Get the Amendment to Tax-Free Savings Account Application Successor Holder and Beneficiary Design...

Show details

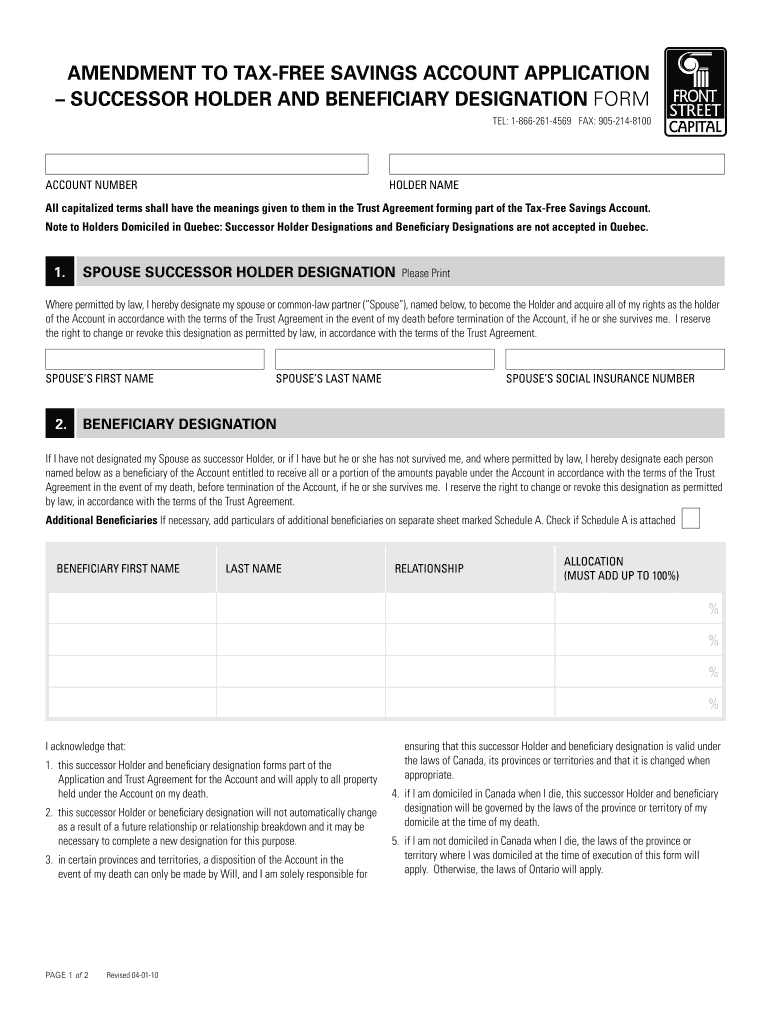

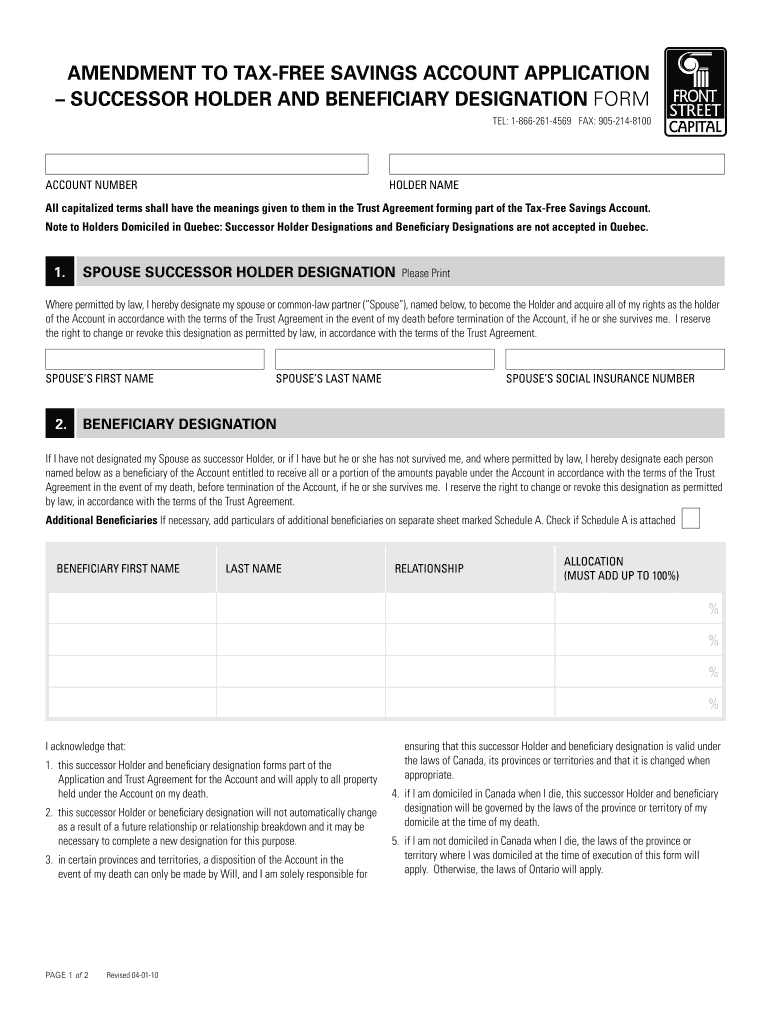

Amendment to Three Savings Account Application Successor Holder and Beneficiary Designation Form Tel: 18662614569 Fax: 9052148100 Account Number Holder Name All capitalized terms shall have the meanings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign amendment to tax- savings

Edit your amendment to tax- savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your amendment to tax- savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit amendment to tax- savings online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit amendment to tax- savings. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out amendment to tax- savings

How to fill out an amendment to tax-savings:

01

Review your previous tax return: Before filling out an amendment to tax-savings, it is essential to carefully review your previous tax return. Make sure you understand what needs to be changed or adjusted for accuracy.

02

Obtain the correct form: The Internal Revenue Service (IRS) provides specific forms for amending tax returns. Depending on the type of amendment you need to make, you will need to fill out the appropriate form. For tax-savings, you will likely need Form 1040X.

03

Gather supporting documents: Collect any supporting documents or forms that are necessary to complete the amendment. This might include W-2 forms, 1099s, or any other tax-related documents that are relevant to the changes you are making.

04

Complete the form accurately: Fill out the amendment form accurately, providing all the required information. Double-check your entries and make sure they match the information you are amending from your previous tax return.

05

Explain the amendment: In the appropriate section of the form, provide a clear and concise explanation of the changes you are making. This helps the IRS understand the purpose of the amendment and the specific adjustments you are making to your tax-savings.

06

Attach supporting documents: Include any necessary supporting documents or attachments that are relevant to your amendment. These documents can help provide evidence for the changes you are making and support the accuracy of your amendment.

07

Sign and date the form: Finally, don't forget to sign and date the amendment form. Unsigned or undated forms may be considered invalid or incomplete, potentially leading to delays or complications with your amendment processing.

Who needs an amendment to tax-savings:

01

Individuals who made errors on their tax returns: If you have made mistakes or errors on your tax return that affect your tax-savings, whether it's overclaiming deductions or missing out on important credits, you may need to file an amendment.

02

Taxpayers who received additional income or refunds: If you have received additional income or refunds after filing your original tax return, you may need to amend your tax-savings to reflect the new information accurately.

03

Individuals who experienced life changes: Life changes such as getting married, having a child, or purchasing a home can impact your tax-savings. If any significant life events occurred after filing your original tax return, you may need to amend your tax-savings accordingly.

Remember, consulting a tax professional or seeking assistance from the IRS can provide you with personalized guidance and ensure that you accurately complete your amendment to tax-savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send amendment to tax- savings for eSignature?

Once your amendment to tax- savings is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute amendment to tax- savings online?

Filling out and eSigning amendment to tax- savings is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in amendment to tax- savings without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing amendment to tax- savings and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is amendment to tax- savings?

Amendment to tax-savings is a formal change or correction made to a previously filed tax return in order to claim additional deductions or credits.

Who is required to file amendment to tax- savings?

Individuals or businesses who need to make changes to their tax return in order to benefit from additional tax savings are required to file an amendment to tax-savings.

How to fill out amendment to tax- savings?

To fill out an amendment to tax-savings, individuals or businesses need to use Form 1040X and provide details about the changes being made to their original tax return.

What is the purpose of amendment to tax- savings?

The purpose of amendment to tax-savings is to ensure that taxpayers are able to take advantage of all available tax deductions and credits in order to minimize their tax liability.

What information must be reported on amendment to tax- savings?

On an amendment to tax-savings, taxpayers must report any changes to their income, deductions, or credits that were not included on their original tax return.

Fill out your amendment to tax- savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Amendment To Tax- Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.