Get the free What Credit Score Do You Need for American Express ...

Show details

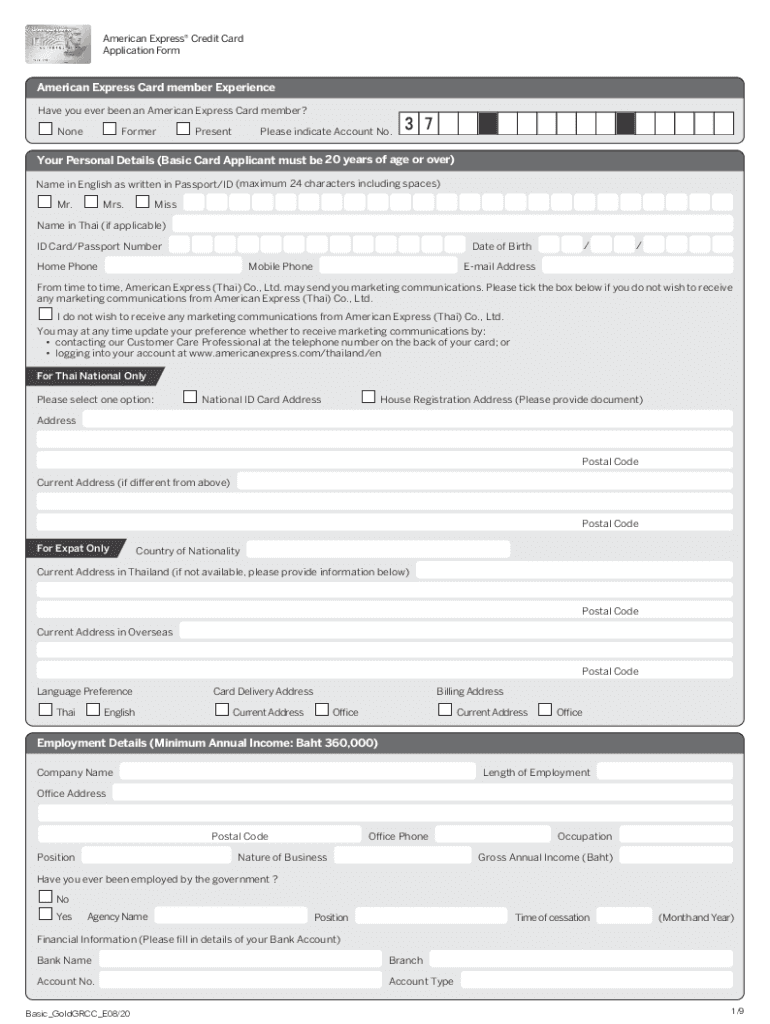

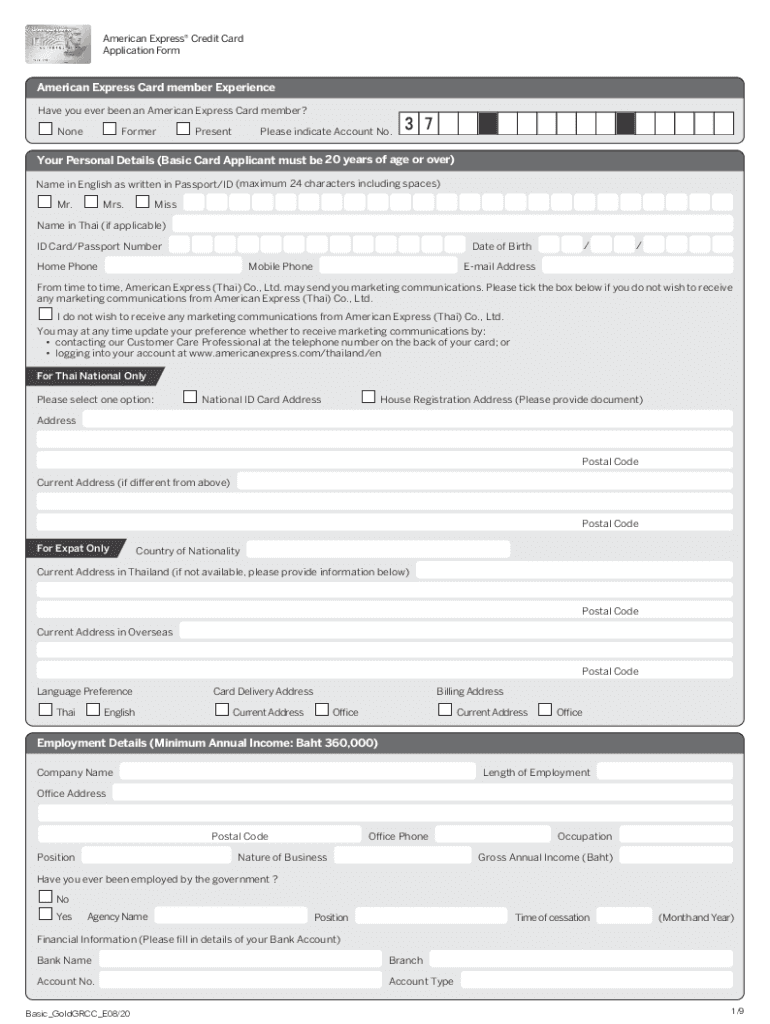

American Express Credit Card Application Form American Express Card member Experience Have you ever been an American Express Card member? None Former PresentPlease indicate Account No. Your Personal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what credit score do

Edit your what credit score do form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what credit score do form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what credit score do online

Follow the steps below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit what credit score do. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what credit score do

How to fill out what credit score do

01

To fill out what credit score do, follow these steps:

02

Start by gathering all the required information and documents, including your personal identification details, financial records, and employment details.

03

Visit the website of a credit reporting agency or a financial institution that offers credit score services.

04

Look for the option to request or check your credit score.

05

Click on the specified option and you will be redirected to a form or a series of questions to fill out.

06

Start filling out the form by providing accurate and truthful information about yourself, such as your full name, date of birth, social security number, and current address.

07

Proceed to provide details about your financial history, including your income, debts, loans, and credit card usage.

08

Double-check all the information you have entered to ensure its accuracy.

09

Submit the completed form and wait for the processing of your credit score request.

10

Once the process is complete, you will be provided with your credit score, which is a numerical representation of your creditworthiness and financial health.

Who needs what credit score do?

01

Various individuals and entities may need to know what credit score you have, including:

02

- Potential lenders: Lenders, such as banks, credit unions, and online lending platforms, rely on credit scores to assess the creditworthiness of borrowers.

03

- Landlords: Landlords often check the credit scores of prospective tenants to determine their financial responsibility and ability to pay rent on time.

04

- Employers: Some employers may request credit scores as part of their background check process to assess an individual's financial management skills.

05

- Insurance companies: Certain insurance providers utilize credit scores to determine the premium rates for auto or home insurance policies.

06

- Government agencies: In some cases, government agencies may require credit scores for eligibility or benefit determinations.

07

- Individuals: People may also be interested in knowing their credit score to monitor their financial health, identify areas for improvement, or make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute what credit score do online?

pdfFiller makes it easy to finish and sign what credit score do online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out what credit score do using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign what credit score do. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit what credit score do on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign what credit score do on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is what credit score do?

A credit score is a numerical representation of an individual's creditworthiness, based on their credit history and other financial behaviors.

Who is required to file what credit score do?

Individuals seeking loans, mortgages, or other credit products are often required to provide their credit score to lenders.

How to fill out what credit score do?

Filling out a credit score request generally involves providing personal information such as name, address, Social Security number, and financial history to a credit reporting agency.

What is the purpose of what credit score do?

The purpose of checking or providing a credit score is to evaluate the risk associated with lending money or extending credit to an individual.

What information must be reported on what credit score do?

Credit scores are calculated based on payment history, amounts owed, length of credit history, new credit inquiries, and types of credit used.

Fill out your what credit score do online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Credit Score Do is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.