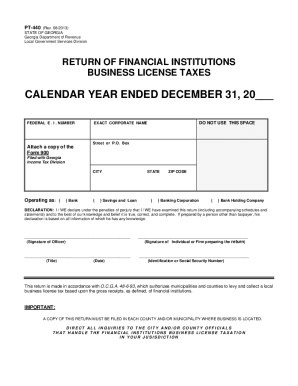

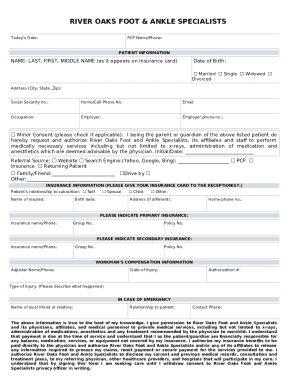

GA DoR PT-440 2005 free printable template

Show details

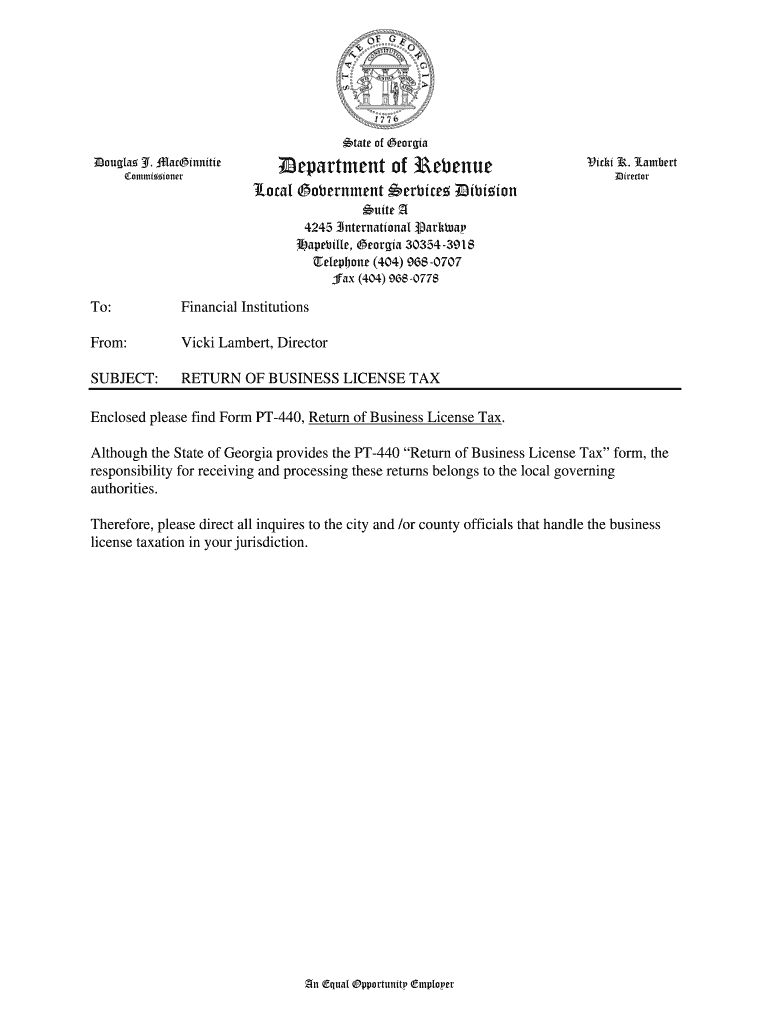

Although the State of Georgia provides the PT-440 Return of Business License Tax form the responsibility for receiving and processing these returns belongs to the local governing authorities. Lambert Director Suite A 4245 International Parkway Hapeville Georgia 30354-3918 Telephone 404 968-0707 Fax 404 968-0778 To Financial Institutions From SUBJECT RETURN OF BUSINESS LICENSE TAX Enclosed please find Form PT-440 Return of Business License Tax. To obtain those amounts multiply the ratio in...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR PT-440

Edit your GA DoR PT-440 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR PT-440 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA DoR PT-440 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit GA DoR PT-440. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR PT-440 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR PT-440

How to fill out GA DoR PT-440

01

Begin by downloading the GA DoR PT-440 form from the Georgia Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Complete the relevant sections by providing details about your financial status and any applicable income sources.

04

If you have dependents, ensure you list them in the designated area.

05

Review the instructions provided with the form for any specific requirements based on your situation.

06

Once all sections are completed, double-check for accuracy and ensure all necessary signatures are included.

07

Submit the form by the deadline indicated on the instructions, either by mail or electronically if options are available.

Who needs GA DoR PT-440?

01

Individuals who are seeking tax relief or exemptions in Georgia.

02

Taxpayers who need to report changes in their financial situation to the Department of Revenue.

03

Residents of Georgia who qualify for specific tax deductions or credits.

Fill

form

: Try Risk Free

People Also Ask about

How should I categorize my LLC?

LLCs are classified as “pass-through” entities for tax reasons, meaning the business profits and losses will flow through to the personal tax return of each member. An LLC can also elect to be taxed as an S-Corporation or a C-Corporation. To be taxed as an S-Corporation, the LLC must file IRS form 2553.

What type of LLC is most common?

Single-member LLCs are recognized in every state and are the most common type of LLC. Here, the word "member" is a stand-in for "owner." Single-member LLCs have an individual owner. The Internal Revenue Service (IRS) treats them as sole proprietorships for tax purposes.

Should you get EIN first or LLC first?

It's necessary to file for LLC before EIN as you are not guaranteed your business name if it has not been registered. Also, the new regulation of the IRS requires filing the articles of incorporation and other documentation before businesses can obtain an EIN.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit GA DoR PT-440 in Chrome?

Install the pdfFiller Google Chrome Extension to edit GA DoR PT-440 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the GA DoR PT-440 form on my smartphone?

Use the pdfFiller mobile app to complete and sign GA DoR PT-440 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit GA DoR PT-440 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share GA DoR PT-440 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is GA DoR PT-440?

GA DoR PT-440 is a form used in the state of Georgia for the purpose of reporting certain types of income and deductions for tax purposes, particularly related to state tax obligations.

Who is required to file GA DoR PT-440?

Individuals or entities who have income that is subject to Georgia taxation, including residents or non-residents earning income in Georgia, are required to file GA DoR PT-440.

How to fill out GA DoR PT-440?

To fill out GA DoR PT-440, taxpayers must provide information such as their personal details, income sources, and applicable deductions. The form usually includes sections that need to be completed accurately based on the taxpayer's financial activity.

What is the purpose of GA DoR PT-440?

The purpose of GA DoR PT-440 is to collect information needed for the assessment of state income tax liabilities and to ensure compliance with Georgia tax laws.

What information must be reported on GA DoR PT-440?

The information that must be reported on GA DoR PT-440 includes personal identification details, total income earned, deductions claimed, and any credits applicable to the taxpayer's situation.

Fill out your GA DoR PT-440 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR PT-440 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.