AZ DoR 131 2020 free printable template

Show details

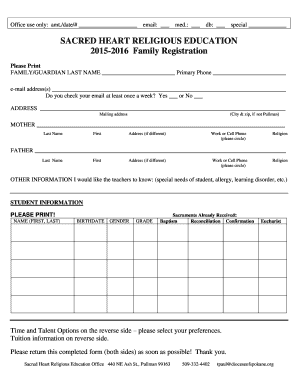

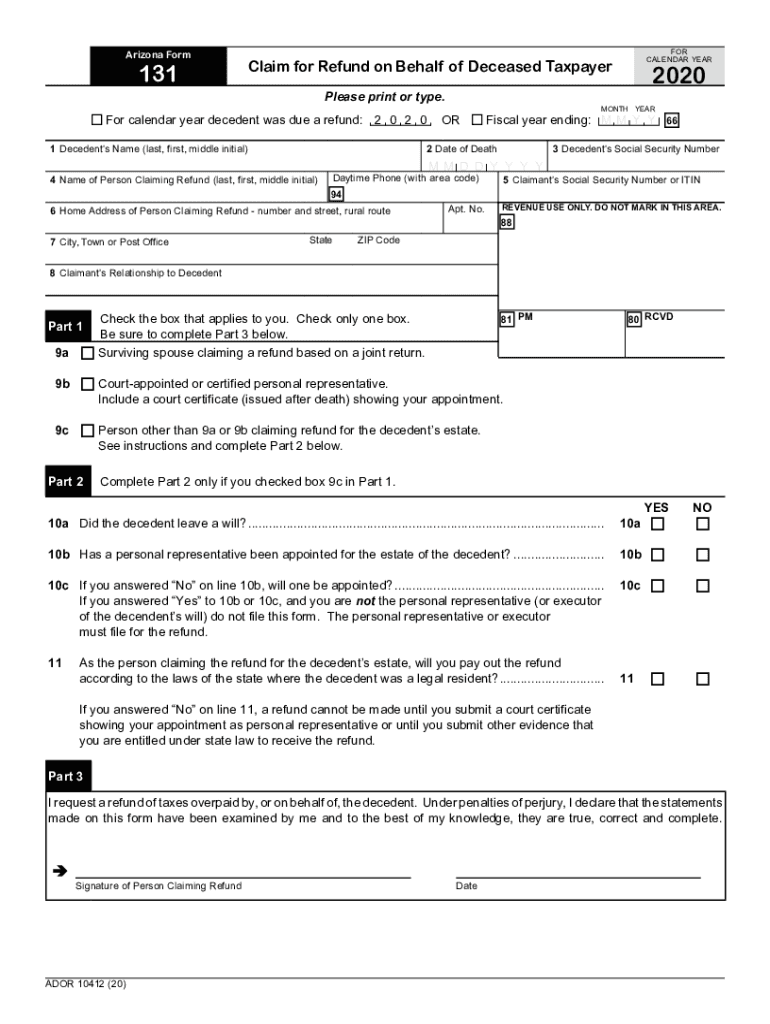

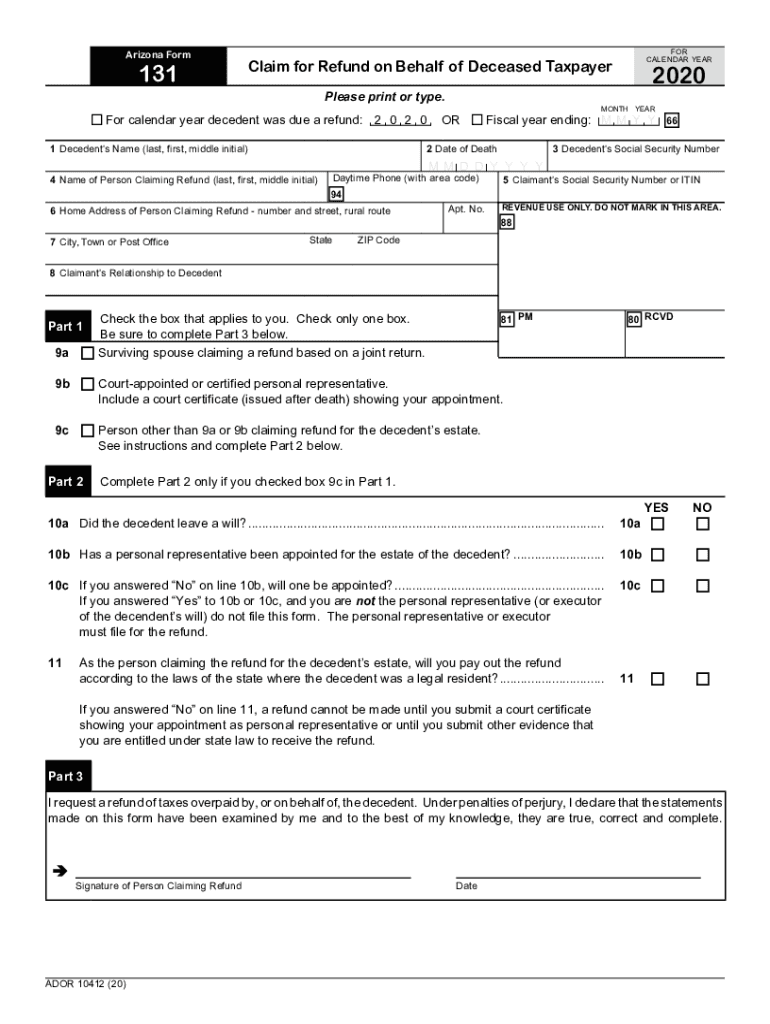

Arizona Form131FOR CALENDAR Acclaim for Refund on Behalf of Deceased Taxpayer Please print or type.2020MONTHYEARFor calendar year decedent was due a refund: 2 0 2 0 OR Fiscal year ending: M Y 1 Decedents

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign for calendar year decedent

Edit your for calendar year decedent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for calendar year decedent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for calendar year decedent online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit for calendar year decedent. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DoR 131 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out for calendar year decedent

How to fill out AZ DoR 131

01

Download the AZ DoR 131 form from the Arizona Department of Revenue website.

02

Fill in your name, address, and tax identification number at the top of the form.

03

Indicate the type of return you are filing by checking the appropriate box.

04

Provide details of your income, deductions, and credits as required in the designated sections.

05

Calculate your total tax liability on the form.

06

Sign and date the form at the bottom.

07

Submit the completed form by mail or electronically as instructed.

Who needs AZ DoR 131?

01

Individuals and businesses filing for tax credits or requesting a refund.

02

Taxpayers who have engaged in specific transactions requiring disclosure.

03

Residents of Arizona who need to report their income to the state for taxation purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I file taxes for a deceased person in Arizona?

Use Form 131 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 131. However, if the refund is issued in the name of the decedent, it may be cashed with the endorsement of the court appointed executor or the administrator of the estate.

What is my Arizona taxable income?

Arizona Income Taxes Single taxpayers and those married filing separately are taxed at 2.55% for income under $28,653 and 2.98% for all other income above that. Joint filers and heads of household will pay 2.55% for income under $57,305 and 2.98% for additional income above that.

What is the procedure for filing income tax return of deceased person?

3. Filing ITR for Deceased after registration of Legal Heir. Once the Legal Heir registration is done, Legal Heir needs to login to his Income Tax e filing portal. After uploading XML, do the E verification through Aadhaar OTP or through Bank or Net banking or Digital Signature.

Do I staple my w2 to my Arizona state tax return?

Do not staple any documents, schedules or payment to your return.

How do I file for a deceased taxpayer in Arizona?

Use Form 131 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 131. However, if the refund is issued in the name of the decedent, it may be cashed with the endorsement of the court appointed executor or the administrator of the estate.

Who do I make the check out to for Arizona state taxes?

✓ Make your check or money order payable to Arizona Department of Revenue.

What does Arizona source income mean?

Income from a business, trade, or profession carried on within Arizona; Income from stocks, bonds, notes, bank deposits, and other intangible personal property having a business or taxable situs in Arizona; and.

What is Arizona gross income?

2. "Arizona gross income" of a resident individual means the individual's federal adjusted gross income for the taxable year, computed pursuant to the internal revenue code. 3. "Dependent" has the same meaning prescribed by section 152 of the internal revenue code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my for calendar year decedent in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your for calendar year decedent and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify for calendar year decedent without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your for calendar year decedent into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete for calendar year decedent on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your for calendar year decedent. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is AZ DoR 131?

AZ DoR 131 is a form used by taxpayers in Arizona to report their business income, expenses, and other relevant financial information for tax purposes.

Who is required to file AZ DoR 131?

Businesses operating in Arizona that are subject to transaction privilege tax (TPT) are required to file AZ DoR 131.

How to fill out AZ DoR 131?

To fill out AZ DoR 131, provide your business information, report your gross income, claim any deductions, and supply other financial details as required on the form.

What is the purpose of AZ DoR 131?

The purpose of AZ DoR 131 is to document and report taxable income and expenses to calculate the appropriate tax liability for businesses in Arizona.

What information must be reported on AZ DoR 131?

AZ DoR 131 requires reporting on gross receipts, allowable deductions, net income, and any other required financial information pertinent to business operations.

Fill out your for calendar year decedent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Calendar Year Decedent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.