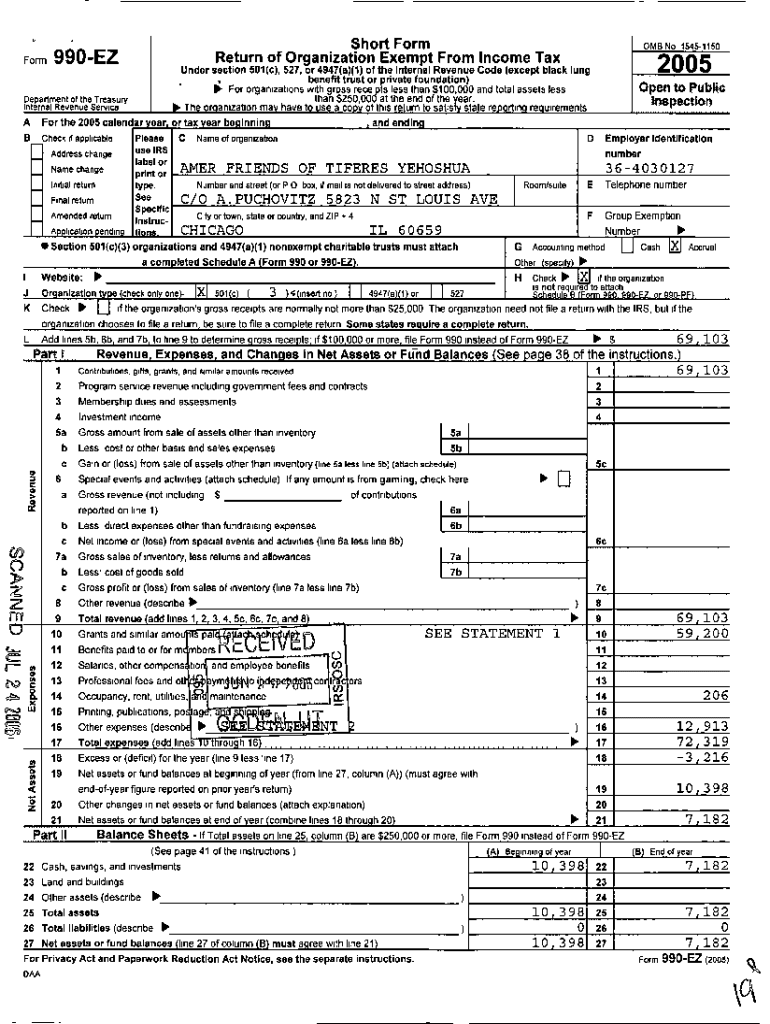

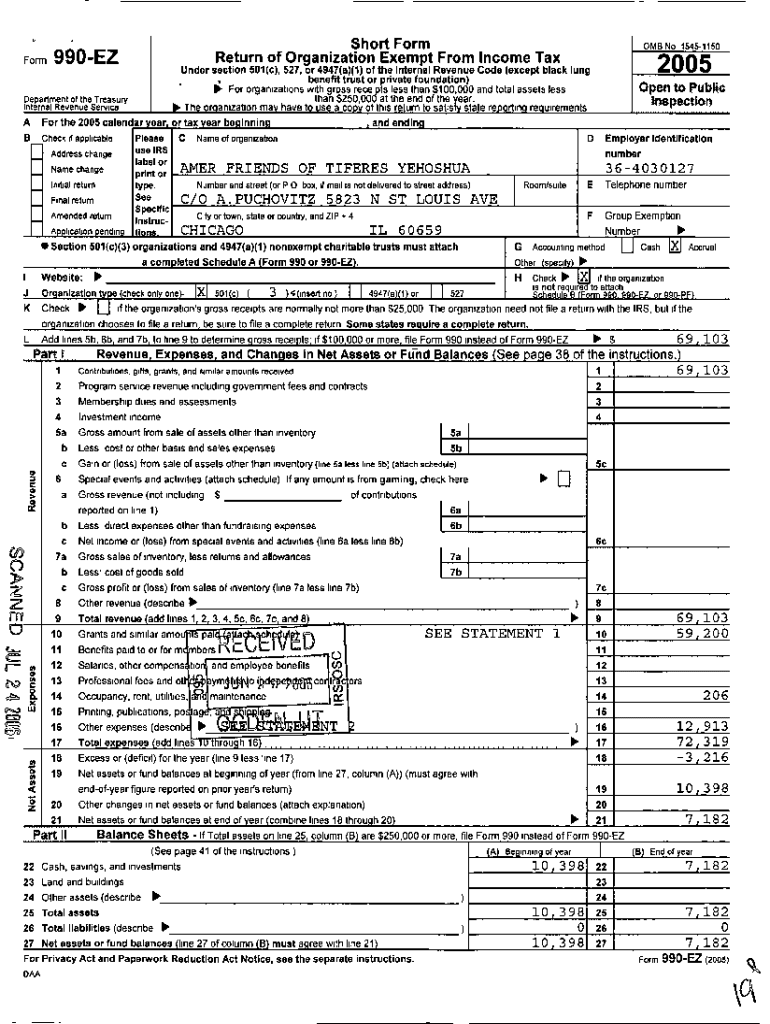

Form Short Form Return of Organization Exempt From Income Tax990 EZ OMB No 15451150205Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign than 250 000 at

Edit your than 250 000 at form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your than 250 000 at form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing than 250 000 at online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit than 250 000 at. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out than 250 000 at

How to fill out than 250 000 at

01

Start by gathering all the necessary documents such as income statements, tax returns, and any other financial documents that may be required.

02

Research and compare different loan options available from banks, credit unions, or other lending institutions.

03

Determine the loan amount needed, in this case, more than 250,000.

04

Fill out the loan application form accurately and completely, providing all the required information.

05

Submit the completed application along with the necessary documents to the chosen lending institution.

06

Wait for the loan officer to review your application and documents.

07

If approved, carefully review the terms and conditions of the loan agreement before signing.

08

Fulfill any additional requirements or conditions specified by the lender, such as providing collateral or guarantors.

09

Receive the loan funds once all the necessary requirements are met.

10

Repay the loan according to the agreed-upon terms, including the principal amount plus any interest and fees.

Who needs than 250 000 at?

01

Business owners who require significant capital for expansion or investment.

02

Entrepreneurs who are starting a new business and need startup funds.

03

Individuals looking to make a large purchase, such as buying a property or investment.

04

People facing unexpected medical expenses or emergencies where a large sum of money is required.

05

Students pursuing higher education and need funding for tuition fees and living expenses.

06

Individuals planning major renovations or home improvements that require substantial funds.

07

Those seeking to consolidate existing debts into a single loan with more favorable terms.

08

Investors looking to finance a new project or venture.

09

Governments or organizations requiring funds for infrastructure development or public projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit than 250 000 at from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like than 250 000 at, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute than 250 000 at online?

Filling out and eSigning than 250 000 at is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out than 250 000 at using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign than 250 000 at and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is than 250 000 at?

The term 'than 250 000 at' does not appear to be a recognized financial or tax document. More context may be needed to provide an accurate description.

Who is required to file than 250 000 at?

Without clarification on what 'than 250 000 at' refers to, it is difficult to determine who is required to file it. Generally, specific tax forms need to be filed by individuals or entities that meet certain income or activity thresholds.

How to fill out than 250 000 at?

Instructions for filling out 'than 250 000 at' cannot be provided without knowing exactly what document it refers to. Usually, tax forms have detailed instructions on how to complete them based on the information requested.

What is the purpose of than 250 000 at?

The purpose of 'than 250 000 at' is unclear without further details. Typically, tax documents serve to report income, claim deductions, and calculate tax liability.

What information must be reported on than 250 000 at?

Without additional context about 'than 250 000 at', it is impossible to specify what information must be reported. Tax forms generally require details about income, deductions, and other financial aspects.

Fill out your than 250 000 at online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Than 250 000 At is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.