KY DoR OL-3EZ - Louisville 2020 free printable template

Show details

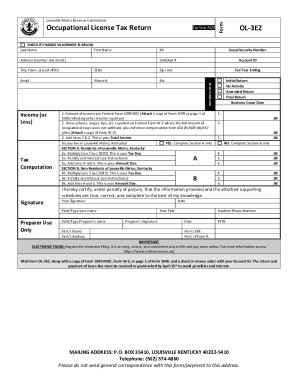

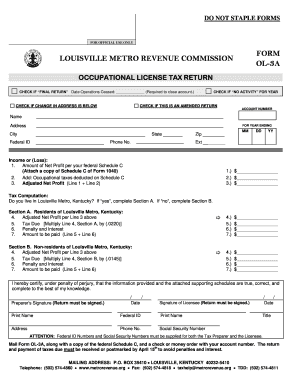

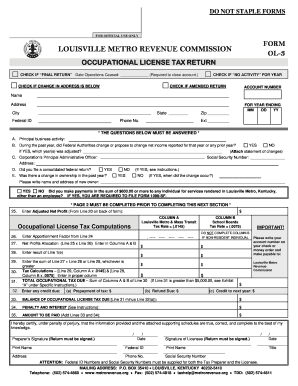

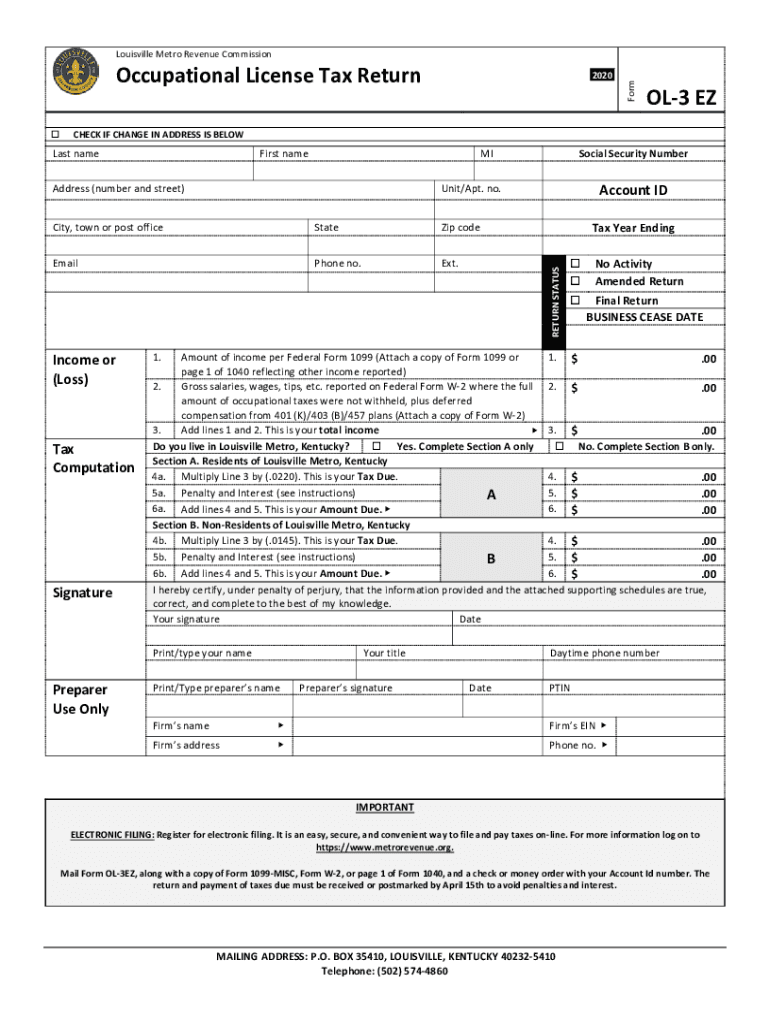

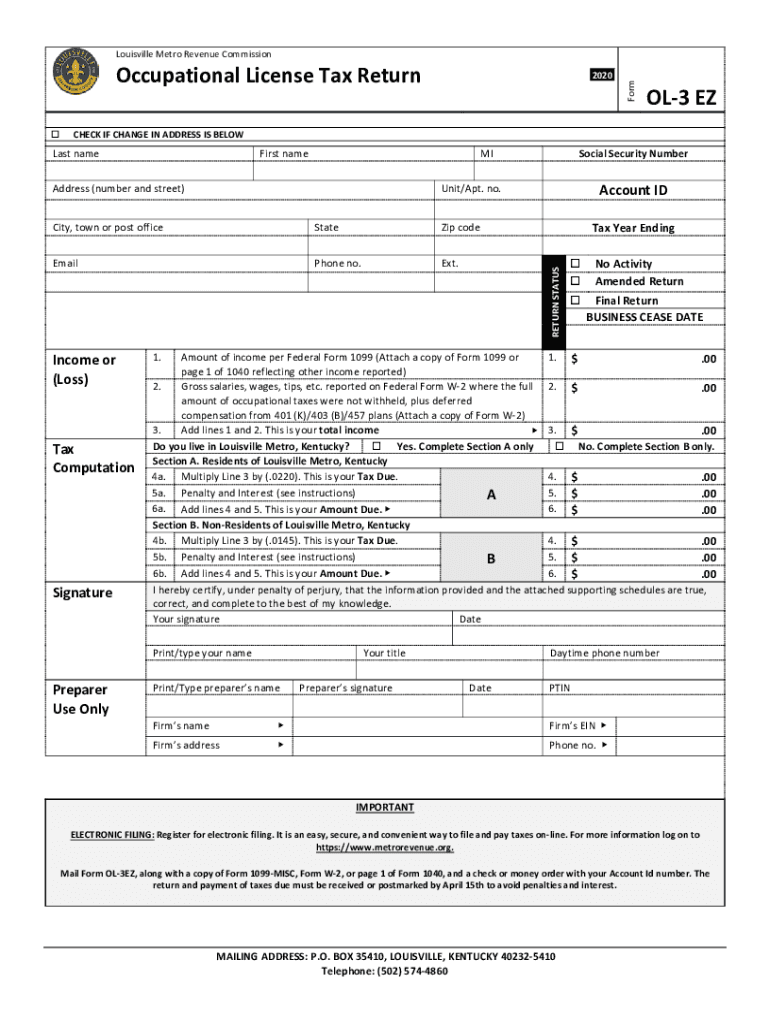

Occupational License Tax Return 2020FormLouisville Metro Revenue CommissionOL3 CHECK IF CHANGE IN ADDRESS IS Belfast nameFirst headdress (number and street)Zip codeEmailPhone no. Ext. Signature No

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR OL-3EZ - Louisville

Edit your KY DoR OL-3EZ - Louisville form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR OL-3EZ - Louisville form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR OL-3EZ - Louisville online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY DoR OL-3EZ - Louisville. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR OL-3EZ - Louisville Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR OL-3EZ - Louisville

How to fill out KY DoR OL-3EZ - Louisville

01

Obtain the KY DoR OL-3EZ form from the Kentucky Department of Revenue website or local office.

02

Complete the taxpayer's information section with your name, address, and Social Security number or tax identification number.

03

Indicate the type of transaction or event that requires the form.

04

Provide any additional details required, such as dates, amounts, and relevant identification numbers.

05

Review the entire form for accuracy and completeness.

06

Sign and date the form certifying all provided information is correct.

07

Submit the completed form by mail or electronically as directed on the form.

Who needs KY DoR OL-3EZ - Louisville?

01

Individuals or businesses in Louisville, Kentucky, that are required to report certain tax-related transactions.

02

Taxpayers seeking to correct or provide additional information regarding their tax returns.

03

Anyone applying for a tax exemption or claiming a refund that necessitates the use of the KY DoR OL-3EZ form.

Fill

form

: Try Risk Free

People Also Ask about

Does Louisville have local income tax?

The City of Louisville imposes a local tax of 2% on all income earned while resident and or working within the city limits. A reduced credit of 60% for taxes paid to other municipalities, which shall not exceed a maximum of one and two-tenths percent (1.2%) of the taxpayer's taxable income in such other municipality.

What is Form OL 3?

This editable tax form is used by individuals, partnerships, and corporations which have had any business activity in Louisville Metro, Kentucky (Jefferson County) during a calendar or fiscal year.

What is Louisville occupational tax?

The tax rate is determined by where the employee lives. For employees who work in Louisville Metro, but live outside of Louisville Metro, the occupational fee/tax rate is 1.45% (. 0145). For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (. 0220).

Who is required to pay Louisville Metro tax?

For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (. 0220). The only exception to this tax rate is for ordained ministers.

Does Kentucky have a local income tax?

Kentucky Tax Rates, Collections, and Burdens Kentucky has a flat 5.00 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Kentucky has a 5.00 percent corporate income tax rate. Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

What is occupational license tax in Louisville?

This occupational license tax shall be measured by: 1. One and one-fourth percent of all wages and compensation paid or payable to every resident or non-resident employee for work done or services performed or rendered in Louisville Metro; and 2.

Do I have to file a Ky local tax return?

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $12,880; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

Do you have to pay state taxes in Kentucky?

Kentucky Tax Rates, Collections, and Burdens Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes. Kentucky's tax system ranks 18th overall on our 2022 State Business Tax Climate Index.

Do you file city taxes in Kentucky?

Most (if not all) KY cities and counties administer their local income tax. It is not handled by the state tax dept.

Does Jefferson County Alabama have an occupational tax?

The Jefferson County Occupational Tax is a 0.45% tax on wages for all workers in Jefferson County, signed into law by Governor Bob Riley on August 14, 2009.

Does Jefferson County KY have a local tax?

The minimum combined 2022 sales tax rate for Jefferson County, Kentucky is 6%.

Who is exempt from Kentucky income tax?

Up to $31,110 of income from private, government, and military retirement plans (including IRAs and 401(k) plans) is exempt.

Does Louisville Ky have local income tax?

Resident employees-Employees who work and live in Louisville Metro, Kentucky, are subject to a tax rate of 2.2% (. 0220).

What is the minimum income to file taxes in 2022?

Minimum income to file taxes $12,550 if under age 65. $14,250 if age 65 or older.

What is an occupational license tax in KY?

Occupational license taxes may be imposed as a percentage of gross earnings (payroll) on all persons working within the city or on gross receipts or net profits on all businesses within a city. A flat annual rate may also be used by cities, which is often referred to as a business license fee.

What taxes do you pay in Louisville Ky?

The minimum combined 2022 sales tax rate for Louisville, Kentucky is 6%. This is the total of state, county and city sales tax rates. The Kentucky sales tax rate is currently 6%.

Do I have to file Kentucky state taxes?

Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

What happens if you don't pay Kentucky state taxes?

Not paying your taxes can result in the Department of Revenue taking Collection Actions. Safeguarding your tax information is our number one priority and we will not talk to anyone besides you unless given permission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KY DoR OL-3EZ - Louisville directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your KY DoR OL-3EZ - Louisville as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit KY DoR OL-3EZ - Louisville on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign KY DoR OL-3EZ - Louisville. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit KY DoR OL-3EZ - Louisville on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute KY DoR OL-3EZ - Louisville from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is KY DoR OL-3EZ - Louisville?

KY DoR OL-3EZ - Louisville is a specific form used by individuals or businesses in Louisville, Kentucky, to report and remit local occupational license taxes.

Who is required to file KY DoR OL-3EZ - Louisville?

Individuals or businesses that earn income within Louisville and are subject to local occupational license taxes are required to file KY DoR OL-3EZ - Louisville.

How to fill out KY DoR OL-3EZ - Louisville?

To fill out KY DoR OL-3EZ - Louisville, you need to provide your personal or business information, report your gross receipts, calculate your tax owed, and submit the form along with any payment due.

What is the purpose of KY DoR OL-3EZ - Louisville?

The purpose of KY DoR OL-3EZ - Louisville is to facilitate the reporting and collection of local occupational license taxes from individuals and businesses operating within the city.

What information must be reported on KY DoR OL-3EZ - Louisville?

Information required on KY DoR OL-3EZ - Louisville includes the reporting entity's name, address, gross receipts, any deductions, local tax rates, and the total tax due.

Fill out your KY DoR OL-3EZ - Louisville online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR OL-3ez - Louisville is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.