Get the free ANNUAL AUDITED REPORT FORM X 17A-5 SEC PART III a-51483 ...

Show details

61)

IN

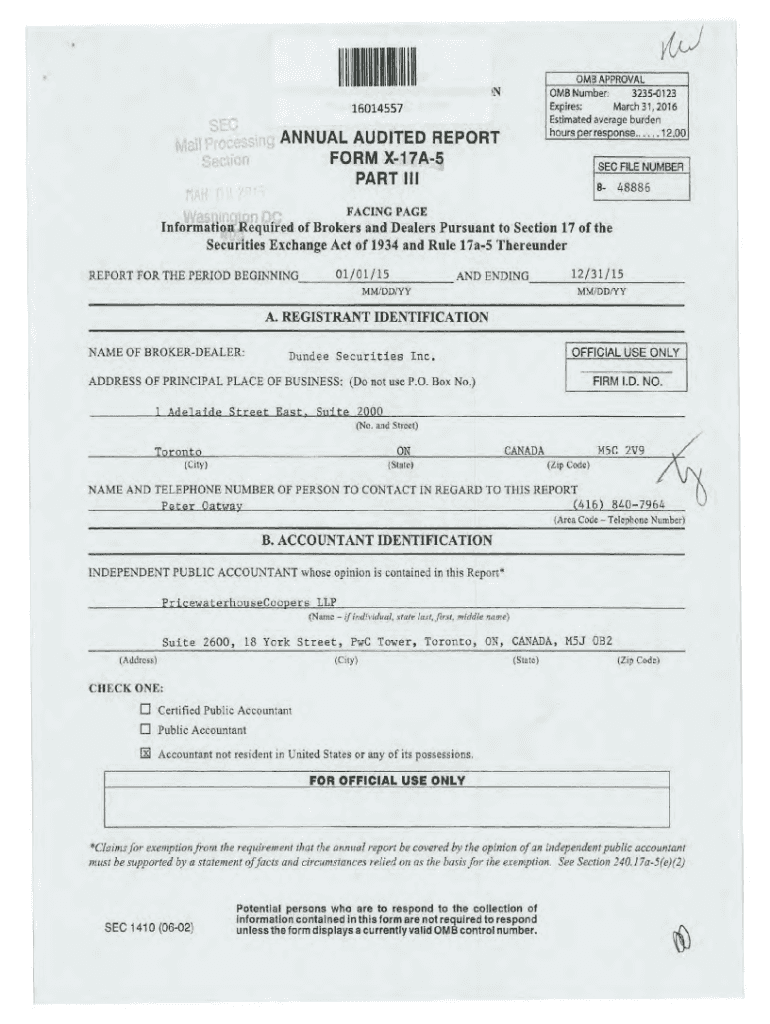

16014557ANNUAL AUDITED REPORT

FORM X17A5

PART III OMB APPROVAL

OMB Number:

32350123

Expires:

March 31, 2016,

Estimated average burden

hours per response......12.00

SEC FILE NUMBER

B 48886FACING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual audited report form

Edit your annual audited report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual audited report form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit annual audited report form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited report form

How to fill out annual audited report form

01

To fill out an annual audited report form, follow these steps:

02

Gather all the required financial documents and records for the reporting period.

03

Start by entering the basic information such as the name of the company, the reporting period, and any applicable identification numbers.

04

Include a balance sheet that shows the company's assets, liabilities, and equity.

05

Provide a statement of income and expenses, detailing the company's revenues, costs, and any other financial transactions.

06

Include a statement of cash flows, outlining the sources and uses of cash during the reporting period.

07

Attach any supporting schedules or documentation that may be required, such as supporting invoices or receipts.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form before submitting it to the appropriate regulatory authority or external auditors.

Who needs annual audited report form?

01

Various entities and organizations may need to fill out an annual audited report form, including:

02

- Publicly traded companies: These companies are required by securities regulations to provide audited financial statements to ensure transparency and protect investor interests.

03

- Non-profit organizations: Non-profits often need to submit audited financial reports to comply with regulatory requirements and maintain their tax-exempt status.

04

- Government agencies: Government departments and agencies may need to prepare audited financial reports to demonstrate accountability and effective use of public funds.

05

- Banks and financial institutions: These entities often require audited financial statements from companies as part of their lending or investment evaluation processes.

06

- Private companies: While not always mandatory, private companies may choose to have their financial statements audited for credibility and transparency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send annual audited report form to be eSigned by others?

When your annual audited report form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the annual audited report form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your annual audited report form in minutes.

How do I edit annual audited report form on an iOS device?

Create, edit, and share annual audited report form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is annual audited report form?

The annual audited report form is a formal document that companies submit to regulatory authorities, containing audited financial statements and disclosures about their financial performance for a specific fiscal year.

Who is required to file annual audited report form?

Typically, publicly traded companies, certain large private companies, and organizations that fall under specific financial regulatory requirements are required to file an annual audited report form.

How to fill out annual audited report form?

To fill out the annual audited report form, companies must compile their financial statements (income statement, balance sheet, cash flow statement), ensure they are audited by a certified public accountant, and complete the form according to the guidelines provided by the relevant authority.

What is the purpose of annual audited report form?

The purpose of the annual audited report form is to provide a transparent overview of a company's financial health, ensuring accountability and compliance with financial regulations while informing investors and stakeholders.

What information must be reported on annual audited report form?

The report typically includes company background, financial statements, notes to the financial statements, management discussion, and analysis, auditor's opinion, and any significant accounting policies.

Fill out your annual audited report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Report Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.