Get the free Motor Insurance Add on Covers

Show details

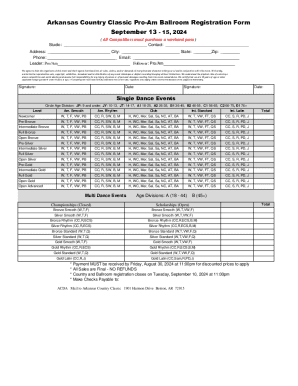

Drive Assure Economy Motor Insurance Add on CoversDepreciation Shield Engine Protector 24×7 Spot AssistanceTYPES FLOSSES DAMAGE Loss or damage to the vehicleLIABILITYLoss or damage to third Dartmoor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor insurance add on

Edit your motor insurance add on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor insurance add on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motor insurance add on online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit motor insurance add on. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor insurance add on

How to fill out motor insurance add on:

01

Start by gathering all the necessary information. This includes your personal details, such as your name, address, and contact information, as well as your vehicle information, such as the make, model, and registration number. This information will be needed throughout the process.

02

Identify the specific add ons you want to include in your motor insurance policy. Add ons can vary from coverage for roadside assistance to protection against personal accident. It is important to review the available options and select the ones that best suit your needs and preferences.

03

Contact your insurance provider or visit their website to access the application form for the motor insurance add on. Fill in the form accurately and provide any additional information or documents that may be required. Double-check all the information before submitting to ensure its accuracy.

04

If you are applying through the insurer's website, follow the on-screen instructions to complete the process. Make sure to review all the terms and conditions associated with the add ons you have selected.

05

If you prefer to apply in person, visit your insurance provider's office or contact their customer service to schedule an appointment. Bring along all the necessary documents, including identification proof and vehicle-related documents.

06

During your appointment, a representative from the insurance company will guide you through the process and answer any questions you may have. They will also review your application and ensure that all the required information has been provided.

07

After submitting your application, it may take some time for the insurance company to process it. Stay in touch with them to check on the status of your application and address any further requirements they may have.

Who needs motor insurance add on:

01

Individuals who frequently travel long distances or use their vehicles for business purposes may benefit from add ons such as roadside assistance and vehicle breakdown coverage. These add ons provide peace of mind in case of unexpected incidents or accidents on the road.

02

If you have a luxury or high-value vehicle, it may be wise to include add ons like zero depreciation cover or engine protection. These add ons can help minimize the financial burden of repairs in case of damage to your vehicle.

03

Residents of areas with a high risk of natural calamities or theft may consider add ons such as comprehensive coverage or coverage against natural disasters. These add ons provide additional protection for your vehicle in case of such unfortunate events.

04

Individuals who often commute during busy traffic hours or in accident-prone areas may find add ons like personal accident coverage or medical expenses coverage useful. These add ons provide financial assistance in case of personal injury or medical expenses resulting from road accidents.

05

It is essential to evaluate your specific needs, driving habits, and budget constraints before deciding on the motor insurance add ons. Consult with your insurance provider or insurance agent to understand the available options and determine which add ons are most suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit motor insurance add on online?

The editing procedure is simple with pdfFiller. Open your motor insurance add on in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the motor insurance add on in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your motor insurance add on right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit motor insurance add on on an Android device?

You can edit, sign, and distribute motor insurance add on on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is motor insurance add on?

Motor insurance add on is an additional coverage option that can be added to an existing motor insurance policy to provide extra protection.

Who is required to file motor insurance add on?

Any individual or organization who wishes to enhance their motor insurance policy with additional coverage may choose to file motor insurance add on.

How to fill out motor insurance add on?

Motor insurance add on can typically be added to a policy by contacting the insurance provider directly and requesting the additional coverage.

What is the purpose of motor insurance add on?

The purpose of motor insurance add on is to provide additional protection and coverage beyond what is included in a standard motor insurance policy.

What information must be reported on motor insurance add on?

When filling out motor insurance add on, individuals may need to provide details such as the type of additional coverage desired, personal information, vehicle details, and payment information.

Fill out your motor insurance add on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Insurance Add On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.