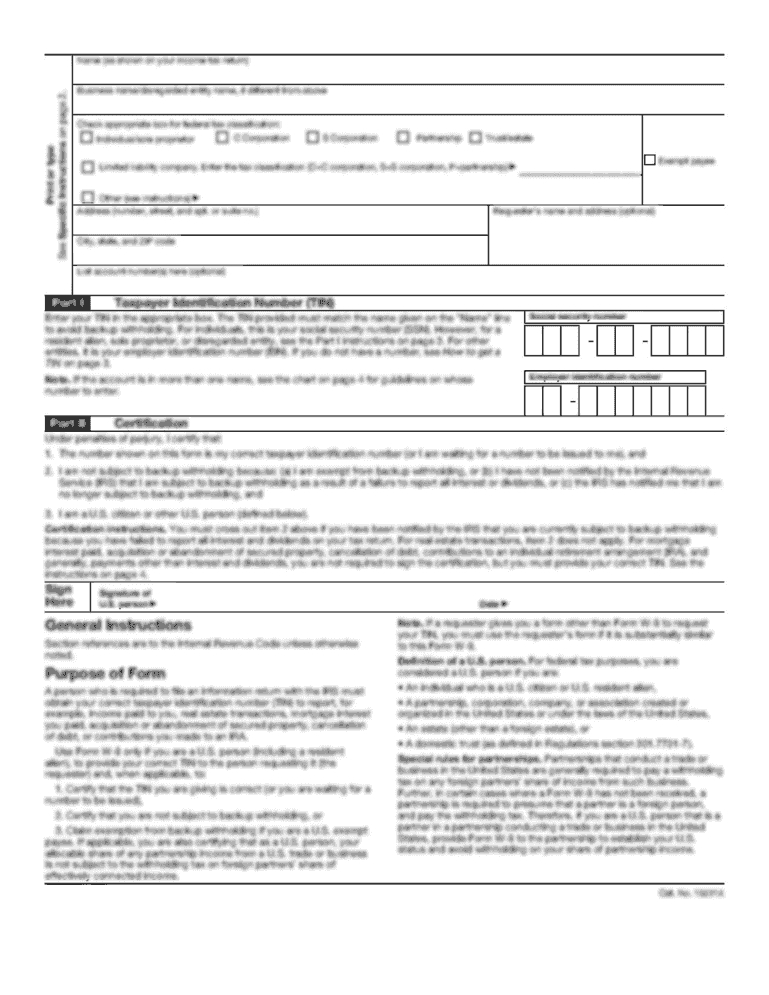

IRS 1040-ES 2021 free printable template

Show details

2021Department of the Treasury

Internal Revenue ServiceNow 1040ES

Estimated Tax for IndividualsPurpose of This Packages Form 1040ES to figure and pay your estimated tax

for 2021.

Estimated tax is

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

To edit IRS 1040-ES, you can download the form and fill it out digitally using PDF editing software like pdfFiller. Start by throwing out any incorrect entries. Make sure to save your work regularly if making multiple changes to avoid data loss.

How to fill out IRS 1040-ES

Filling out IRS 1040-ES involves a few key steps. First, gather necessary financial documents such as your previous year’s tax return, income statements, and any other relevant income records. Next, determine your estimated tax liability using the worksheet included in the form or IRS guidelines. Finally, complete the form by entering your personal information and estimated payments.

01

Step 1: Download the form from the IRS website.

02

Step 2: Collect relevant financial documents.

03

Step 3: Calculate your estimated tax liability.

04

Step 4: Fill out personal details on the form.

05

Step 5: Review for accuracy before submission.

About IRS 1040-ES 2021 previous version

What is IRS 1040-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040-ES 2021 previous version

What is IRS 1040-ES?

IRS 1040-ES is the Estimated Tax for Individuals form used by U.S. taxpayers who receive income that isn't subject to withholding tax. This form helps taxpayers calculate and pay estimated quarterly taxes to avoid underpayment penalties.

What is the purpose of this form?

The primary purpose of IRS 1040-ES is to assist individuals in reporting and paying estimated taxes based on income received throughout the year. This includes income from self-employment, interest, dividends, rents, and alimony. By submitting estimated tax payments, individuals can ensure they meet their tax obligations timely.

Who needs the form?

Individuals who expect to owe at least a certain amount of tax when they file their return must use IRS 1040-ES. This typically includes self-employed individuals, freelancers, or anyone who has significant income not subject to withholding. If you expect your withholding and credits to be less than your tax liability, you should file this form.

When am I exempt from filling out this form?

Taxpayers are generally exempt from filling out IRS 1040-ES if they had no tax liability last year and expect none this year. Additionally, those whose tax withholding covers their estimated tax liability do not need to submit this form. It is essential to review your specific tax situation to determine exemption eligibility.

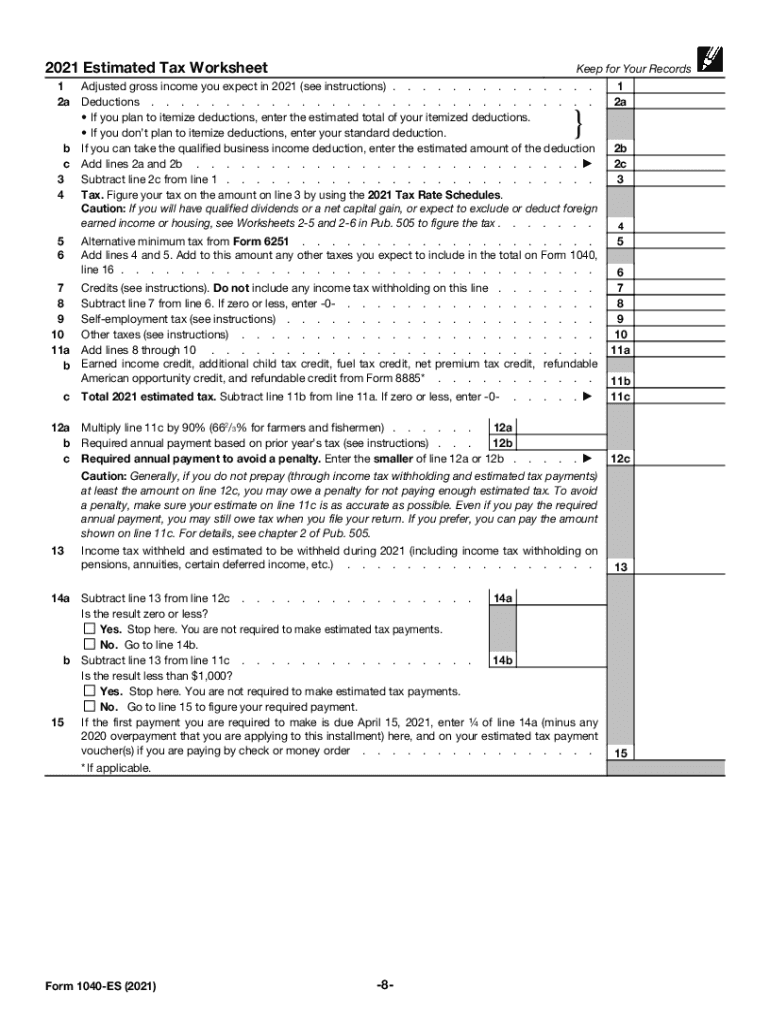

Components of the form

IRS 1040-ES consists of several key components. It includes the estimated tax payment vouchers for each quarter, a worksheet to help calculate your estimated tax, and the instruction page. Careful completion of these components ensures accurate and timely payment of taxes.

What are the penalties for not issuing the form?

If you fail to remit estimated taxes through IRS 1040-ES, you may face penalties. The IRS imposes late payment penalties, which can accumulate if not paid promptly. Additionally, you may owe interest on unpaid taxes, which can compound over time. It is essential to fulfill your payment obligations to avoid additional financial burdens.

What information do you need when you file the form?

When filing IRS 1040-ES, you need key information such as your Social Security number, estimated income, and the previous year’s tax return for reference. You should also have details about potential deductions and credits available to you. Gathering this information ahead of time aids in streamlined completion of the form.

Is the form accompanied by other forms?

IRS 1040-ES typically does not require submission of additional forms unless your specific tax situation necessitates them. However, you may need to reference other forms for calculations, such as IRS Form 1040 when determining your overall tax liability if you owe taxes or claim rebates.

Where do I send the form?

Completed IRS 1040-ES forms can be sent to the address provided in the instructions accompanying the form. The mailing address varies by your state of residence and whether you are enclosing a payment. Always double-check the latest IRS guidance to ensure proper submission.

See what our users say