NY BPSS-153 2014 free printable template

Show details

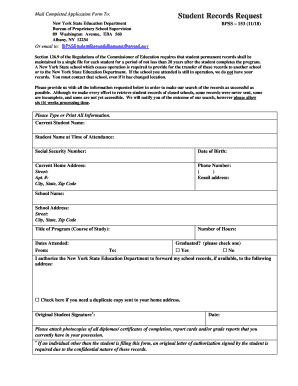

Mail Completed Application Form To: New York State Education Department Bureau of Proprietary School Supervision 99 Washington Avenue, Room 1613 OCP Albany, NY 12234 Student Records Request BASS 153

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY BPSS-153

Edit your NY BPSS-153 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY BPSS-153 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY BPSS-153 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY BPSS-153. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY BPSS-153 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY BPSS-153

How to fill out NY BPSS-153

01

Begin by downloading the NY BPSS-153 form from the official website.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Provide the details related to your business activities in the designated sections.

04

Indicate the type of business entity you are operating.

05

Complete any financial information required, such as gross income and expenditures.

06

Sign and date the form at the bottom.

07

Submit the completed form as per the instructions provided, either by mail or online.

Who needs NY BPSS-153?

01

Individuals or businesses seeking to apply for a license or permit under the New York State Department of Consumer Affairs.

02

Those who are engaged in specific regulated activities that require disclosure of business information.

03

Professionals needing to comply with the state's regulatory requirements for operating certain types of businesses.

Fill

form

: Try Risk Free

People Also Ask about

Are student records maintained at the New York State Education Department True or false?

Complete student records are maintained by schools and school districts and not at NYSED, therefore, NYSED cannot make amendments to school or school district records.

Where are student records maintained in New York State?

New York State Center for School Health.

Are student records maintained at the New York State education Department?

Complete student records are maintained by schools and school districts and not at NYSED, therefore, NYSED cannot make amendments to school or school district records. Schools and school districts are best positioned to make corrections to students' education records.

What are the record keeping requirements in NY?

Generally, you must keep records and supporting documents for at least three years after you file a return. Your records may be in paper or electronic format, or both. You must be able to compare records from one time period (such as month, quarter, or year) with records from another period.

What is the New York State law for student data privacy?

New York State Education Law 2-d prohibits the unauthorized release of personally identifiable student, teacher, or administrator data (PII). It also requires Parents' Bill of Rights for Data Privacy and Security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NY BPSS-153?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the NY BPSS-153 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit NY BPSS-153 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your NY BPSS-153 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the NY BPSS-153 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NY BPSS-153 and you'll be done in minutes.

What is NY BPSS-153?

NY BPSS-153 is a form used by businesses in New York State to report certain tax information related to the Business Personal Property tax.

Who is required to file NY BPSS-153?

Businesses that own or lease personal property in New York State and are subject to the Business Personal Property tax must file NY BPSS-153.

How to fill out NY BPSS-153?

To fill out NY BPSS-153, businesses need to provide details about their personal property, including types of property, acquisition costs, and any applicable exemptions.

What is the purpose of NY BPSS-153?

The purpose of NY BPSS-153 is to report the value of business personal property for taxation purposes in order to assess the appropriate tax liability.

What information must be reported on NY BPSS-153?

The information that must be reported includes a description of the property, acquisition date, cost, depreciation, and any exemptions claimed.

Fill out your NY BPSS-153 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY BPSS-153 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.