Get the free Loan Extension Request - Campus Federal

Show details

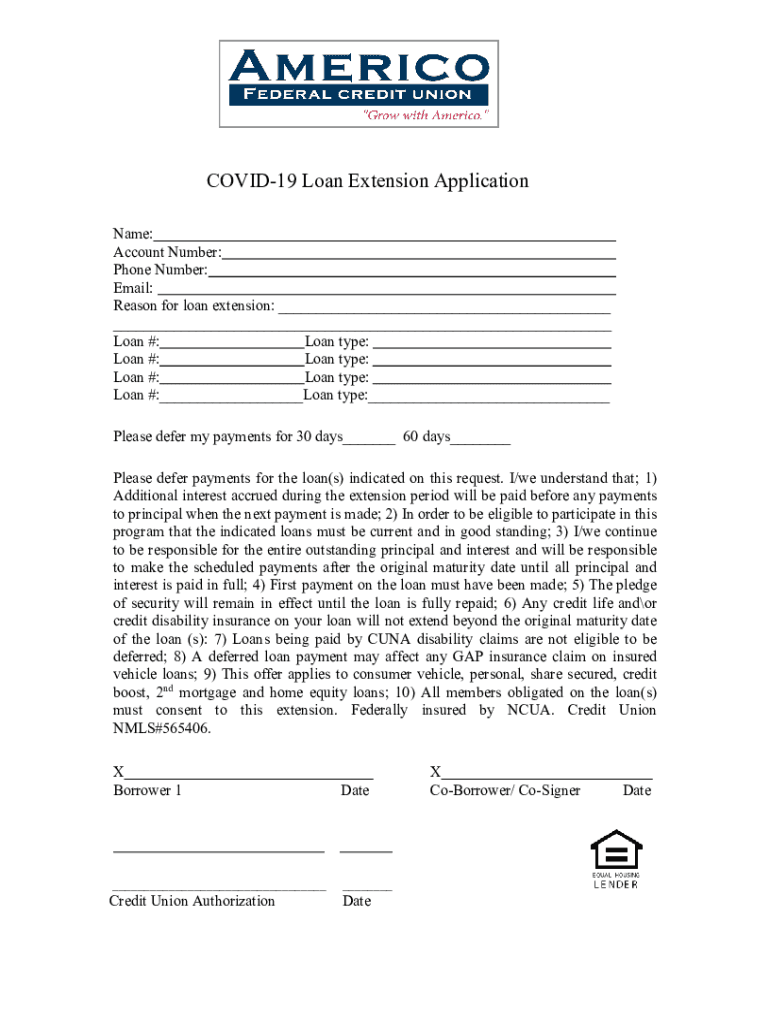

COVID-19 Loan Extension Application Name: Account Number: Phone Number: Email: Reason for loan extension: Loan #: Loan type: Loan #: Loan type: Loan #: Loan type: Loan #: Loan type: Please defer my

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan extension request

Edit your loan extension request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan extension request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan extension request online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan extension request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan extension request

How to fill out loan extension request

01

To fill out a loan extension request, follow these steps:

02

Contact your lender: Reach out to your loan provider to inquire about the process of requesting a loan extension.

03

Gather necessary information: Collect all the required documentation, such as loan account details, personal identification, and any supporting documents related to your request.

04

Understand the terms: Familiarize yourself with the terms and conditions of your loan agreement to determine if you are eligible for an extension. Be aware of any fees or penalties associated with the extension.

05

Write a formal letter: Prepare a formal letter requesting the loan extension. Include your reasons for needing the extension and a proposed timeline for repayment.

06

Provide supporting documents: Attach any relevant supporting documents to validate your request, such as proof of financial hardship or medical certificates if applicable.

07

Submit your request: Send the filled-out loan extension request along with the supporting documents to your lender via mail, email, or through their online portal.

08

Follow-up: Keep track of your request's progress and follow up with your lender if necessary.

09

Await a response: Wait for a response from your lender regarding the decision on your loan extension request. If approved, review the new terms and conditions provided.

10

Review and sign: If you agree with the terms, sign the loan extension agreement as instructed by your lender.

11

Comply with the new terms: Abide by the revised terms and make timely payments as agreed in the loan extension agreement.

Who needs loan extension request?

01

Loan extension requests are generally required by individuals who are unable to fulfill their loan repayment obligations within the agreed-upon timeframe.

02

Common scenarios where someone might need a loan extension include:

03

- Experiencing financial hardships like job loss, unexpected medical expenses, or other unforeseen circumstances affecting their ability to repay

04

- Temporary financial setbacks or cash flow issues

05

- Needing additional time to arrange alternative repayment methods

06

- Individuals who foresee future financial difficulties and want to proactively secure an extension to avoid defaulting on the loan

07

It is advised to contact your specific lender for more information regarding their loan extension policies and eligibility criteria.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute loan extension request online?

Completing and signing loan extension request online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit loan extension request in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your loan extension request, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the loan extension request in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your loan extension request directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is loan extension request?

A loan extension request is a formal application submitted to a lender to extend the term of a loan, allowing the borrower more time to repay the borrowed amount.

Who is required to file loan extension request?

Borrowers who seek additional time to repay their loans or those who anticipate difficulty in meeting the original loan agreement are required to file a loan extension request.

How to fill out loan extension request?

To fill out a loan extension request, borrowers should provide personal information, loan details, the reason for the extension, and any supporting documentation that outlines their financial situation.

What is the purpose of loan extension request?

The purpose of a loan extension request is to provide borrowers with additional time to meet their repayment obligations, thus avoiding default and potential penalties.

What information must be reported on loan extension request?

The information that must be reported on a loan extension request includes borrower’s details, loan account information, amount owed, reason for extension, and any relevant financial documentation.

Fill out your loan extension request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Extension Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.