Get the free INHERITED IRA SCHEDULED PAYMENT ELECTION

Show details

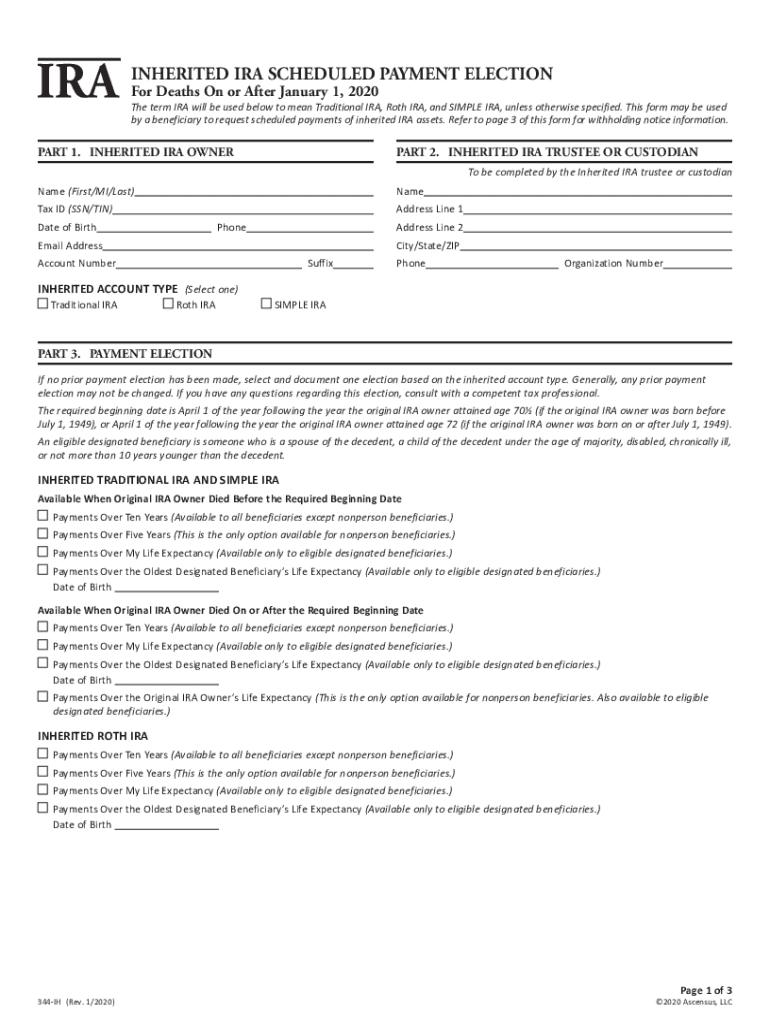

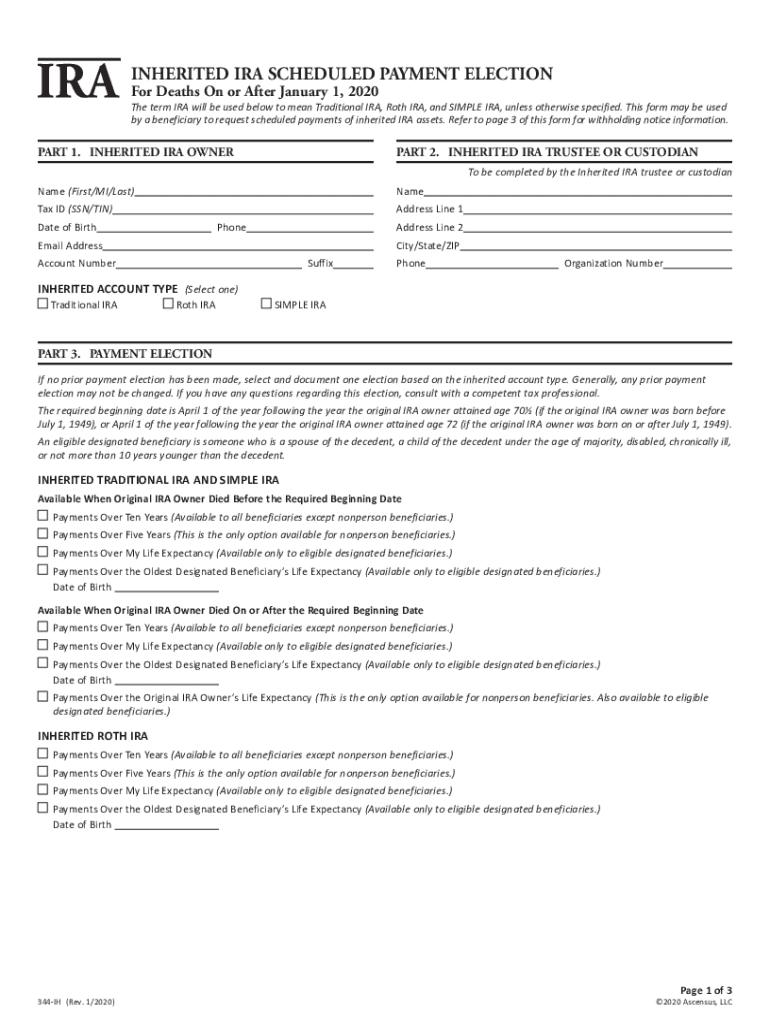

INHERITED IRA SCHEDULED PAYMENT ELECTION

For Deaths On or After January 1, 2020The term IRA will be used below to mean Traditional IRA, Roth IRA, and SIMPLE IRA, unless otherwise specified. This form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inherited ira scheduled payment

Edit your inherited ira scheduled payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inherited ira scheduled payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit inherited ira scheduled payment online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit inherited ira scheduled payment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out inherited ira scheduled payment

How to fill out inherited ira scheduled payment

01

To fill out an inherited IRA scheduled payment, follow these steps:

02

Gather the necessary information: You will need the account details of the inherited IRA, such as account number, beneficiary information, and payment amount.

03

Contact the financial institution: Reach out to the financial institution holding the inherited IRA to initiate the scheduled payment. They will provide you with the required forms and instructions.

04

Fill out the forms: Complete the provided forms with accurate information. These forms typically require details about the beneficiary, payment frequency, and payment amount.

05

Review and sign: Double-check all the information you have provided, making sure there are no errors or inconsistencies. Sign the forms where required.

06

Submit the forms: Send the completed forms back to the financial institution through the specified method, such as mail, fax, or online submission.

07

Verify the scheduled payment: Once the forms are received and processed by the financial institution, they will set up the scheduled payment according to your instructions.

08

Monitor the payments: Keep track of the scheduled payments to ensure they are being processed correctly and on time. Contact the financial institution if you encounter any issues or discrepancies.

09

Note: It is recommended to consult with a financial advisor or tax professional for personalized guidance regarding inherited IRA scheduled payments.

Who needs inherited ira scheduled payment?

01

Individuals who inherit an IRA from a deceased account holder may need to set up an inherited IRA scheduled payment.

02

This payment option is relevant for beneficiaries who wish to receive regular distributions from the inherited IRA over a specific period rather than taking a lump sum.

03

By setting up a scheduled payment, beneficiaries can manage their inherited IRA funds more effectively and ensure a steady stream of income.

04

It is important to note that eligibility and requirements for inherited IRA scheduled payments may vary based on individual circumstances and applicable tax regulations. Consulting with a financial advisor or tax professional can provide clarity on whether this payment option is suitable in a specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit inherited ira scheduled payment from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your inherited ira scheduled payment into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the inherited ira scheduled payment electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit inherited ira scheduled payment on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute inherited ira scheduled payment from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is inherited ira scheduled payment?

An inherited IRA scheduled payment is a regular distribution that beneficiaries must take from an inherited Individual Retirement Account (IRA) based on IRS rules and the specific terms of the account.

Who is required to file inherited ira scheduled payment?

Beneficiaries of an inherited IRA are required to file inherited IRA scheduled payments, which applies to both individuals and entities receiving distributions from the account.

How to fill out inherited ira scheduled payment?

To fill out an inherited IRA scheduled payment, beneficiaries should provide information such as their name, the IRA owner's details, the amount being withdrawn, and the schedule of payments according to IRS guidelines.

What is the purpose of inherited ira scheduled payment?

The purpose of inherited IRA scheduled payments is to ensure beneficiaries withdraw required minimum distributions (RMDs) from the inherited account within specified timeframes, thus regulating how much can be withdrawn while potentially minimizing tax impacts.

What information must be reported on inherited ira scheduled payment?

The information that must be reported includes the beneficiary's details, the deceased owner's details, the amount of each scheduled payment, and the timeline of withdrawals as per IRS requirements.

Fill out your inherited ira scheduled payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inherited Ira Scheduled Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.