NJ RU-9 2021 free printable template

Show details

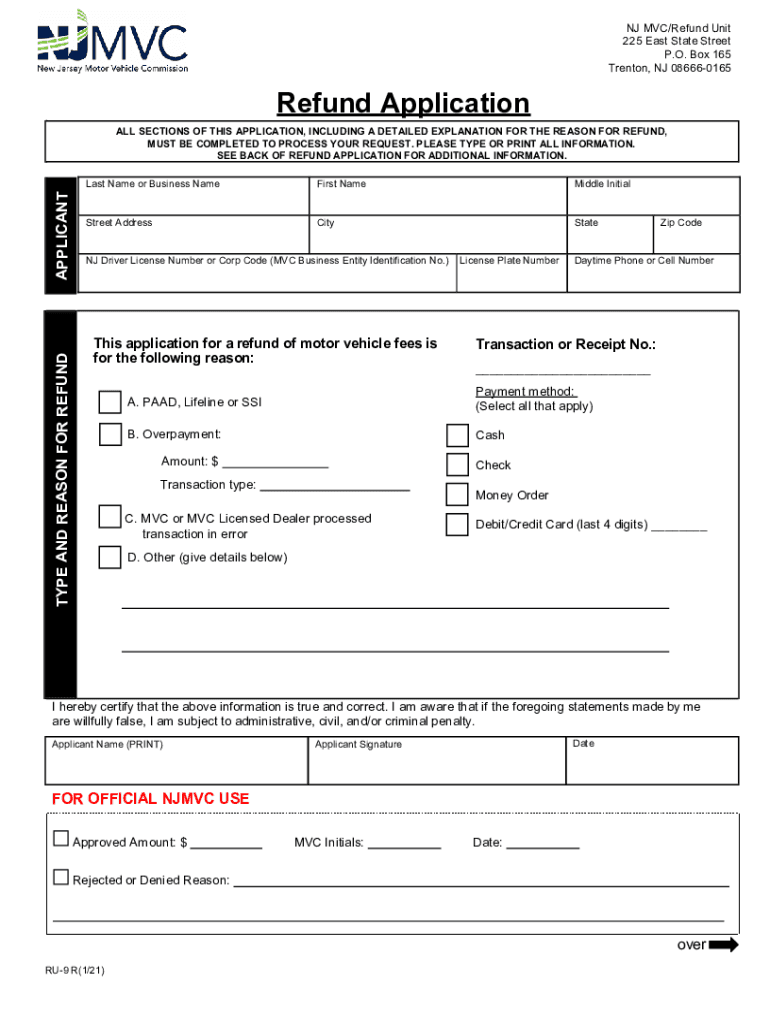

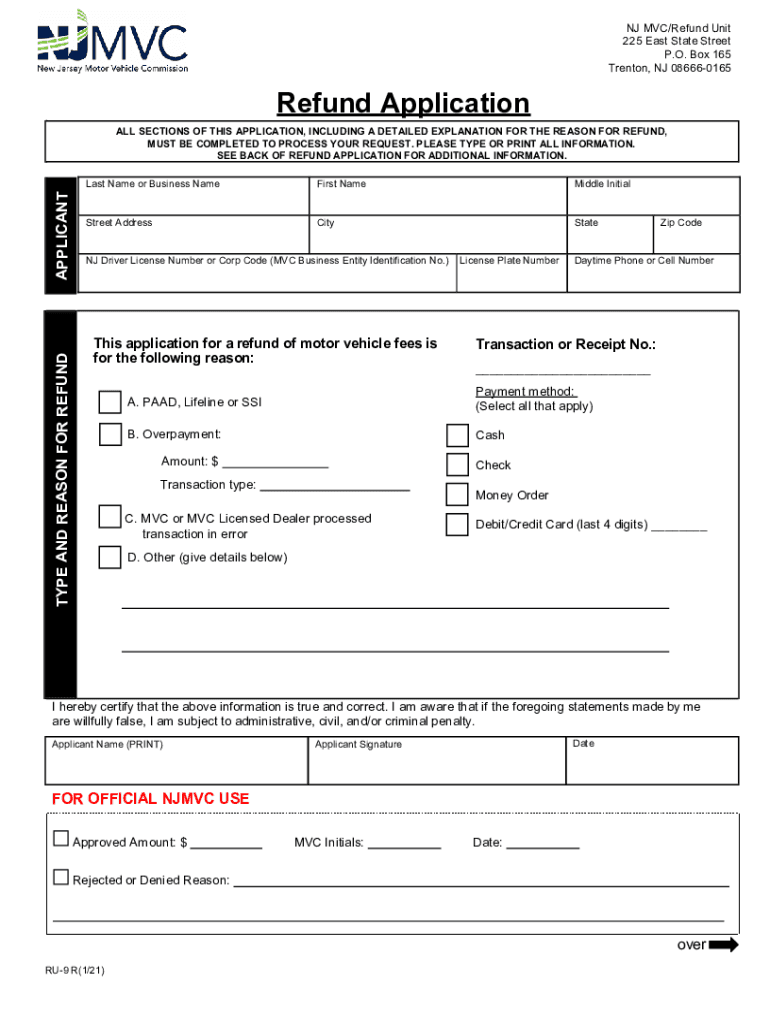

NJ MVC/Refund Unit

225 East State Street

P.O. Box 165

Trenton, NJ 086660165Refund Application

APPLICANT ALL SECTIONS OF THIS APPLICATION, INCLUDING A DETAILED EXPLANATION FOR THE REASON FOR REFUND,

MUST

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ RU-9

Edit your NJ RU-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ RU-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ RU-9 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ RU-9. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ RU-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ RU-9

How to fill out NJ RU-9

01

Obtain the NJ RU-9 form from the New Jersey Division of Taxation website or local tax office.

02

Enter your personal information in the designated fields, including name, address, and Social Security number.

03

Indicate the income type and amount for which you are filing.

04

Complete the section regarding your federal tax return details, including any relevant adjustments.

05

Review any applicable credits or deductions you may qualify for.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form by the specified deadline, either electronically or by mail.

Who needs NJ RU-9?

01

Individuals or businesses that are subject to New Jersey income tax and need to report certain income types.

02

Taxpayers who are claiming specific deductions or credits that require the use of the NJ RU-9 form.

03

Anyone who has received income that falls under the guidelines requiring this form for accurate reporting to the state.

Fill

form

: Try Risk Free

People Also Ask about

Who is getting the $500 rebate in New Jersey?

Have New Jersey Gross Income (line 29 of the NJ-1040) of $150,000 or less for individuals with a filing status of Married Filing Joint, Head of Household, or Surviving Spouse ($75,000 or less for individuals with a filing status of Married Filing Separate or Single).

How do I get a sales tax refund in NJ?

The Claim for Refund (Form A-3730) must be filed with documents, such as invoices, receipts, proof of payment of tax, and exemption certificates. These documents must be provided in a format suitable to determine the correctness of the grounds for the refund and the amount of the refund or credit.

How do I file a refund?

To claim an income tax refund, you need to fulfil the following requirements: You should have filed your income tax return for the relevant assessment year. You should have accurate details of the tax payments made by you during the relevant assessment year. You should have proof of TDS or advance tax payments made by you.

What is Form NJ 600?

NJ-600 Employer Notice of Adjustment of New Jersey Gross Income Tax.

Who gets NJ 500 refund?

Have New Jersey Gross Income (line 29 of the NJ-1040) of $150,000 or less for individuals with a filing status of Married Filing Joint, Head of Household, or Surviving Spouse ($75,000 or less for individuals with a filing status of Married Filing Separate or Single).

Who gets the NJ rebate check?

More than 1.7 million New Jersey residents applied for the ANCHOR rebate program, including 1.25 million homeowners and over 514,000 renters. The majority of payments will be issued before May 3, 2023, with applications that need additional information potentially taking more time to finalize.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ RU-9 for eSignature?

When your NJ RU-9 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the NJ RU-9 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your NJ RU-9 in seconds.

How do I complete NJ RU-9 on an Android device?

Use the pdfFiller Android app to finish your NJ RU-9 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NJ RU-9?

NJ RU-9 is a form used in New Jersey for reporting information related to New Jersey's Unemployment Insurance benefits and payroll taxes.

Who is required to file NJ RU-9?

Businesses and employers in New Jersey who have employees and are subject to the state's Unemployment Insurance law are required to file NJ RU-9.

How to fill out NJ RU-9?

To fill out NJ RU-9, employers must provide detailed information about their employees' wages, hours worked, and any unemployment benefits claimed. Follow the instructions on the form carefully and ensure all sections are completed accurately.

What is the purpose of NJ RU-9?

The purpose of NJ RU-9 is to ensure accurate reporting of payroll information to help determine unemployment insurance eligibility and benefits for employees.

What information must be reported on NJ RU-9?

The NJ RU-9 requires reporting of employee names, Social Security numbers, earnings, hours worked, and other relevant payroll information.

Fill out your NJ RU-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ RU-9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.