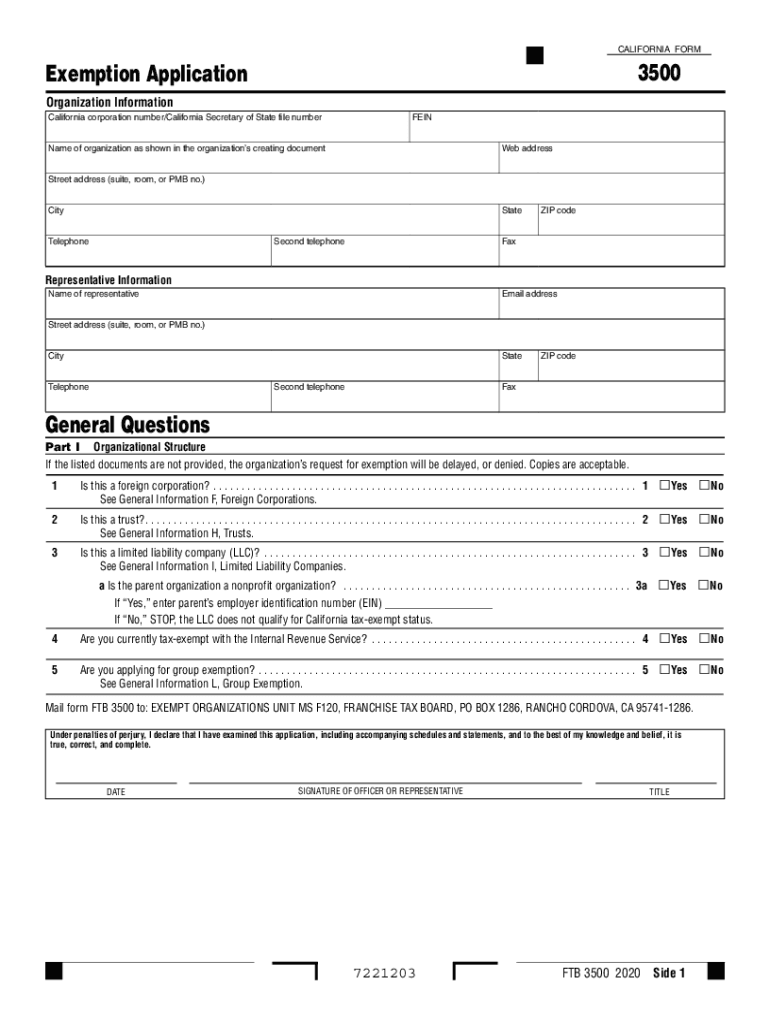

What is California Form 3500?

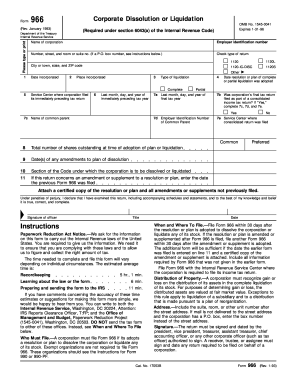

California Form 3500 is officially called the Exemption Application. This form is fee-based. The fee is $25. This from must be filed by individuals, trusts, California corporations, Limited Liability Companies, foreign corporations, estates or other organizations claiming for a tax-exempt status.

What is California Form 3500 for?

This form is mainly used to request a tax-exempt status for your organization.

When is California Form 3500 Due?

The form can be filed when it is required. It does not have a certain due date to be followed.

Is California Form 3500 Accompanied by Other Forms?

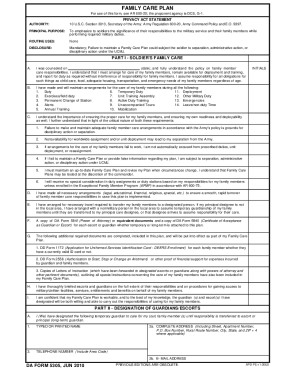

Yes, you must attach such copies as the payment check confirming a $25 fee, federal determination letter, entity’s creating document, bylaws or proposed bylaws, etc.

What Information do I Include in California Form 3500?

First you must describe your organization providing such information as corporation number, VEIN, corporation’s name and full address, the first and the second telephone numbers, and fax. After that provide the information about the representative: name, e-mail address, mailing address, the first and the second telephone numbers, and fax. You must choose the type of organization. You must date the document. The representative must sign it. The next part of the form is called the Narrative of the Activities with multiple yes/no questions. Your financial data is also required in this form. It has several schedules.

Where do I send California Form 3500?

Send this form to the Franchise Tax Board of California.