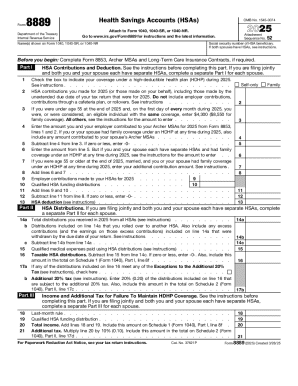

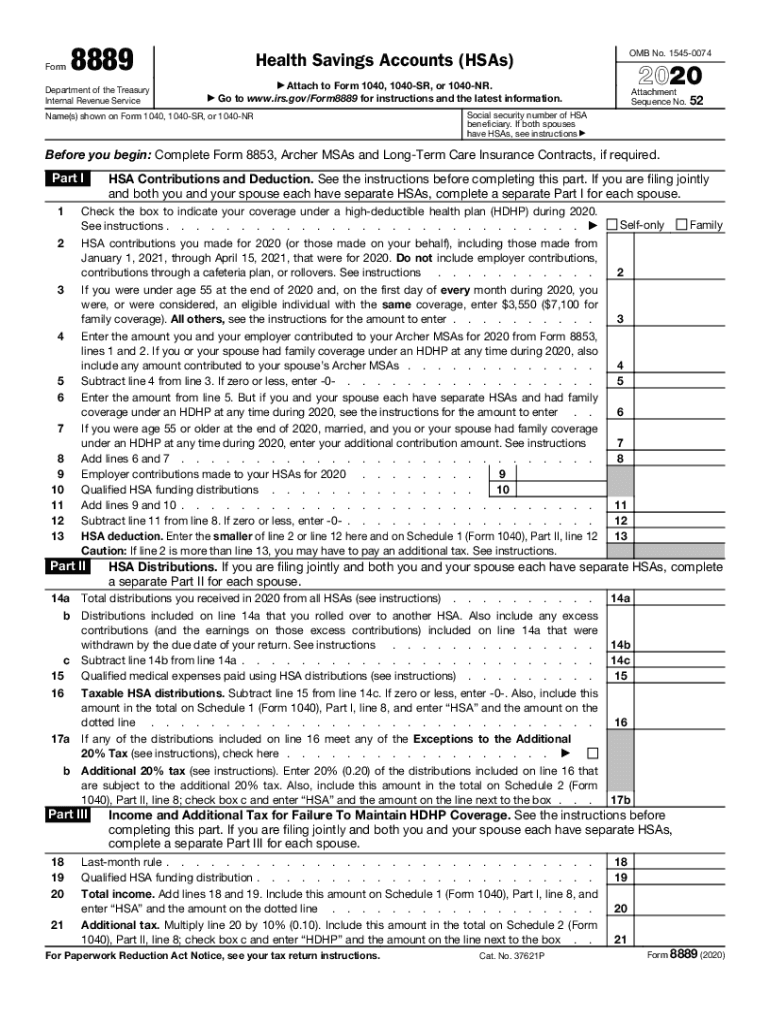

IRS 8889 2020 free printable template

Instructions and Help about IRS 8889

How to edit IRS 8889

How to fill out IRS 8889

About IRS 8 previous version

What is IRS 8889?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8889

What should I do if I need to correct an error after filing IRS 8889?

If you realize you've made a mistake on your IRS 8889 after filing, you need to submit a corrected form. This can usually be done by filing an amended return using Form 1040-X, where you can explain the changes in detail. Keep a record of any correspondence and documents related to the amendment.

How can I track the status of my IRS 8889 submission?

To track the status of your IRS 8889 submission, you can use the IRS 'Where's My Refund?' tool if it's part of a refund claim. For e-filed submissions, keep an eye out for confirmation emails which indicate the IRS has received your form. Additionally, you can call the IRS for updates or verification.

What common mistakes should I avoid when filing IRS 8889?

Common mistakes when filing IRS 8889 include providing incorrect or incomplete information, missing signatures, and failing to check box selections. Always double-check the figures and ensure that all required fields are filled to minimize the chances of rejection. Additional care in documentation can prevent follow-ups.

Are e-signatures acceptable for IRS 8889 submissions?

Yes, e-signatures are accepted for IRS 8889 submissions when filed electronically. Ensure that your e-signature complies with IRS regulations, which usually means it must include your PIN or any verified information associating your identity with the submission. However, for paper submissions, a handwritten signature is still required.