Get the free Home Federal Housing Finance Agency

Show details

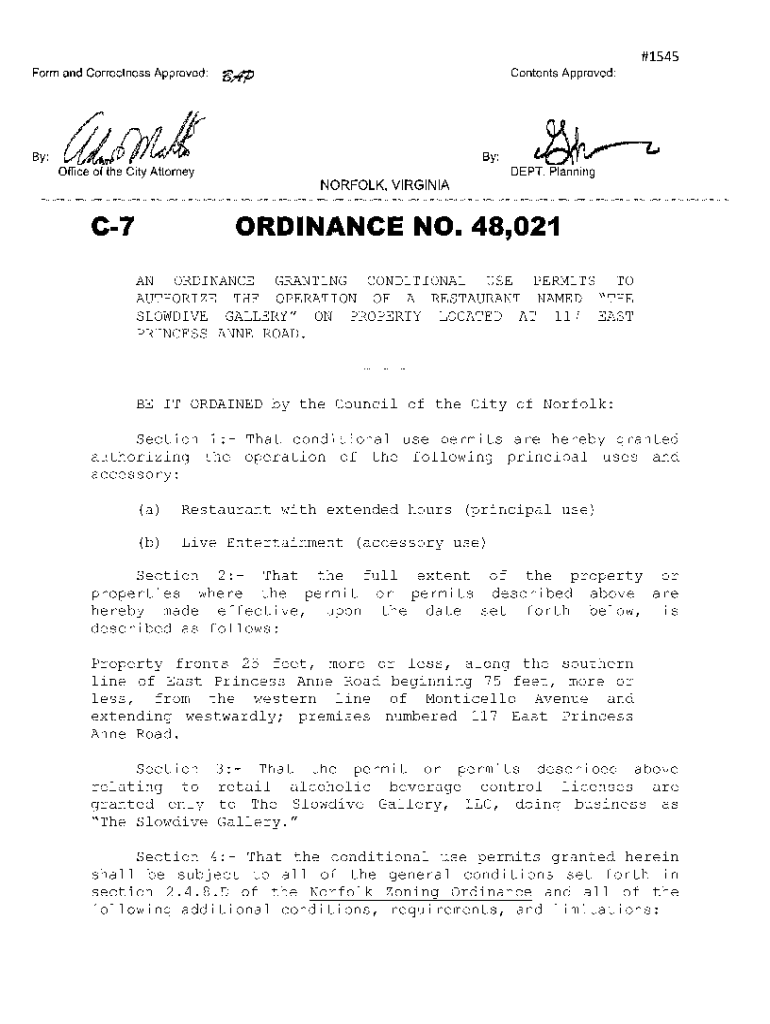

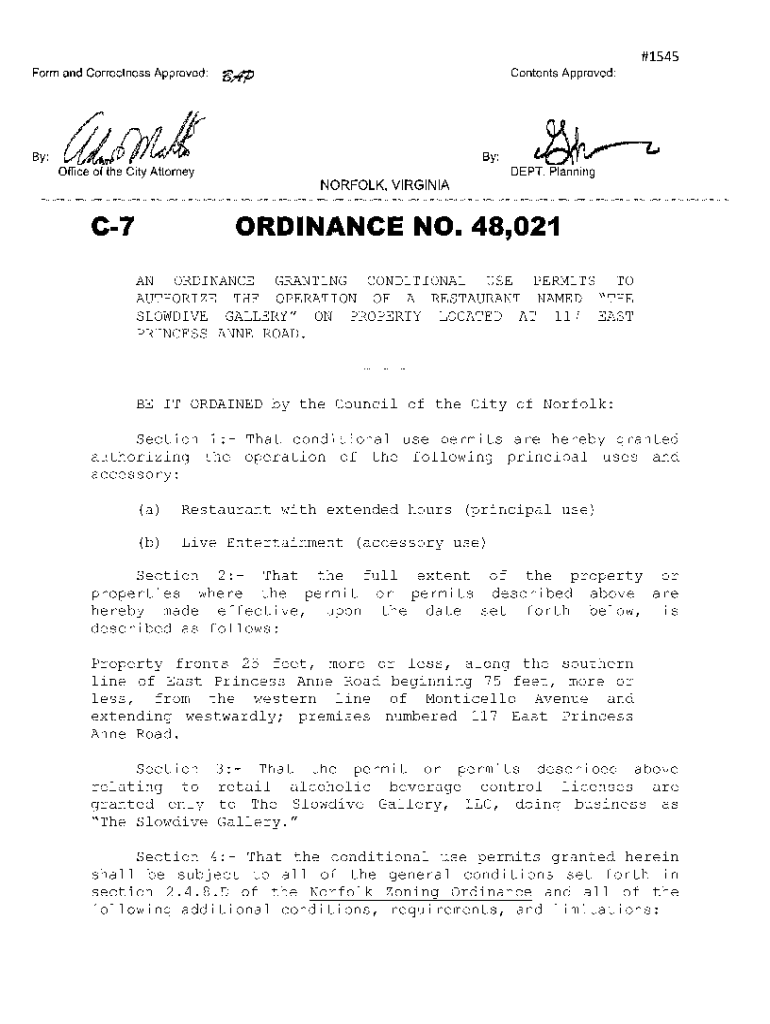

1545 FormandCorrectnessApproved:Contents6,4pBy:Approved:By: DEPT. Office of the City Attorney NORFOLK, C 7PlanningVIRGINIAORDI DANCE NO. 48 021 ORDINANCEANAUTHORIZESLOWDIVEANNE1SectionthebyThattheauthorizingONOFAUSEPERMITSRESTAURANTPROPERTYTONAMED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home federal housing finance

Edit your home federal housing finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home federal housing finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

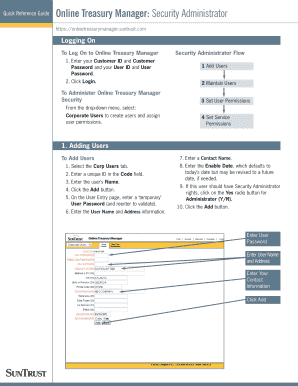

Editing home federal housing finance online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home federal housing finance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home federal housing finance

How to fill out home federal housing finance

01

Gather all necessary documentation such as income statements, proof of employment, and identification.

02

Obtain a home federal housing finance application form from a local financial institution or download it from their website.

03

Carefully read and understand the instructions provided with the application form.

04

Fill out all personal information accurately, including name, address, contact details, and social security number.

05

Provide information about your current housing situation, including rent or mortgage payments.

06

Disclose your employment status, income details, and any other financial obligations you may have.

07

Attach all required supporting documents, ensuring they are legible and up to date.

08

Review the completed application form for any errors or missing information.

09

Submit the application form along with the supporting documents to the designated authorities.

10

Wait for the review and approval process to be completed. You may be contacted for additional information or verification if needed.

11

Once approved, carefully read and understand the terms and conditions of the home federal housing finance.

12

Sign the necessary documents and fulfill any additional requirements as specified by the financial institution.

13

Receive the funds or financial assistance as per the terms of the home federal housing finance program.

14

Comply with the repayment schedule and any other obligations outlined in the agreement.

15

Seek guidance or assistance from the financial institution if you have any questions or concerns during the process.

Who needs home federal housing finance?

01

Anyone who is looking to purchase or refinance a home may need home federal housing finance.

02

Individuals or families with a moderate to low income who may not have sufficient funds for a down payment or cannot qualify for a conventional mortgage.

03

Those who want to take advantage of government-backed programs aimed at promoting affordable housing and homeownership.

04

People who are seeking financial assistance or favorable terms to make homeownership more accessible and affordable.

05

Borrowers who are eligible for specific benefits or subsidies offered through home federal housing finance programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit home federal housing finance online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your home federal housing finance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in home federal housing finance without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit home federal housing finance and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the home federal housing finance electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your home federal housing finance in minutes.

What is home federal housing finance?

Home federal housing finance refers to a program focused on the regulation and oversight of residential mortgage financing, typically involving government-sponsored enterprises (GSEs) that provide stability and affordability in the housing market.

Who is required to file home federal housing finance?

Entities such as mortgage lenders, banks, and other financial institutions that issue home loans or engage in mortgage financing typically are required to file home federal housing finance reports.

How to fill out home federal housing finance?

Filling out home federal housing finance forms requires gathering relevant financial information, completing the form accurately, and submitting it according to the specified guidelines, which typically includes ensuring compliance with federal regulations.

What is the purpose of home federal housing finance?

The purpose of home federal housing finance is to ensure a stable and accessible housing market by promoting affordable mortgage lending practices and providing guidelines for reporting and accountability among financial institutions.

What information must be reported on home federal housing finance?

Information that must be reported includes details on mortgage origination, loan amounts, property values, borrower demographics, and compliance with federal housing policies.

Fill out your home federal housing finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Federal Housing Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.