Get the free Services Subject to Sales Tax in Ohio

Show details

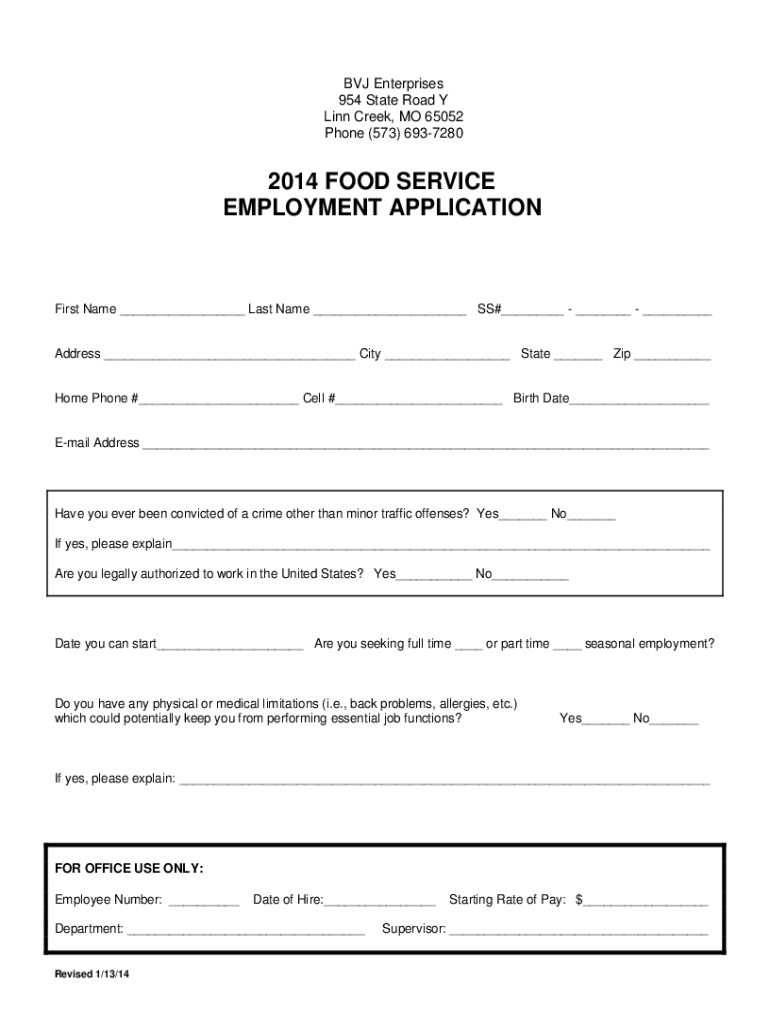

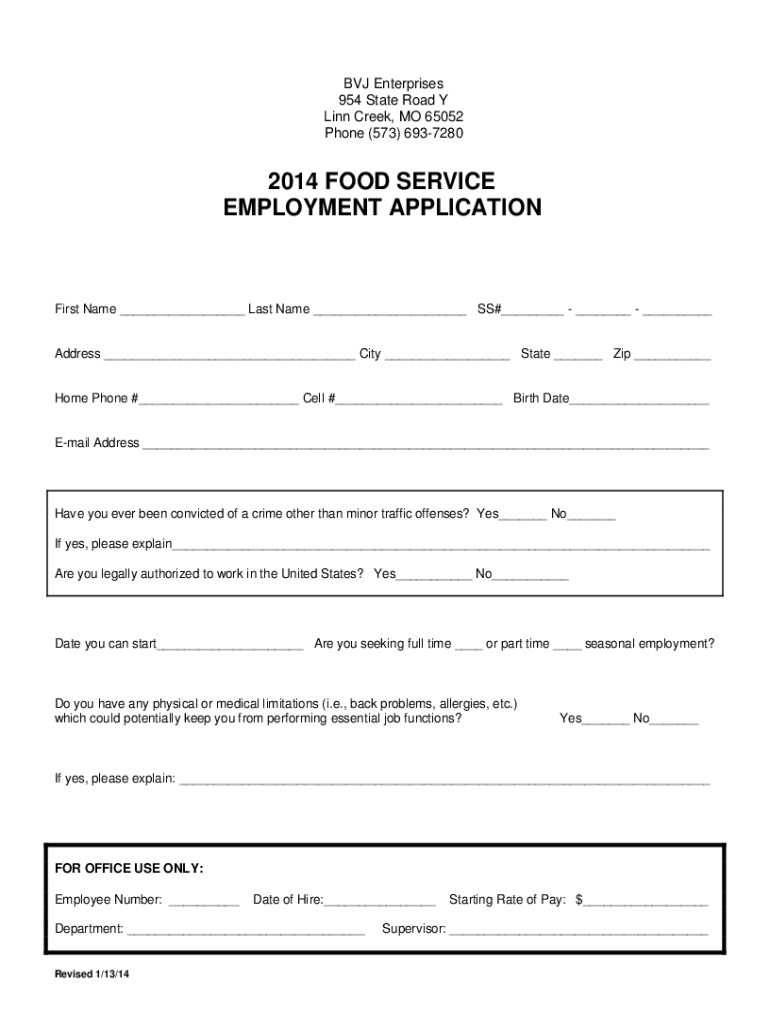

BBJ Enterprises 954 State Road YL inn Creek, MO 65052 Phone (573) 69372802014 FOOD SERVICE EMPLOYMENT APPLICATIONFirst Name Last Name SS# Address City State Zip Home Phone # Cell # Birth Date Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign services subject to sales

Edit your services subject to sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your services subject to sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing services subject to sales online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit services subject to sales. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out services subject to sales

How to fill out services subject to sales

01

To fill out services subject to sales, follow these steps:

02

Begin by collecting all relevant information such as the name of the service provider, the service description, pricing details, and any applicable taxes.

03

Next, determine the sales category under which the service falls. This may include categories like professional services, consulting, maintenance, etc.

04

Once you have identified the category, fill out the necessary information in the respective section of the sales form. Provide accurate details about the service, including its purpose and benefits.

05

Calculate the total cost of the service, including any taxes or additional charges.

06

If applicable, provide any additional documentation or proof to support the sales transaction.

07

Double-check all the information filled out in the form to ensure accuracy and completeness.

08

Submit the completed form along with any supporting documents as required by the relevant authority.

09

Keep a copy of the filled-out form for future reference in case of any audits or inquiries.

10

Remember to consult with a tax or legal professional to ensure compliance with local regulations and requirements.

Who needs services subject to sales?

01

Services subject to sales are needed by various individuals and organizations, including:

02

Businesses offering services to their customers, such as consultancy firms, IT service providers, marketing agencies, etc.

03

Independent service providers who offer their expertise to clients, such as freelancers, contractors, and consultants.

04

Non-profit organizations that provide services for which they charge a fee.

05

Government agencies or departments that offer specialized services to the public.

06

Individuals or professionals who provide services on a self-employed basis.

07

It is important to note that the specific regulations and requirements regarding services subject to sales may vary depending on the jurisdiction and industry. Therefore, it is advisable to consult with a tax or legal professional for personalized guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify services subject to sales without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including services subject to sales. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete services subject to sales on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your services subject to sales from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete services subject to sales on an Android device?

Use the pdfFiller mobile app to complete your services subject to sales on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is services subject to sales?

Services subject to sales refer to specific types of services that are taxable under state sales tax laws. These services can vary by jurisdiction but often include professional services, repair services, and certain personal services.

Who is required to file services subject to sales?

Businesses and individuals that provide taxable services and meet certain revenue thresholds are required to file services subject to sales. This typically includes service providers registered to collect sales tax.

How to fill out services subject to sales?

To fill out services subject to sales, providers must complete a sales tax return form, listing all taxable services provided, the amounts charged, and the sales tax collected. Instructions are usually provided by the state tax authority.

What is the purpose of services subject to sales?

The purpose of services subject to sales is to collect tax revenue for state and local governments, which is used to fund public services and infrastructure.

What information must be reported on services subject to sales?

Information that must be reported includes the total revenue from taxable services, the amount of sales tax collected, the types of services rendered, and any exemptions claimed.

Fill out your services subject to sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Services Subject To Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.