Get the free HOME EQUITY LOANS REMOVED FROM OPTIONAL LOAN TYPES

Show details

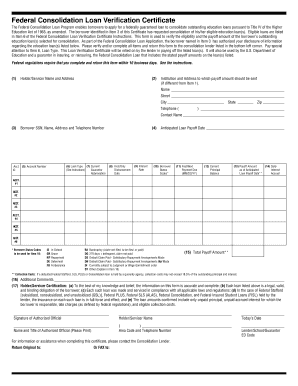

2020 CRA FILE SPECIFICATIONSBoard of Governors of the Federal Reserve System (FRS)

Federal Deposit Insurance Corporation (FDIC)

Office of the Comptroller of the Currency (OCC)Respondent Identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity loans removed

Edit your home equity loans removed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity loans removed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home equity loans removed online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit home equity loans removed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home equity loans removed

How to fill out home equity loans removed

01

Gather all necessary documents such as income statements, property value assessments, and credit reports.

02

Research and compare different mortgage lenders to find the best home equity loan option for your needs.

03

Complete the application form provided by the chosen lender, providing accurate and detailed information about your financial situation.

04

Submit the application along with all the required documents for verification and evaluation by the lender.

05

Await approval and review any additional information or documentation requested by the lender.

06

If approved, carefully review the terms and conditions of the home equity loan offered, including interest rates, repayment terms, and any associated fees.

07

Sign the loan agreement if you agree with the terms and conditions, and ensure that you have a clear understanding of your obligations as a borrower.

08

Use the funds provided by the home equity loan for the intended purposes, such as home improvement, debt consolidation, or educational expenses.

09

Make regular payments according to the agreed-upon repayment schedule to avoid any penalties or negative impact on your credit score.

10

Monitor your home equity loan account and stay in touch with the lender for any updates or changes that may affect your loan.

Who needs home equity loans removed?

01

Homeowners who need funds for major home renovations or improvements.

02

Individuals who want to consolidate high-interest debts into a single loan with potentially lower interest rates.

03

Homeowners who want to access their home's equity for education expenses or to cover medical costs.

04

Those who are planning to invest in real estate or other ventures and need additional capital.

05

People who want to have a financial safety net for emergencies or unexpected expenses.

06

Individuals who want to take advantage of potential tax benefits associated with home equity loan interest deductions.

07

Homeowners who have a stable income and can afford the loan payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify home equity loans removed without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your home equity loans removed into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in home equity loans removed?

With pdfFiller, it's easy to make changes. Open your home equity loans removed in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the home equity loans removed in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your home equity loans removed and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is home equity loans removed?

Home equity loans removed refers to the process of eliminating or canceling a mortgage loan that is secured by the equity in a borrower's home. This can happen if the loan is paid off or forgiven.

Who is required to file home equity loans removed?

Typically, individuals or entities that have taken out home equity loans and are seeking to remove or discharge them from their records need to file the appropriate documentation.

How to fill out home equity loans removed?

To fill out home equity loans removed, one should follow the specific instructions provided by their lender or relevant financial institution, ensuring to include all required personal and loan information.

What is the purpose of home equity loans removed?

The purpose of home equity loans removed is to formally acknowledge the settlement or discharge of a loan, ensuring that the borrower's financial obligations are accurately represented in their credit history.

What information must be reported on home equity loans removed?

The information that must be reported includes the loan account number, the amount paid or forgiven, the date of removal, and any other relevant details specified by the lender.

Fill out your home equity loans removed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Loans Removed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.