Get the free Fair Credit Billing Act Disclosures

Show details

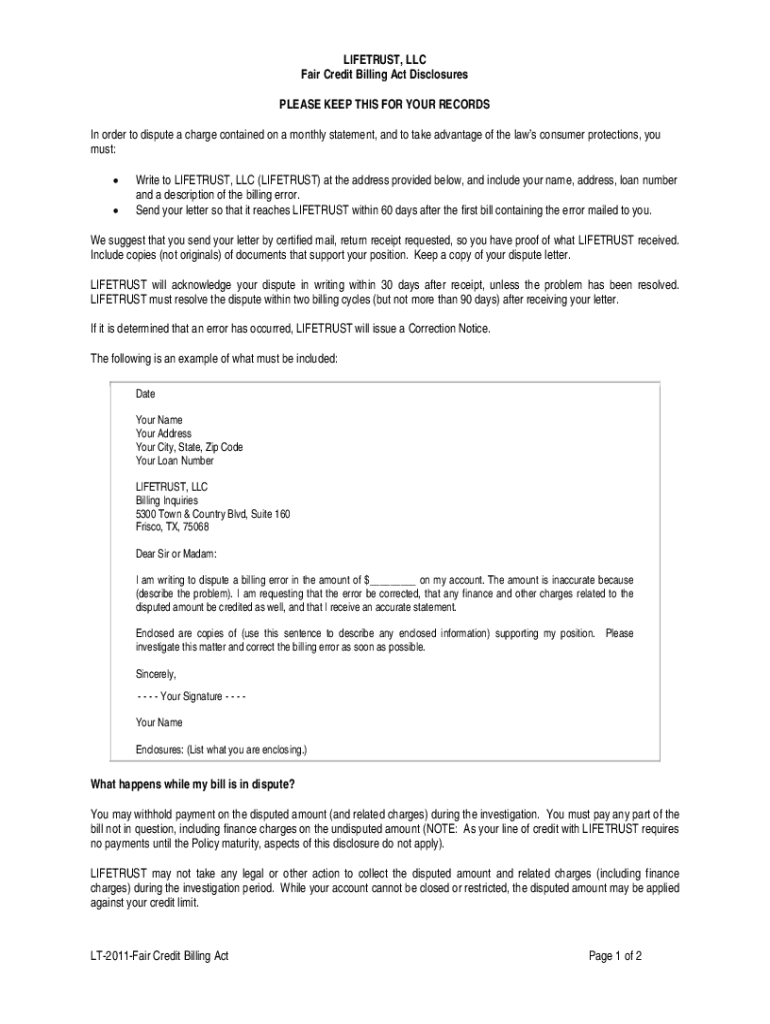

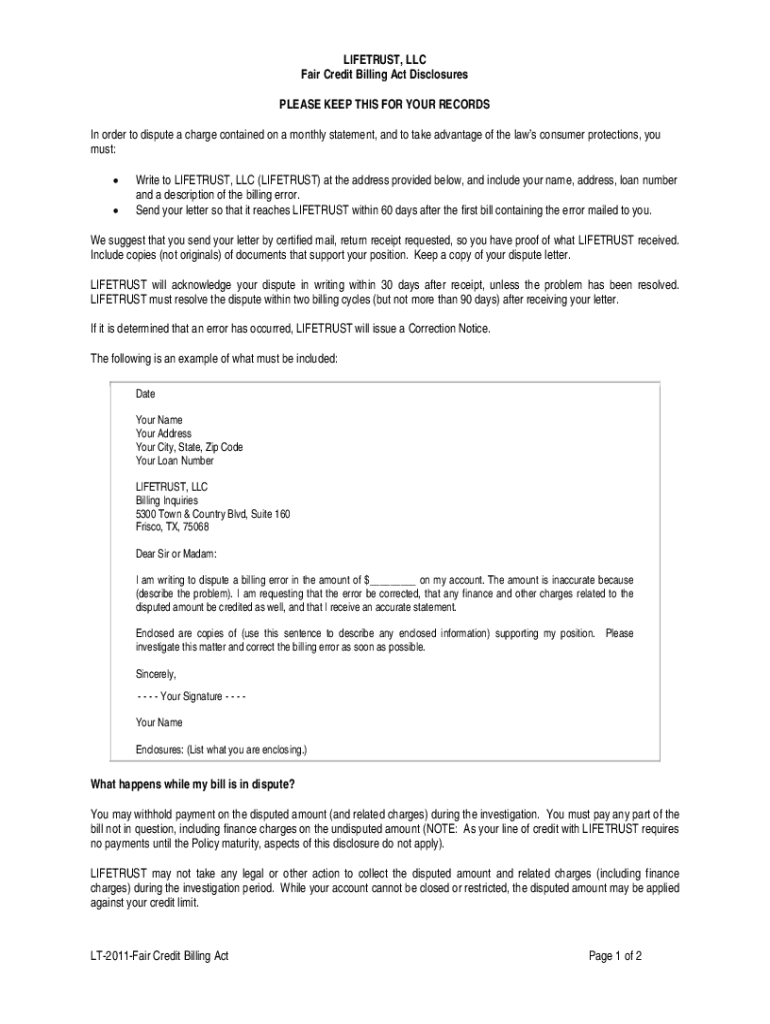

DISTRUST, LLC Fair Credit Billing Act Disclosures PLEASE KEEP THIS FOR YOUR RECORDS In order to dispute a charge contained on a monthly statement, and to take advantage of the laws' consumer protections,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair credit billing act

Edit your fair credit billing act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair credit billing act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fair credit billing act online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fair credit billing act. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair credit billing act

How to fill out fair credit billing act

01

To fill out the Fair Credit Billing Act, follow these steps:

02

Review your credit card statement carefully to identify any billing errors or fraudulent charges.

03

Write a letter to your credit card issuer within 60 days of receiving the statement that contains the error.

04

In the letter, provide your name, address, account number, and a detailed explanation of the error.

05

Include copies of any supporting documentation such as receipts or correspondence.

06

Send the letter via certified mail with a return receipt requested to ensure it is received by the issuer.

07

The credit card issuer has 30 days to acknowledge your complaint and investigate the error.

08

During the investigation, the issuer must resolve the error within two billing cycles or 90 days (whichever is shorter).

09

If the investigation confirms the error, the issuer must correct the billing and remove any finance charges or late fees associated with the error.

10

If the investigation does not resolve the error, you have the right to dispute the findings and request further investigation.

11

Keep copies of all correspondence and documentation for your records.

12

If the credit card issuer fails to comply with the Fair Credit Billing Act, you can escalate your complaint to the Consumer Financial Protection Bureau or seek legal advice.

Who needs fair credit billing act?

01

Anyone who has a credit card or uses credit for financial transactions needs to be aware of the Fair Credit Billing Act.

02

It is particularly important for individuals who have experienced billing errors, unauthorized charges, or fraudulent activity on their credit card statements.

03

The Fair Credit Billing Act provides consumer protection rights and guidelines for resolving billing disputes, ensuring fair and accurate billing practices, and limiting potential financial liability.

04

It empowers credit card users to dispute incorrect charges, obtain refunds, and seek resolution for any billing issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fair credit billing act without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including fair credit billing act, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for signing my fair credit billing act in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your fair credit billing act right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit fair credit billing act on an iOS device?

Use the pdfFiller mobile app to create, edit, and share fair credit billing act from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is fair credit billing act?

The Fair Credit Billing Act (FCBA) is a federal law that protects consumers from unfair billing practices and provides a mechanism for addressing billing errors in credit card accounts.

Who is required to file fair credit billing act?

Consumers who identify billing errors on their credit card accounts are required to file a notice under the Fair Credit Billing Act.

How to fill out fair credit billing act?

To fill out a complaint under the Fair Credit Billing Act, consumers should provide details of the billing error in writing, including their account information, a description of the error, and any supporting documents.

What is the purpose of fair credit billing act?

The purpose of the Fair Credit Billing Act is to protect consumers from unauthorized charges and billing mistakes, ensuring they can dispute errors and seek corrections.

What information must be reported on fair credit billing act?

Consumers must report the nature of the billing error, their account number, and any relevant documentation that supports their claim when filing under the Fair Credit Billing Act.

Fill out your fair credit billing act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Credit Billing Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.