Get the free gr form

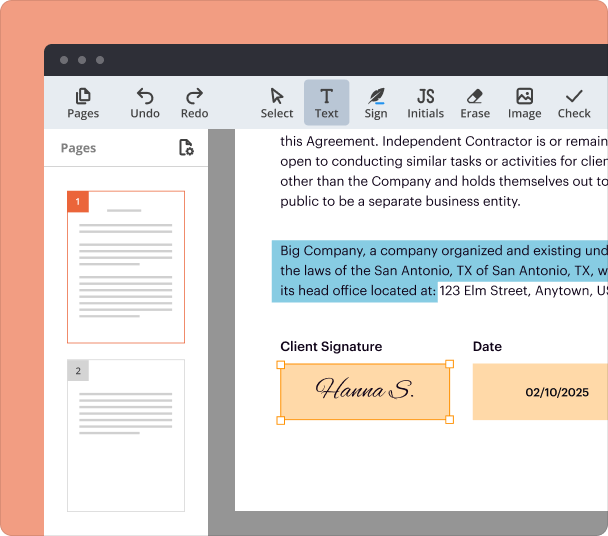

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

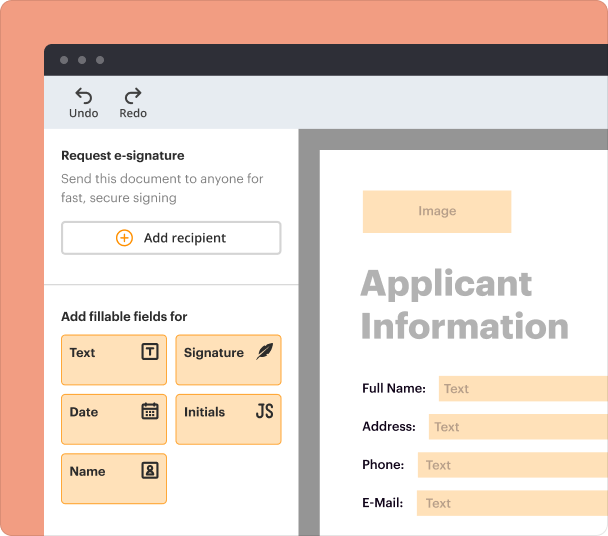

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

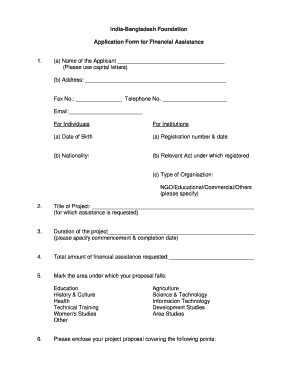

The ultimate guide to understanding the GR form and its significance

How to fill out a GR form?

Filling out a GR form involves carefully completing each section to ensure compliance with export regulations. This document is essential for exporters to remit funds abroad securely. Utilize tools available on pdfFiller for easy editing and signing.

Understanding GR form & GR waiver

The GR form serves a crucial role in export documentation, primarily allowing exporters to remit payments to overseas parties efficiently. The Guaranteed Remittance Waiver (GR Waiver) further enhances this process by offering significant advantages to Indian exporters.

-

The GR form is a mandatory document under the Foreign Exchange Management Act, 1999, required for exports.

-

It serves to ensure that exporters comply with foreign exchange regulations.

-

To obtain a GR Waiver, exporters must meet specific criteria set by the Reserve Bank of India.

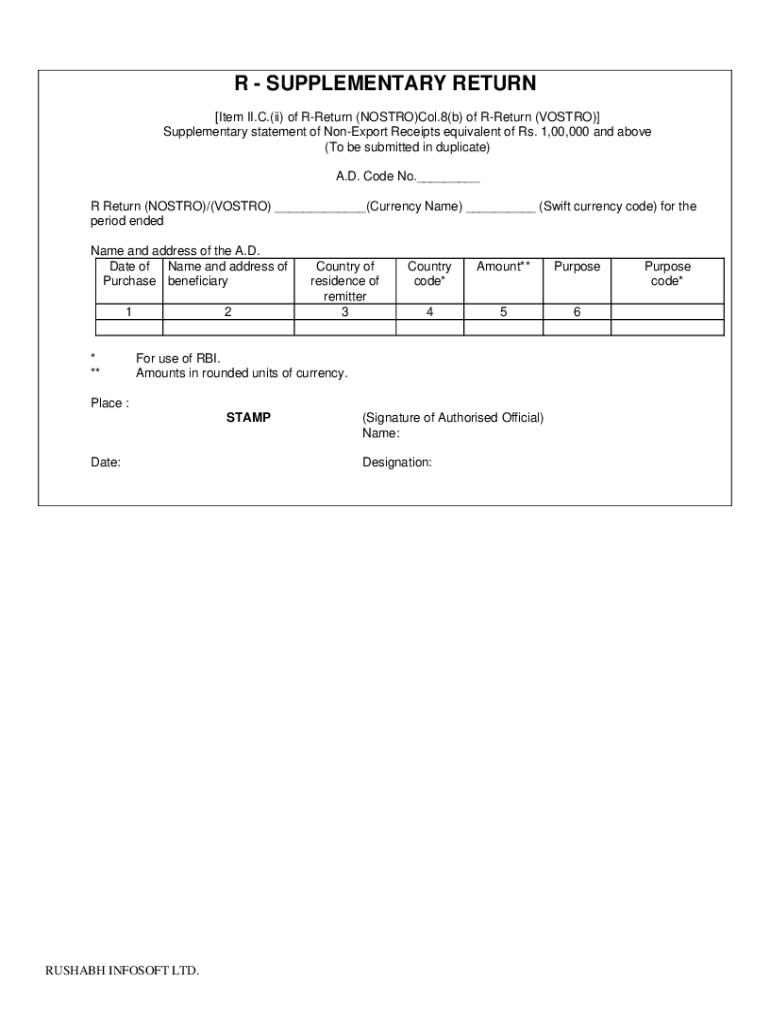

What are the key sections of the GR form?

Every exporter must pay attention to the various sections of the GR form. Correctly filling fields such as the Authorised Dealer (A.D.) Code, Currency Name, and Swift Code is vital for the timely processing of the document.

-

This code identifies the bank managing the foreign exchange transaction.

-

Accurately stating the currency used helps in proper remittance.

-

These may be required for Non-Export Receipts to clarify the purpose of funds.

How does the GR form differ from SOFTEX and related forms?

The GR form and SOFTEX are both crucial in the export documentation process, but they cater to different needs. SOFTEX is specifically designed for software exports, whereas the GR form encompasses all types of goods.

-

While the GR form is broader, SOFTEX applies solely to software and IT-enabled services.

-

Forms like BAF and CAF are used in tandem with the GR form to ensure compliance.

-

Selecting the correct form based on product type prevents regulatory issues.

What are the steps to complete a GR form?

To ensure accuracy when filling out a GR form, follow a structured approach. This includes utilizing pdfFiller’s tools for easy editing and signing.

-

Gather all necessary information including A.D. Code and transaction details.

-

Fill out the GR form accurately, paying close attention to each section.

-

Review your entries to avoid common mistakes.

What are essential guidelines for managing export documentation?

Export documentation requires meticulous management to ensure compliance. This encompasses understanding relevant documentation in conjunction with the GR Form and benefits from using tools like those offered by pdfFiller.

-

Familiarize yourself with documents needed before exporting, such as invoices and shipping documents.

-

Utilize pdfFiller’s features for real-time collaboration with team members.

-

Ensure all supporting documents accompany the GR form for smooth processing.

How to navigate export risks and solutions?

Engaging in the export business can expose companies to various risks. Successful exporters implement strategies to mitigate these risks, ensuring thorough documentation plays a pivotal role in safeguarding against challenges.

-

Delays in documentation and non-compliance with regulatory requirements.

-

Setting up compliance checks and continuous training for staff on regulatory updates.

-

Accurate and complete documentation is crucial to avoid legal complications.

Frequently Asked Questions about Gr Form

What is the GR form?

The GR form is a mandatory document required for the export of goods, ensuring compliance with foreign exchange regulations in India.

Who needs to fill out the GR form?

Any exporter wishing to remit payments for goods exported must complete the GR form to comply with the Foreign Exchange Management Act.

Why is the GR Waiver important?

The GR Waiver allows eligible Indian exporters to remit money without restrictions, improving cash flow and business operations.

What are typical mistakes to avoid on the GR form?

Common mistakes include providing incorrect A.D. Codes and incomplete information, which can delay processing and compliance checks.

pdfFiller scores top ratings on review platforms