Get the free Return of Private Foundation or Section 4947(aX1 ) Nonexempt Charitable Trust Treate...

Show details

Return of Private Foundation or Section 4947(aX1) Nonexempt Charitable Trust Treated as a Private Foundation Form 990-PF t For calendar year 2003, or tax year beginning Dec 1 G Check all that apply:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign return of private foundation

Edit your return of private foundation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your return of private foundation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

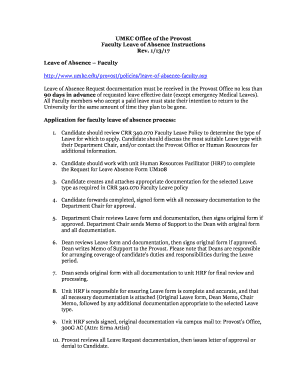

Editing return of private foundation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit return of private foundation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out return of private foundation

How to fill out return of private foundation:

01

Gather all relevant financial information: Start by collecting all necessary financial documents such as income statements, balance sheets, and receipts. Ensure that you have accurate records of all transactions made by the private foundation during the reporting period.

02

Determine the applicable tax form: Identify the correct tax form to use for filing the return of the private foundation. Most foundations use Form 990-PF, which is specifically designed for private foundations. Familiarize yourself with the form and its instructions to ensure accurate completion.

03

Provide basic information: Fill out the basic information section of the tax form, including the foundation's name, address, and Employer Identification Number (EIN). Double-check the accuracy of this information as any errors may cause delays or complications.

04

Disclose financial activities: Report the foundation's financial activities in the appropriate sections of the tax form. This includes providing details on income sources, grants and contributions made, investments, and any other financial transactions. Thoroughly review the form instructions to understand what specific information is required and how it should be reported.

05

Calculate and pay any applicable taxes: Determine whether the private foundation owes any excise taxes based on its financial activities. Use the instructions provided with the tax form to calculate any taxes owed accurately. Remember to make the necessary payment to the IRS along with the submitted return, if applicable.

06

Attach required schedules: Assemble and attach any schedules that are required based on the foundation's financial activities. These schedules provide additional details and supporting documentation for specific sections of the tax form. Common schedules include Schedule A (for reporting grants and assistance), Schedule B (for reporting contributors), and Schedule D (for reporting investments).

Who needs return of private foundation?

01

Private foundations: Private foundations, as defined by the Internal Revenue Service (IRS), must file a return each year. This includes organizations established for charitable, educational, scientific, or religious purposes, where a substantial portion of their income is derived from investment assets or donations.

02

Tax-exempt organizations: While most non-profit organizations are exempt from filing an annual return, private foundations fall under a different set of rules. Due to their potential for abuse or self-dealing, private foundations are subject to additional reporting and transparency requirements, which necessitate the filing of a return.

03

Regulatory authorities: The IRS and other regulatory authorities require private foundations to file a return to ensure compliance with tax laws and regulations. These returns enable oversight and transparency, allowing authorities to assess the foundation's activities, financial management, and adherence to tax-exempt purposes.

It is important to note that specific requirements and deadlines for filing the return of a private foundation may vary based on the jurisdiction and the foundation's particular circumstances. It is advisable to consult with a tax professional or legal advisor for accurate and up-to-date guidance tailored to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is return of private foundation?

Return of private foundation is a form filed with the IRS by a private foundation to report its financial activities and fulfill its tax-exempt obligations.

Who is required to file return of private foundation?

Private foundations, as defined by the IRS, are required to file a return.

How to fill out return of private foundation?

The return of private foundation can be filled out online on the IRS website or by using Form 990-PF.

What is the purpose of return of private foundation?

The purpose of the return is to provide transparency about the foundation's financial activities and ensure compliance with tax laws.

What information must be reported on return of private foundation?

Information about the foundation's income, expenses, grants, investments, and other financial activities must be reported.

Can I create an eSignature for the return of private foundation in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your return of private foundation right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit return of private foundation straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing return of private foundation right away.

How do I edit return of private foundation on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as return of private foundation. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your return of private foundation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Return Of Private Foundation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.