Get the free laundering activities, Federal law requires all financial institutions to obtain, ve...

Show details

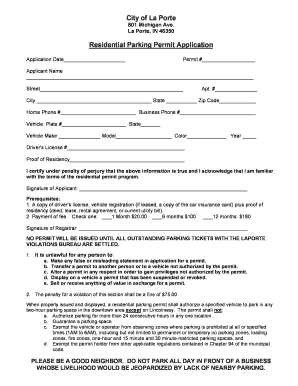

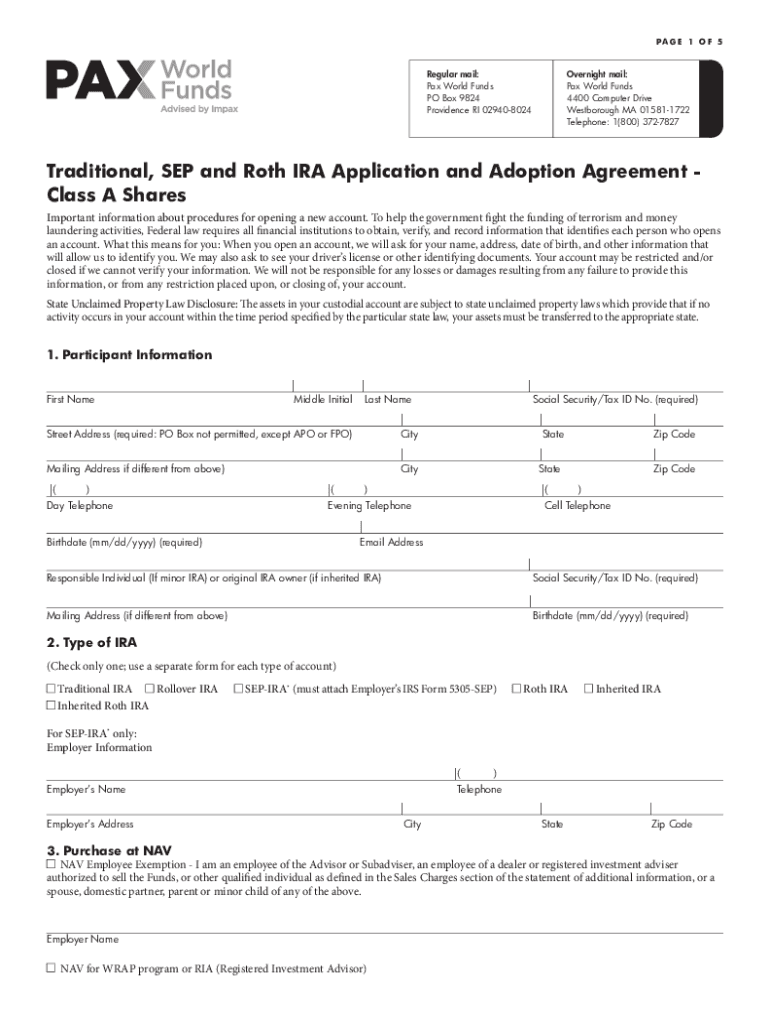

PAG E 1 O F 5Regular mail:

Pax World Funds

PO Box 9824

Providence RI 029408024Overnight mail:

Pax World Funds

4400 Computer Drive

West borough MA 015811722

Telephone: 1(800) 3727827Traditional, SEP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign laundering activities federal law

Edit your laundering activities federal law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your laundering activities federal law form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing laundering activities federal law online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit laundering activities federal law. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out laundering activities federal law

How to fill out laundering activities federal law

01

Step 1: Understand the federal law on laundering activities. This includes the Bank Secrecy Act (BSA), the USA PATRIOT Act, and other relevant laws and regulations.

02

Step 2: Familiarize yourself with the reporting requirements and obligations under the federal law. This may include filing Suspicious Activity Reports (SARs) or Currency Transaction Reports (CTRs) with the Financial Crimes Enforcement Network (FinCEN).

03

Step 3: Establish internal policies and procedures to detect and prevent money laundering activities. This may involve implementing customer due diligence processes, conducting risk assessments, and maintaining adequate record-keeping practices.

04

Step 4: Train employees on the federal law and their responsibilities in preventing money laundering. This may include providing education on red flags and suspicious activity indicators.

05

Step 5: Monitor transactions and activities for any signs of money laundering. Regularly review and analyze financial records and customer transactions to identify potential risks.

06

Step 6: Report any suspicious activities or transactions to the appropriate authorities as required by the federal law. Maintain proper documentation and records of the reported incidents.

07

Step 7: Stay updated on changes and updates to the federal law on laundering activities. Regularly review new regulations or guidance issued by FinCEN or other regulatory bodies.

08

Step 8: Conduct regular audits and assessments of your organization's compliance with the federal law. Identify any areas of improvement and take corrective actions as necessary.

09

Step 9: Cooperate with law enforcement agencies and regulatory authorities during investigations or examinations related to money laundering activities.

10

Step 10: Continuously monitor and improve your organization's anti-money laundering measures to stay compliant with the changing landscape of laundering activities federal law.

Who needs laundering activities federal law?

01

Financial institutions such as banks, credit unions, and other money services businesses

02

Businesses involved in high-risk industries like casinos, insurance companies, jewelers, and real estate

03

Professionals such as accountants, lawyers, and real estate agents who may come across money laundering activities in their work

04

Government agencies responsible for regulating and enforcing anti-money laundering laws and regulations

05

Any individual or organization involved in financial transactions and has a legal obligation to prevent money laundering activities

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get laundering activities federal law?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific laundering activities federal law and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in laundering activities federal law?

With pdfFiller, the editing process is straightforward. Open your laundering activities federal law in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit laundering activities federal law on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign laundering activities federal law right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is laundering activities federal law?

Laundering activities federal law refers to the legal statutes and regulations designed to prevent and punish the act of money laundering, which involves concealing the origins of illegally obtained money, typically by passing it through a complex sequence of banking transfers or commercial transactions.

Who is required to file laundering activities federal law?

Individuals and entities engaged in certain financial activities, including banks, credit unions, securities firms, and other financial institutions are required to file reports under federal law if they suspect money laundering activities.

How to fill out laundering activities federal law?

To fill out the necessary forms for reporting laundering activities, individuals must gather pertinent information about the transaction, the parties involved, and the reasons for suspicion, and then complete the required FinCEN Form 116 or other relevant forms specific to their institution, ensuring accuracy and thoroughness.

What is the purpose of laundering activities federal law?

The purpose of laundering activities federal law is to prevent, detect, and penalize money laundering, thereby enhancing the integrity of the financial system and safeguarding it from being misused for criminal activities.

What information must be reported on laundering activities federal law?

Reports must include detailed information such as the identities of individuals involved, account numbers, amounts of money, dates of transactions, the nature of the transaction, and any relevant supporting documentation or evidence of suspicious circumstances.

Fill out your laundering activities federal law online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Laundering Activities Federal Law is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.