WV ATTC-1 2016-2025 free printable template

Get, Create, Make and Sign wv credit form printable

Editing apprenticeship training tax credit online

Uncompromising security for your PDF editing and eSignature needs

WV ATTC-1 Form Versions

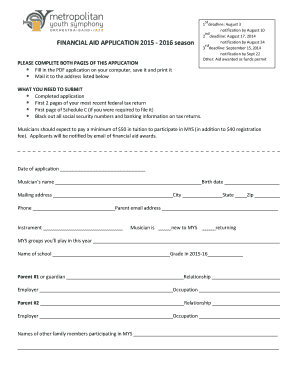

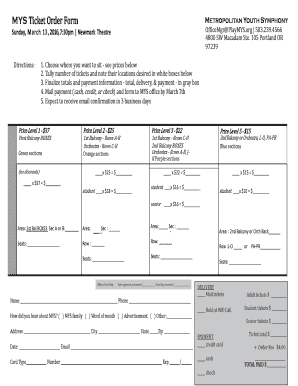

How to fill out attc 1 form

How to fill out WV ATTC-1

Who needs WV ATTC-1?

Video instructions and help with filling out and completing attc 1

Instructions and Help about wv training tax edit

The wheels on the bus go round and runaround and round and round The wheels on the bus go round and Randall through the town The sound of the bus goes Clink Clank Clonking Clank Clonk Clink Clank Clonk The sound of the bus goes Clink Clank Clonal through the town The driver on the bus says we need some help need some help We need some help The driver on the bus says we need some helpful through the town The bus on the road says This way pleases way please This way please The bus on the road says This way please through the town The breakdown truck has come to welcome to help Come to help The breakdown truck has come to helpful through the town The mechanic says I'll change the parts I'll change the parts I'll change the parts The mechanic says I'll change the partial through the town The wheels on the bus go round aground again Round The wheels on the bus go round against through the town

People Also Ask about wv attc 1

Who is legally required to file a tax return?

What is WV it 140 form?

Do all seniors have to file a tax return?

Does West Virginia have a state withholding form?

Does West Virginia have a state tax form?

Is there state tax in West Virginia?

How long do you have to be a resident of West Virginia to get in state tuition?

Do you have to file a state tax return in West Virginia?

At what point are you a resident?

How long do you have to live in WV to become a resident?

How do you qualify for in state tuition in West Virginia?

Do you have to make estimated quarterly tax payments?

Does West Virginia require estimated tax payments?

How long can you live somewhere without becoming a resident?

What is an IRS Form 140?

Who do I make check out to for WV state taxes?

Who has to file a WV tax return?

Who is exempt from filing a tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my attc 1 2016-2025 form in Gmail?

How can I fill out attc 1 2016-2025 form on an iOS device?

How do I edit attc 1 2016-2025 form on an Android device?

What is WV ATTC-1?

Who is required to file WV ATTC-1?

How to fill out WV ATTC-1?

What is the purpose of WV ATTC-1?

What information must be reported on WV ATTC-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.