Get the free aIld lotal assets tess

Show details

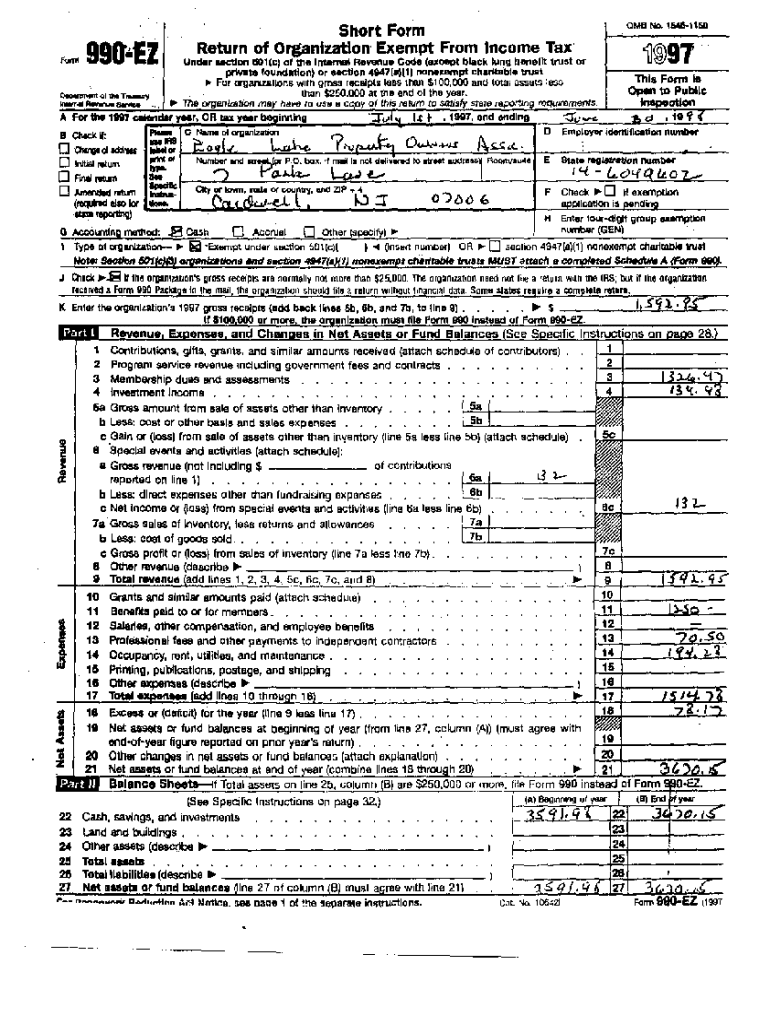

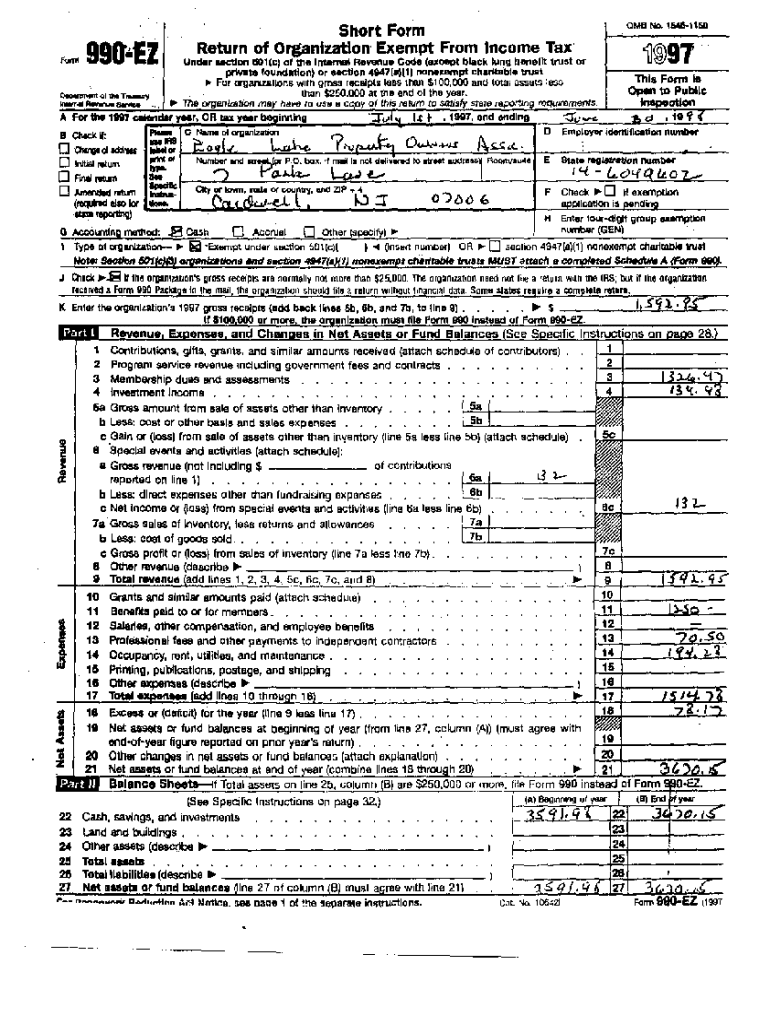

OMS No. 16461150Short Form990 'From Income Tax Benefit trust or ...’t aid local assets tender 91B1f:o. Paid:;;:::::::: o Initial reign o Amended mmStatttOF.......1 '1 0 “) 1..... F, Check If exemptiOnUmkw:::.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aild lotal assets tess

Edit your aild lotal assets tess form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aild lotal assets tess form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aild lotal assets tess online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aild lotal assets tess. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aild lotal assets tess

How to fill out aild lotal assets tess

01

Gather all necessary documents and information such as bank statements, investment records, property deeds, and any other documentation related to your assets.

02

Calculate the value of each asset by listing out the details and their corresponding market value.

03

Determine if any of the assets are jointly owned or have beneficiaries that need to be accounted for.

04

Consult with a professional, such as an attorney or financial advisor, to ensure accuracy and compliance with any legal requirements.

05

Fill out the lotal assets tess form accurately, providing all requested information and supporting documentation.

06

Review the completed form for any errors or omissions before submitting it.

07

Submit the filled-out form and any required attachments to the designated authority or organization.

Who needs aild lotal assets tess?

01

Anyone who possesses assets and wants to assess their total value may need to fill out aild lotal assets tess.

02

This could include individuals, families, businesses, or organizations.

03

Additionally, individuals who need to present their assets for legal or financial purposes, such as during divorce proceedings or estate planning, may also need to fill out this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit aild lotal assets tess online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your aild lotal assets tess and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in aild lotal assets tess without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit aild lotal assets tess and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the aild lotal assets tess electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is aild lotal assets tess?

The aild lotal assets tess refers to a form or declaration that individuals or entities must submit, detailing their total assets for tax assessment or regulatory purposes.

Who is required to file aild lotal assets tess?

Individuals or entities with total assets exceeding a specified threshold, as determined by tax authorities or regulatory bodies, are required to file the aild lotal assets tess.

How to fill out aild lotal assets tess?

To fill out the aild lotal assets tess, individuals or entities should gather all relevant financial information, complete the required sections of the form accurately, and ensure all figures are documented and verified.

What is the purpose of aild lotal assets tess?

The purpose of the aild lotal assets tess is to provide tax authorities with an overview of a filer’s assets, which assists in tax assessment and compliance monitoring.

What information must be reported on aild lotal assets tess?

Reported information on aild lotal assets tess typically includes a detailed listing of all assets, their values, and any liabilities or debts associated with those assets.

Fill out your aild lotal assets tess online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aild Lotal Assets Tess is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.