Get the free Returned goods relief. Returned goods relief

Show details

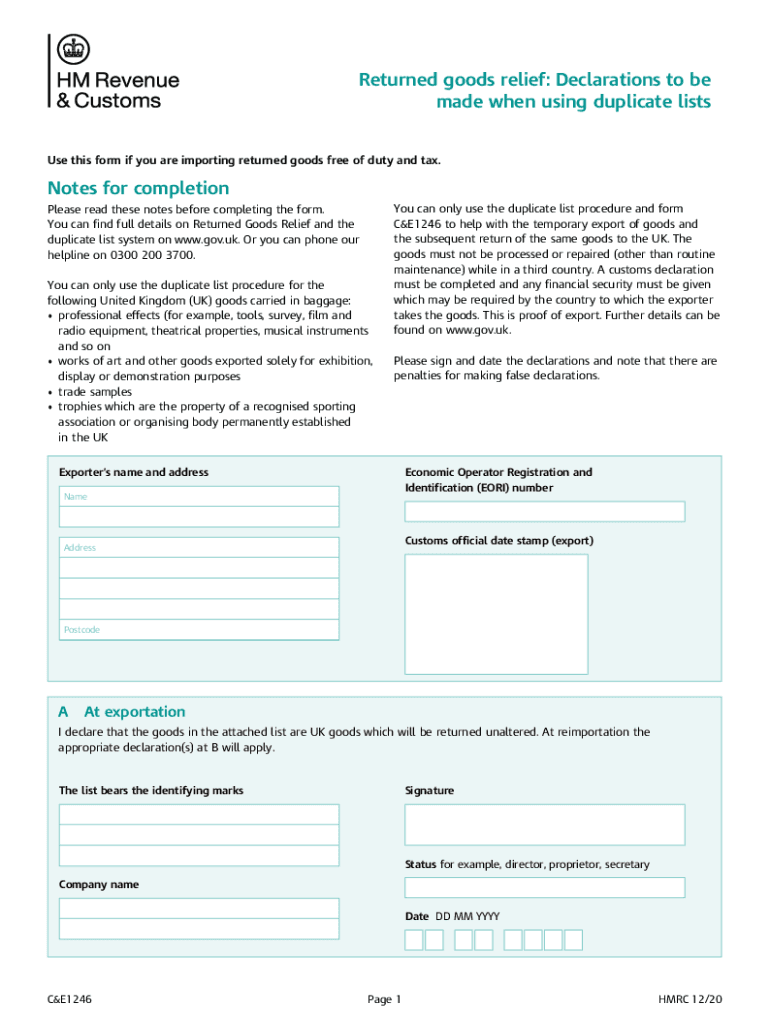

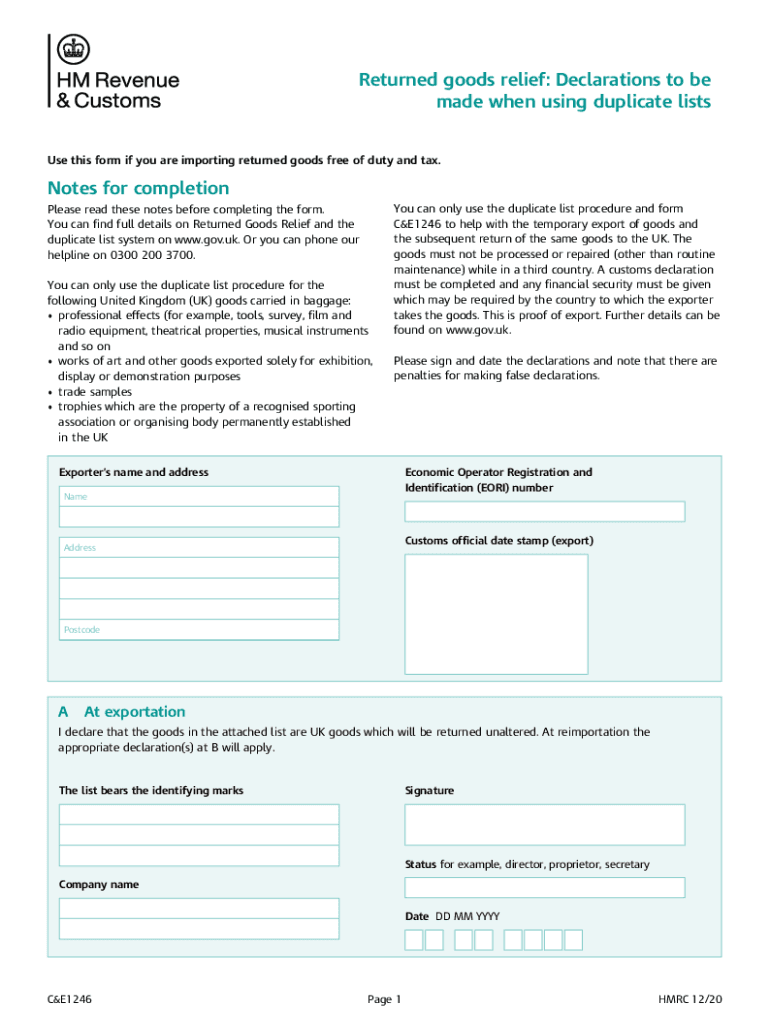

Returned goods relief: Declarations to be

made when using duplicate lists

Use this form if you are importing returned goods free of duty and tax. Notes for completion

Please read these notes before

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign returned goods relief returned

Edit your returned goods relief returned form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your returned goods relief returned form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing returned goods relief returned online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit returned goods relief returned. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out returned goods relief returned

How to fill out returned goods relief returned

01

Obtain the necessary documents: you will need to have a completed and signed returned goods relief returned form, any relevant invoices or proof of purchase, and any supporting documentation such as proof of export or proof of destruction.

02

Complete the returned goods relief returned form: carefully fill out all sections of the form, providing detailed information about the goods being returned, the reason for return, and any supporting documentation or evidence that may be required.

03

Attach the supporting documents: make sure to include all relevant invoices, proof of export, or any other documentation that supports your claim for returned goods relief.

04

Submit the form and supporting documents: send the completed form and supporting documents to the appropriate authority or customs office as specified in the returned goods relief returned guidelines.

05

Await approval or feedback: after submitting the form, you may need to wait for the authority or customs office to review your application and provide any necessary feedback or clarification.

06

Follow further instructions: if your application is approved, you will be provided with further instructions on how to proceed with the returned goods relief returned process. Make sure to follow these instructions carefully to ensure compliance with all requirements and regulations.

07

Keep records: it is important to maintain records of all communication, documentation, and actions taken during the returned goods relief returned process. This will help in case of any future audits or inquiries.

Who needs returned goods relief returned?

01

Returned goods relief returned is typically needed by individuals or businesses who have imported goods into a country but need to return them for various reasons. Some common examples of who may need returned goods relief returned include:

02

- Individuals who purchased goods from abroad but received damaged or faulty items and want to return them for a refund or replacement.

03

- Businesses that imported goods for sale but later found out that the products were not as described or did not meet the required quality standards, and need to return them to the supplier or manufacturer.

04

- Exporters who exported goods to another country but found out that the goods were not accepted or rejected by the receiving country, and need to bring them back to their original location.

05

- Importers who mistakenly ordered or received incorrect goods and need to return them to the sender or supplier.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit returned goods relief returned online?

With pdfFiller, the editing process is straightforward. Open your returned goods relief returned in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the returned goods relief returned in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your returned goods relief returned in seconds.

How can I fill out returned goods relief returned on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your returned goods relief returned. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is returned goods relief returned?

Returned goods relief returned is a process that allows businesses to reclaim import duties on goods that have been returned to them after being exported.

Who is required to file returned goods relief returned?

Businesses that have exported goods and are returning them for reasons such as defect, unsold inventory, or other valid reasons are required to file a returned goods relief return.

How to fill out returned goods relief returned?

To fill out a returned goods relief return, businesses must complete the appropriate forms provided by customs authorities, providing accurate details about the returned goods, including their value and reason for return.

What is the purpose of returned goods relief returned?

The purpose of returned goods relief returned is to allow businesses to recover duties paid on goods that are re-imported after being exported, thereby reducing the financial impact of returning products.

What information must be reported on returned goods relief returned?

Information that must be reported includes the description of the goods, the original export details, the reason for return, the value of the goods, and any shipping or customs documentation.

Fill out your returned goods relief returned online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Returned Goods Relief Returned is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.