NM TRD PIT-1 2020 free printable template

Show details

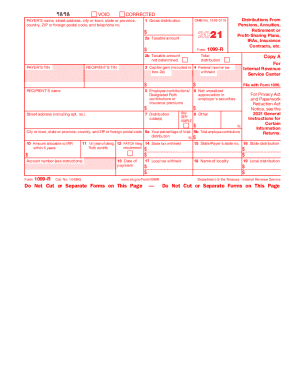

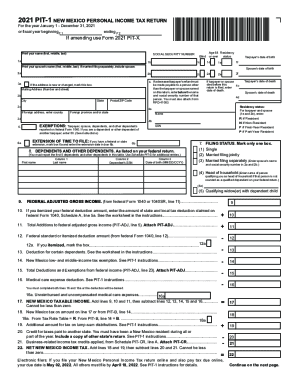

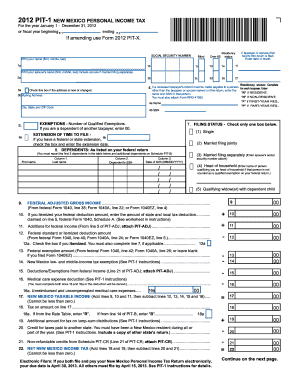

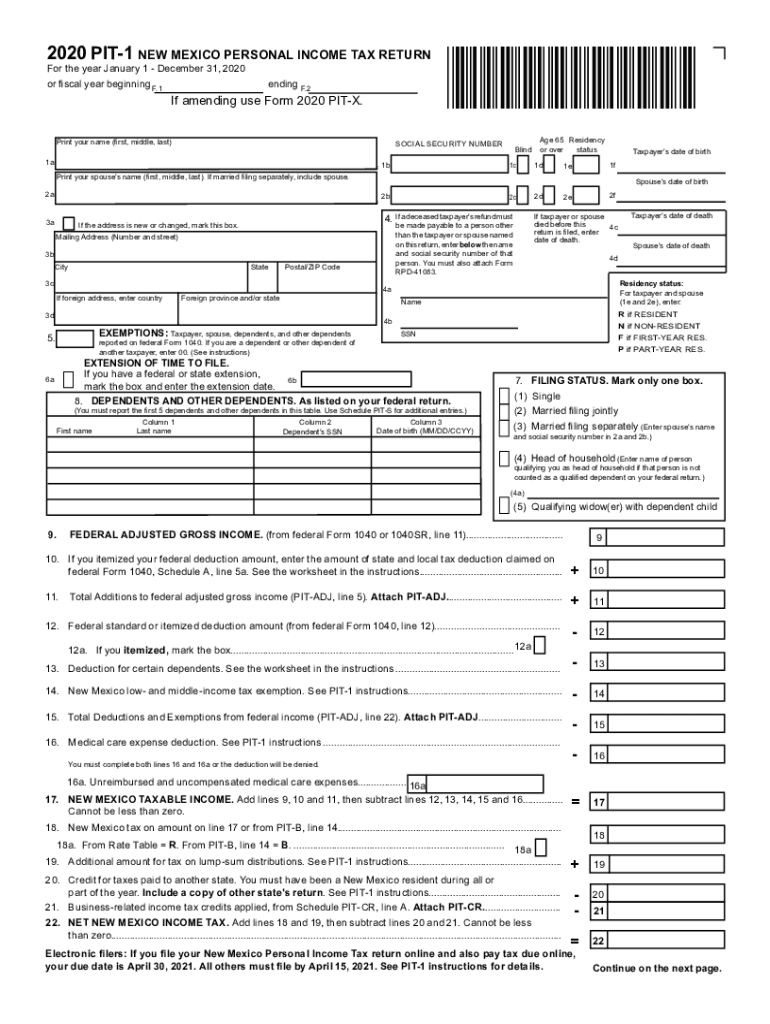

2020 PIT1 NEW MEXICO PERSONAL INCOME TAX RETURN For the year January 1 December 31, 2020, or fiscal year beginning F.1ending F.2If amending use Form 2020 PIT. Print your name (first, middle, last)*200180200×SOCIAL

pdfFiller is not affiliated with any government organization

Instructions and Help about NM TRD PIT-1

How to edit NM TRD PIT-1

How to fill out NM TRD PIT-1

Instructions and Help about NM TRD PIT-1

How to edit NM TRD PIT-1

To edit the NM TRD PIT-1 Tax Form, utilize pdfFiller's tools for editing PDFs. Open the form in pdfFiller, make necessary changes directly on the document, and save. Ensure that any edits are compliant with current state requirements to avoid discrepancies during filing.

How to fill out NM TRD PIT-1

Filling out the NM TRD PIT-1 involves providing specific personal and financial information. Follow these steps to ensure proper completion:

01

Gather relevant financial documents, including W-2 forms and other income statements.

02

Clearly print your name, address, and Social Security number at the top of the form.

03

Report your total income and calculate your taxable income as instructed.

04

Include any credits or deductions you may qualify for.

05

Review the form for accuracy before submitting.

About NM TRD PIT-1 2020 previous version

What is NM TRD PIT-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NM TRD PIT-1 2020 previous version

What is NM TRD PIT-1?

NM TRD PIT-1 is the New Mexico Personal Income Tax Form that residents must use to report their individual income and calculate state tax liabilities. It's specifically designed for taxpayers in New Mexico to ensure compliance with state tax laws.

What is the purpose of this form?

The purpose of NM TRD PIT-1 is to report personal income earned during the tax year and to calculate the amount of tax owed to the state of New Mexico. This form helps state authorities assess income tax properly and ensures taxpayers meet their financial responsibilities.

Who needs the form?

Taxpayers who earn income in New Mexico and are required to file a state income tax return must submit the NM TRD PIT-1 form. This includes individuals, married couples, and certain businesses that meet specific income thresholds.

When am I exempt from filling out this form?

You may be exempt from filling out the NM TRD PIT-1 if your income is below the minimum filing requirement set by the state, or if you qualify for specific exemptions such as being a dependent or qualifying for certain tax credits based on your income level.

Components of the form

The NM TRD PIT-1 includes several key components such as: taxpayer identification information, income section, deduction section, credits section, and summary lines for tax calculations. Each component helps delineate different aspects of the taxpayer's financial situation to assess the correct tax amount.

Due date

The due date for submitting the NM TRD PIT-1 typically aligns with federal income tax deadlines, which is usually April 15 of each year. If this date falls on a weekend or holiday, the due date will be adjusted accordingly. It's important to check the New Mexico Taxation and Revenue Department's announcements for any changes.

What are the penalties for not issuing the form?

Failing to issue the NM TRD PIT-1 on time may result in penalties and interest on any unpaid taxes. New Mexico may impose additional fines for late submissions which can increase over time, thus emphasizing the importance of timely filing.

What information do you need when you file the form?

When filing the NM TRD PIT-1, you will need the following information: your Social Security number, income information from W-2s or 1099s, details about any deductions or credits, and any prior year tax information you wish to reference. This ensures that your form is complete and accurate.

Is the form accompanied by other forms?

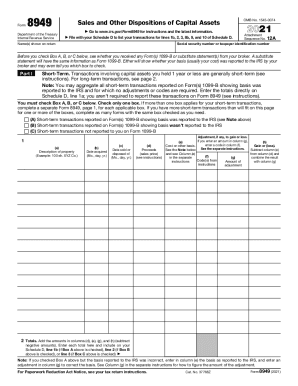

The NM TRD PIT-1 can be accompanied by additional forms depending on your tax situation. For example, if you are claiming specific deductions or credits, you may need to submit schedules or other documentation to support those claims.

Where do I send the form?

The completed NM TRD PIT-1 should be sent to the New Mexico Taxation and Revenue Department. For mailing details, refer to the instructions provided with the form or visit the official state tax website for updated submission guidelines.

See what our users say