Get the free MIRA 205 G-GST Return Dhiveh

Show details

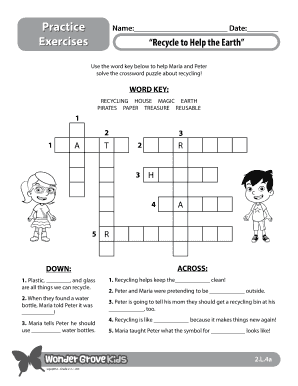

MIRA 205 Version 12.1 CFWB IT.sea. IJ Clear Form ctwmudiK iaWlwdum egukwtWriaWd CNN Triad cmwzirUT CNN egutWrwf Card cricket (urwbcnwn cnwxEkifiTcneDiawa rwyepcsckeT) unit stop WviawgcTekifcTes cnwxErcTcsijer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mira 205 g-gst return

Edit your mira 205 g-gst return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mira 205 g-gst return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mira 205 g-gst return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mira 205 g-gst return. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mira 205 g-gst return

How to Fill Out Mira 205 G-GST Return:

01

Begin by gathering all necessary information and documents for the Mira 205 G-GST return. This may include invoices, receipts, and other financial records related to your business activities.

02

Next, carefully review the provided form and instructions to ensure you understand the requirements and any specific details needed for accurate completion.

03

Start filling out the form by entering your business information, such as your legal name, address, and GST registration number. Double-check these details for accuracy.

04

Move on to the section where you will report your sales and output tax. This may involve calculating the total amount of GST you have collected from your customers during the specified period. Include any applicable exemptions or zero-rated supplies.

05

Proceed to the section where you will report your purchases and input tax. Here, you will include the total amount of GST you have paid on business expenses during the specified period. Be sure to include any applicable input tax credits for items that qualify.

06

After completing the sales and purchase sections, calculate the difference between your output tax and input tax. This will determine the net amount of GST that you owe or are entitled to claim as a refund.

07

The form may have additional sections for reporting information such as bad debts, adjustments, or any other specific circumstances that apply to your business. Complete these sections as necessary.

08

Review your completed form to ensure all information is accurate and all calculations are correct. Make any necessary corrections or adjustments before proceeding.

09

Sign and date the form, and include any required supporting documentation. Keep copies of the completed form and all supporting documents for your records.

Who Needs Mira 205 G-GST Return?

01

Businesses registered for Goods and Services Tax (GST) in the relevant jurisdiction are typically required to file the Mira 205 G-GST return. This may include sole proprietors, partnership firms, limited liability partnerships (LLPs), private limited companies, and other legal entities.

02

Small to large-sized businesses engaged in the sale of goods or services that attract GST are often mandated to file regular GST returns, such as the Mira 205 G-GST return. Compliance with GST regulations is crucial for businesses to fulfill their tax obligations and avoid penalties.

03

It is important for businesses to consult and stay updated with the local tax authorities or the relevant government department regarding the requirements for filing the Mira 205 G-GST return to ensure timely and accurate submission.

Note: The specific requirements for filing the Mira 205 G-GST return may vary depending on the jurisdiction and applicable tax laws. It is advisable to seek professional advice or refer to the official sources for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mira 205 g-gst return directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your mira 205 g-gst return and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get mira 205 g-gst return?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mira 205 g-gst return and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit mira 205 g-gst return on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute mira 205 g-gst return from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your mira 205 g-gst return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mira 205 G-Gst Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.