Get the free fraud checklist

Show details

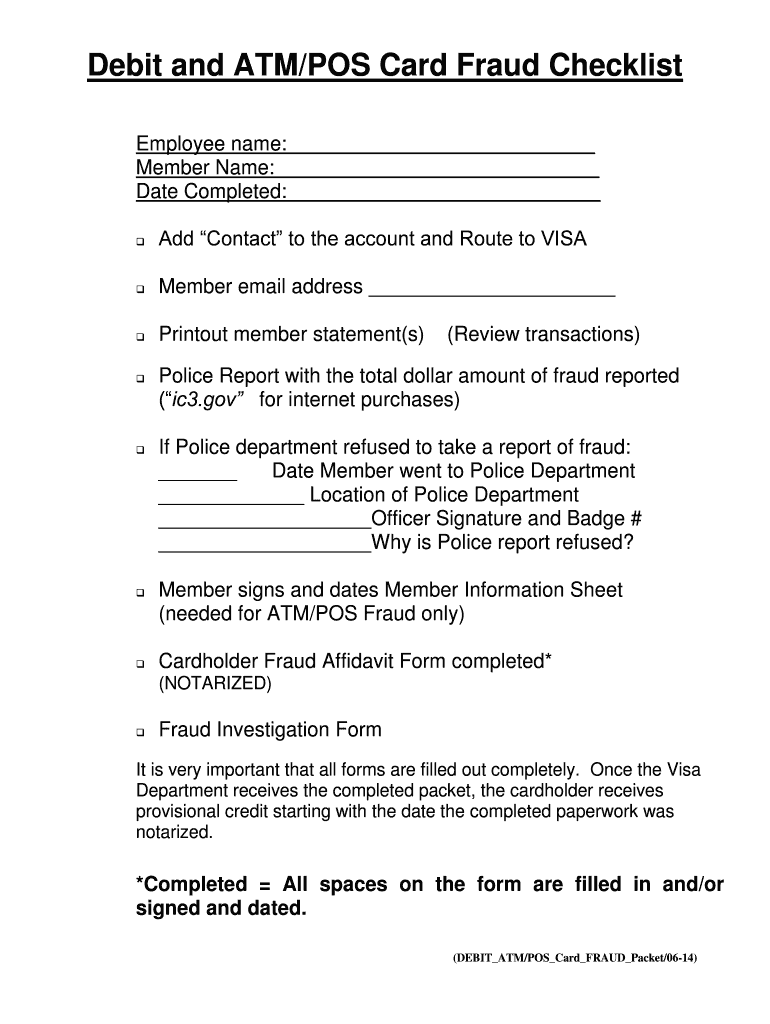

Debit and ATM/POS Card Fraud Checklist Employee name: Member Name: Date Completed: ? Add Contact to the account and Route to VISA ? Member email address ? Printout member statement(s) ? ? ? ? (Review

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fraud investigation report form

Edit your fraud checklist form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fraud checklist form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fraud checklist form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fraud checklist form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fraud checklist form

How to fill out a checklist of a fraud:

01

Gather information: Start by collecting all relevant information about the suspected fraudulent activity. This includes details about the individuals involved, the transactions or activities in question, and any supporting evidence or documentation.

02

Identify red flags: Use the checklist to identify common red flags of fraud. These can include abnormal financial transactions, discrepancies in records, suspicious behavior or patterns, or any other indicators that suggest fraudulent activity.

03

Document findings: As you complete the checklist, make sure to document your findings thoroughly. This includes recording the specific red flags observed, any supporting evidence or documentation, and any additional notes or comments that may be relevant.

04

Analyze the data: Once you have completed the checklist, analyze the data to determine the likelihood and severity of the fraud. Consider the overall impact on the organization or individuals involved, and assess the potential financial or reputational risks.

05

Report and escalate: If the checklist indicates a high probability of fraud, it is important to report the findings to the appropriate authorities or internal stakeholders. This may involve submitting a formal report, notifying management or compliance departments, or contacting law enforcement agencies if necessary.

Who needs a checklist of a fraud?

01

Auditors: Auditors play a crucial role in detecting and preventing fraud. They need a checklist to ensure they cover all necessary aspects while conducting audits and evaluating the effectiveness of internal control systems.

02

Risk Management Professionals: Individuals involved in risk management need a fraud checklist to identify potential risks, implement appropriate control measures, and continuously monitor for any signs of fraudulent activities within an organization.

03

Compliance Officers: Compliance officers are responsible for ensuring that organizations adhere to relevant laws, regulations, and internal policies. They require a checklist to help them identify any potential compliance breaches related to fraud and take appropriate actions.

04

Investigators: Investigators, whether working in law enforcement or internal corporate roles, use a fraud checklist to guide their investigations and ensure they thoroughly examine all relevant aspects and evidence while building a case.

05

Individuals and Consumers: While not directly involved in fraud prevention or investigation, individuals and consumers can benefit from a fraud checklist to help them identify potential scams or fraudulent activities targeting them. This can help them protect their personal information, financial assets, and overall well-being.

By following a structured checklist and involving the right stakeholders, organizations and individuals can effectively detect, prevent, and mitigate the risks associated with fraud.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a fraud report?

Our fraud audit report consists of seven sections: Background and assumptions. Statement of opinions. Relevant information. Exhibits. Basis of the opinions. Recommended actions. Documents necessary to complete investigation.

What happens when someone reports fraud?

What usually happens in the end? Once you report fraudulent charges and provide any necessary documentation, the bank has 30 days to respond to your issue and begin an investigation. From there, the bank has to complete the investigation within 90 days.

What should be included in a fraud report?

Include the address, city, county and state. ∎ A detailed description of any efforts to contact all parties involved in the fraudulent act, include dates, names and contact information. ∎ A detailed description of why you suspect the claim or act is fraudulent.

What to do after you are a victim of fraud?

Article: 6 Steps to Take after Discovering Fraud Don't pay any more money. Collect all the pertinent information and documents. Protect your identity and accounts. Report the fraud to authorities. Check your insurance coverage, and other financial recovery steps.

What to do if you suspect fraud in your company?

After you identify the fraud, take the following actions: Assess and repair damage. Evaluate the potential damage to the company's reputation, both internally and with customers. Report the crime. Report the crime to law enforcement and to your insurance company. Reward whistleblowers. Review controls.

What if there is something on my credit report that is not mine?

If you believe the information on your credit report has been mixed with that of someone else, you should submit a dispute with all of the credit bureaus that have incorrect information on your credit reports. When submitting your dispute, identify the information that does not belong to you.

How do you check if your identity has been stolen?

What you can do to detect identity theft Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. Check your bank account statement. Get and review your credit reports.

What details does someone need to fraud you?

Your name, address and date of birth provide enough information to create another 'you'. An identity thief can use a number of methods to find out your personal information and will then use it to open bank accounts, take out credit cards and apply for state benefits in your name.

How can I find out if someone opened an account in my name?

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I get off the fraud list?

Head to Experian's Fraud Alert Center. Print out and complete this form, putting in writing your request to remove the fraud alert from your credit report. Photocopy a government-issued identification card and a utility bill, bank statement, or insurance statement (to verify your identity).

How do I write a fraud report letter?

Dear Sir/Madam: This letter is to serve as written follow-up to my phone call to your office on [Date]. As I stated in my call to your representative [Name], I am the victim of identity fraud. I became aware of the theft of my identity on [Date] and in the following manner: [Brief description of crime].

What is fraud reporting system?

The Fraud Reporting System (FRS) is Visa's centralized clearinghouse that helps users report, track, and analyze fraudulent transactions. The service consolidates fraud information, helps users detect fraud patterns, and reduces losses due to fraud.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fraud checklist form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your fraud checklist form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the fraud checklist form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fraud checklist form in minutes.

How do I fill out fraud checklist form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign fraud checklist form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is checklist of a fraud?

Checklist of a fraud is a list of items used to identify and prevent fraudulent activities.

Who is required to file checklist of a fraud?

Any organization or individual who wants to prevent fraud within their operations.

How to fill out checklist of a fraud?

Fill out the checklist by providing accurate information about potential fraud risks and preventive measures.

What is the purpose of checklist of a fraud?

The purpose is to identify and mitigate fraud risks in order to protect the organization from financial losses.

What information must be reported on checklist of a fraud?

Information about potential fraud risks, control measures, and responsible parties.

Fill out your fraud checklist form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fraud Checklist Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.