Get the free CREDIT APPLICATION / BUSINESS PROFILE

Show details

RESET

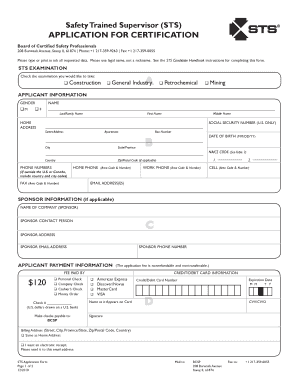

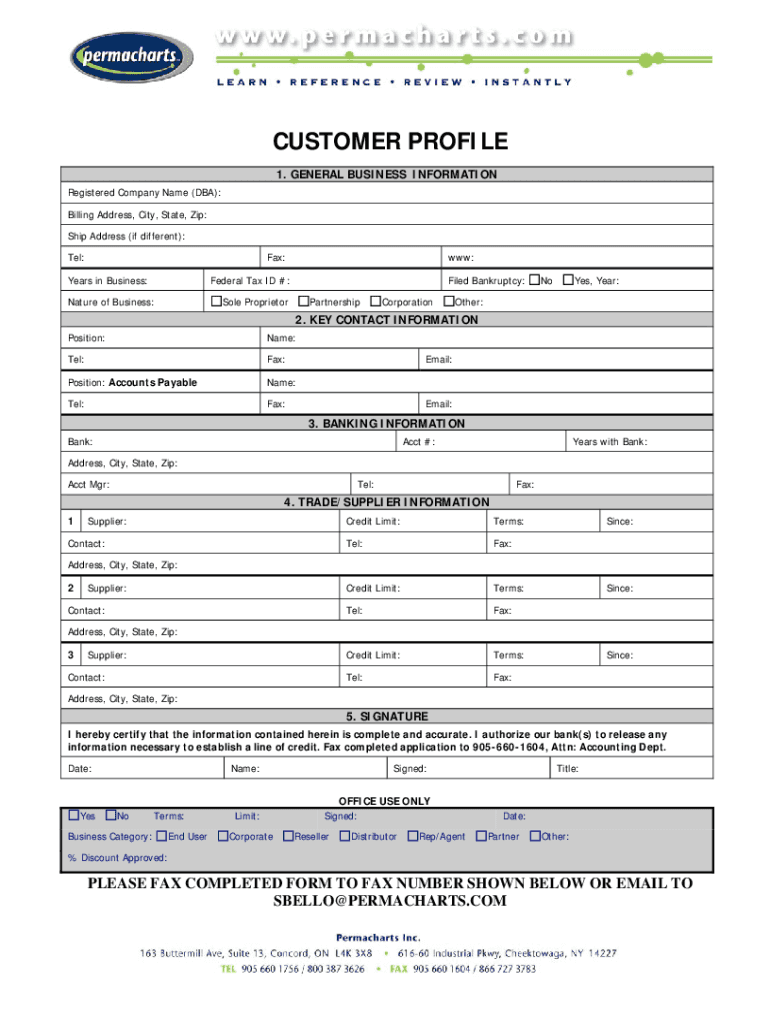

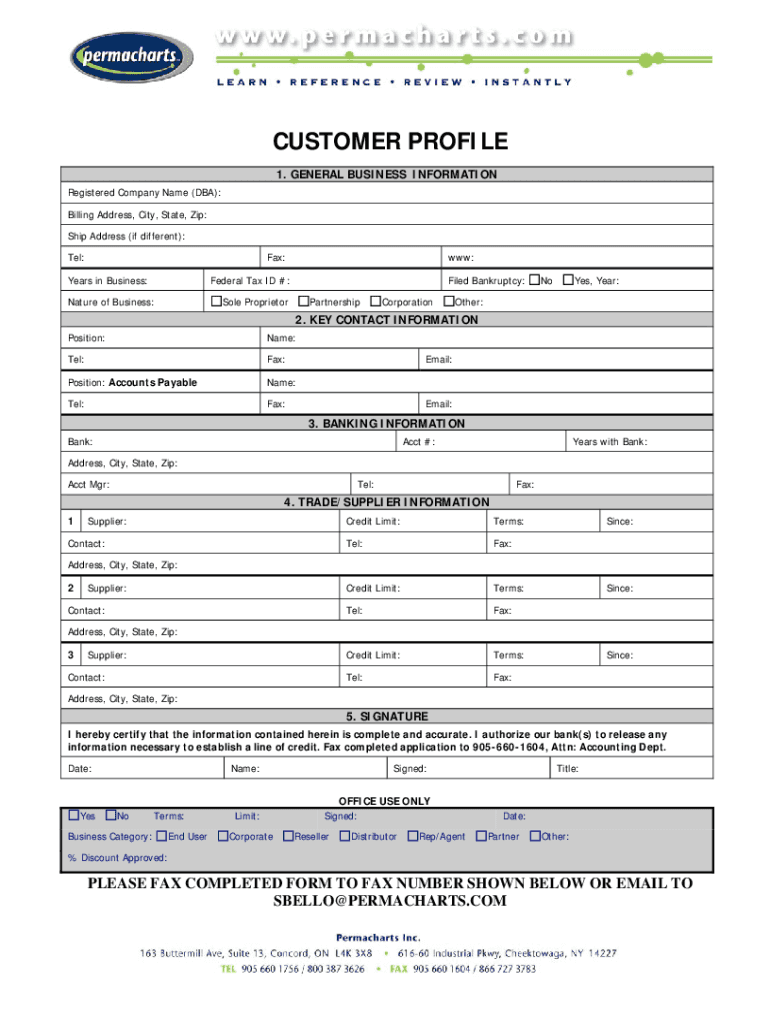

PRINTCUSTOMER PROFILESUBMIT1. GENERAL BUSINESS INFORMATION

Registered Company Name (DBA):

Billing Address, City, State, Zip:

Ship Address (if different):

Tel:Fax:Years in Business:WWW:Federal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application business profile

Edit your credit application business profile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application business profile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application business profile online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit application business profile. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application business profile

How to fill out credit application business profile

01

Start by gathering all necessary information about your business, such as its legal name, address, and contact information.

02

Provide details about your business structure, whether it is a sole proprietorship, partnership, corporation, or LLC.

03

Include your business's industry and the products or services it offers.

04

Mention the number of years your business has been operating.

05

Describe your business's ownership or management structure, including names and titles of key individuals.

06

Provide information about the financial aspects of your business, such as annual revenue, profit, and any outstanding debts or loans.

07

Include details about your business's banking relationships and credit references.

08

Provide information about any legal or regulatory compliance your business must adhere to, such as licenses or permits.

09

Don't forget to include any additional supporting documents, such as financial statements, tax returns, or business plans.

10

Double-check all the information provided to ensure accuracy and completeness before submitting the credit application business profile.

Who needs credit application business profile?

01

Any business that is seeking credit from a financial institution or supplier may need a credit application business profile. This includes both established businesses looking for additional financing and new businesses looking to establish credit relationships. By providing a detailed profile of their business, including financial information and references, businesses can increase their chances of obtaining credit and building strong business relationships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application business profile for eSignature?

credit application business profile is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the credit application business profile in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your credit application business profile in minutes.

How do I fill out credit application business profile using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign credit application business profile and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is credit application business profile?

A credit application business profile is a document that provides detailed information about a business's financial status, creditworthiness, and operational background to potential creditors or lenders.

Who is required to file credit application business profile?

Typically, businesses seeking credit or loans are required to file a credit application business profile, including sole proprietorships, partnerships, and corporations.

How to fill out credit application business profile?

To fill out a credit application business profile, provide accurate information regarding your business name, address, ownership structure, financial history, amount of credit requested, and other relevant financial data as required by the lender.

What is the purpose of credit application business profile?

The purpose of a credit application business profile is to provide lenders with insight into a business's financial stability and creditworthiness, helping them make informed decisions about granting credit.

What information must be reported on credit application business profile?

Information that must be reported includes business identification details, ownership information, financial statements, credit history, and references from other creditors or lenders.

Fill out your credit application business profile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application Business Profile is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.