Get the free Section 6130 - California Department of Pesticide Regulation

Show details

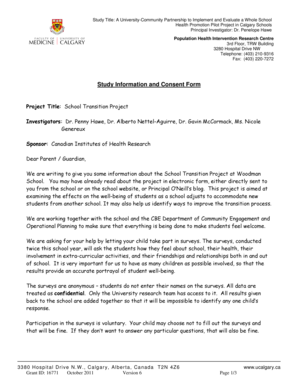

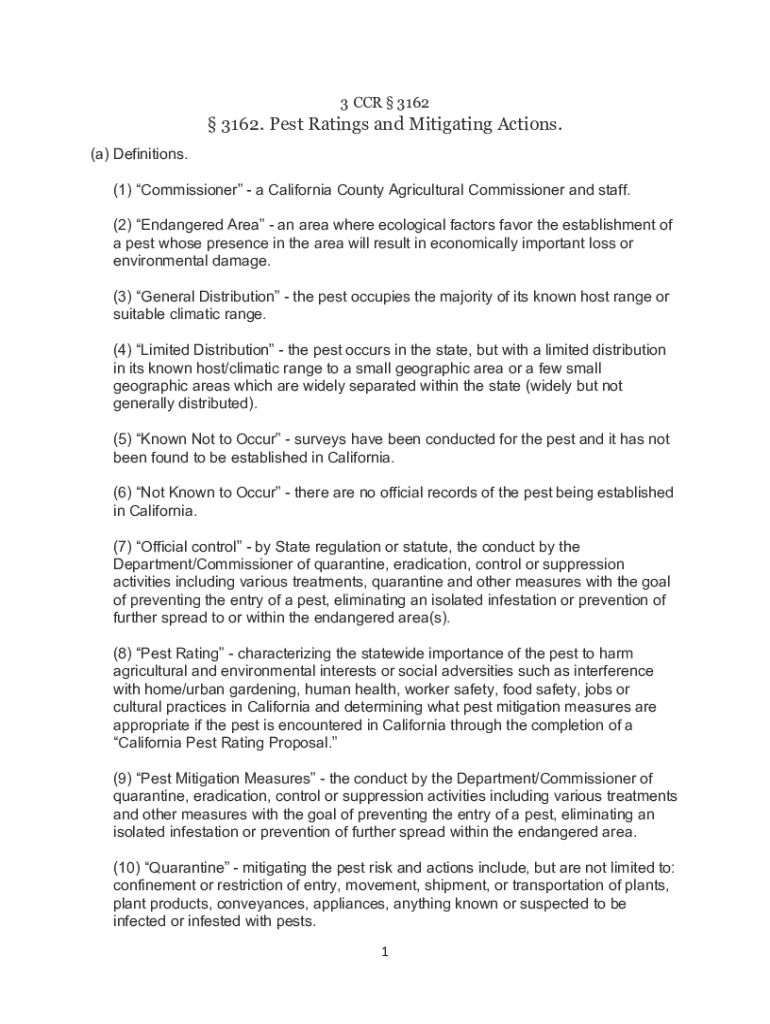

3 CCR 3162 3162. Pest Ratings and Mitigating Actions. (a) Definitions. (1) Commissioner a California County Agricultural Commissioner and staff. (2) Endangered Area an area where ecological factors

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 6130 - california

Edit your section 6130 - california form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 6130 - california form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 6130 - california online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit section 6130 - california. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 6130 - california

How to fill out section 6130 - california

01

To fill out section 6130 in California, follow these steps:

02

Start by obtaining the necessary form for section 6130. This form is usually provided by the California government or can be found on their official website.

03

Read the instructions carefully to understand the purpose and requirements of section 6130.

04

Fill in your personal information accurately. This may include your name, address, and contact details.

05

Provide any supporting documents or evidence required for section 6130. This could include financial statements, tax returns, or other relevant paperwork.

06

Answer each question in section 6130 honestly and to the best of your knowledge. Be thorough in explaining your circumstances or reasons for applying.

07

Double-check your filled-out form for any errors or missing information. It is important to ensure accuracy to avoid delays or complications.

08

Sign and date the completed section 6130 form. Remember to retain a copy for your records.

09

Submit the filled-out form and any supporting documents to the designated authority as instructed. This may involve mailing the form or submitting it online.

10

Wait for a response from the authority regarding your section 6130 application. This response will detail whether your application was approved or denied.

11

If approved, follow any additional instructions provided in the response. If denied, you may have the option to appeal the decision.

12

It is advisable to consult with a legal professional or seek guidance from the California government if you have any specific questions or concerns about filling out section 6130.

Who needs section 6130 - california?

01

Section 6130 in California is generally needed by individuals or businesses seeking to apply for a specific program, benefit, or license offered by the California government.

02

The exact requirements and eligibility criteria for section 6130 depend on the specific program or benefit you are applying for.

03

Common examples of individuals who may need to fill out section 6130 include those applying for financial assistance, permits, licenses, or certifications from the California government.

04

It is recommended to review the specific guidelines and instructions provided by the California government or consult with the relevant authority to determine if section 6130 is necessary for your particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send section 6130 - california to be eSigned by others?

When you're ready to share your section 6130 - california, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out section 6130 - california using my mobile device?

Use the pdfFiller mobile app to fill out and sign section 6130 - california. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out section 6130 - california on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your section 6130 - california. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is section 6130 - california?

Section 6130 is a provision in California tax law that pertains to the reporting and filing of certain tax-related information for entities operating within the state.

Who is required to file section 6130 - california?

Entities that conduct business within California and meet specific criteria as outlined by the state tax regulations are required to file section 6130.

How to fill out section 6130 - california?

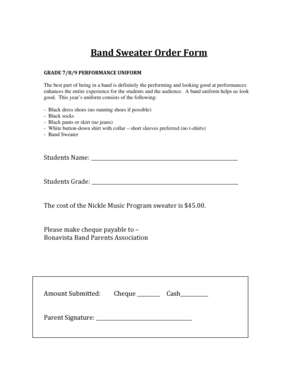

Section 6130 can be filled out using the designated forms provided by the California Franchise Tax Board, ensuring all required information is accurately reported.

What is the purpose of section 6130 - california?

The purpose of section 6130 is to ensure that all business entities adequately report their income, expenses, and other relevant financial information to maintain compliance with California tax laws.

What information must be reported on section 6130 - california?

Section 6130 requires firms to report their income, deductions, credits, and any other pertinent financial details as mandated by California law.

Fill out your section 6130 - california online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 6130 - California is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.