Get the free structural and collateral term sheet what is form

Show details

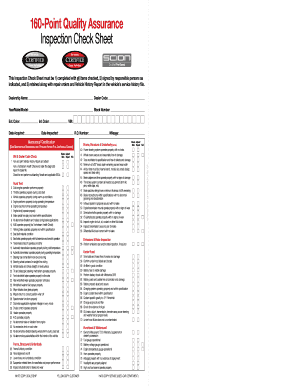

*** Preliminary and Subject to Change *** Fannie Mae Gem STM Guaranteed REMIX Structural and Collateral Term Sheet Fannie Mae Structured Pass-Through Certificates Series 2012-M5, Class A1, A2, AB1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign structural and collateral term

Edit your structural and collateral term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your structural and collateral term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit structural and collateral term online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit structural and collateral term. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out structural and collateral term

01

To fill out a structural and collateral term, you need to have a thorough understanding of the project or loan for which the term is being applied. This includes understanding the scope of the project, the assets involved, and any potential risks or requirements.

02

Start by gathering all the necessary information about the project or loan, including the details of the assets or collateral being used as security. This may include property titles, valuations, ownership documents, and any existing loans or encumbrances on the assets.

03

Consult with legal and financial experts to ensure that the structural and collateral term is drafted correctly and complies with the applicable laws and regulations. They can provide guidance on structuring the term to sufficiently protect the lender's interests while also being fair to the borrower.

04

Be specific and detailed in describing the assets or collateral being used to secure the loan. Include identifying information such as addresses, descriptions, and any relevant documentation or certifications.

05

Clearly define the terms and conditions of the structural and collateral term, including the duration of the term, the responsibilities of the borrower and lender, and any conditions or events that may trigger a default or require additional actions.

06

Review the completed structural and collateral term with all relevant parties involved, making sure that everyone understands and agrees to the terms. It is essential to have open communication and address any concerns or questions before finalizing the document.

07

Keep copies of the completed structural and collateral term for future reference and ensure that all parties involved have their own copies as well. This will help avoid any misunderstandings or disputes in the future.

Who needs structural and collateral term:

01

Lenders: Financial institutions, banks, or private lenders who provide loans or funding for projects or acquisitions typically require a structural and collateral term to protect their interests. This term establishes the legal framework for the loan and provides a recourse in the event of default.

02

Borrowers: Individuals, businesses, or organizations seeking to secure a loan or financing for a project or acquisition may need to fill out a structural and collateral term. This document outlines their obligations and responsibilities regarding the assets used as collateral and provides a clear understanding of the lender's requirements.

03

Legal and Financial Experts: Lawyers, solicitors, and financial professionals play a crucial role in assisting both lenders and borrowers in filling out structural and collateral terms. They provide guidance on compliance, legal implications, and ensure that the terms are fair and equitable for all parties involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the structural and collateral term electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your structural and collateral term in minutes.

How do I edit structural and collateral term straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing structural and collateral term, you need to install and log in to the app.

How can I fill out structural and collateral term on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your structural and collateral term. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is structural and collateral term?

Structural and collateral term refers to a legal document that outlines the terms and conditions related to the collateral provided for a loan or other financial agreement.

Who is required to file structural and collateral term?

The parties involved in a loan or financial agreement, such as the lender and borrower, are required to file the structural and collateral term.

How to fill out structural and collateral term?

To fill out a structural and collateral term, the involved parties must provide relevant details about the collateral, including its value, type, condition, and any additional terms or conditions related to its use or release.

What is the purpose of structural and collateral term?

The purpose of a structural and collateral term is to establish and document the rights and obligations of the parties involved in a loan or financial agreement regarding the collateral provided.

What information must be reported on structural and collateral term?

The structural and collateral term must include details about the collateral, such as its description, estimated value, any restrictions on its use, and provisions related to its release or foreclosure.

Fill out your structural and collateral term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Structural And Collateral Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.