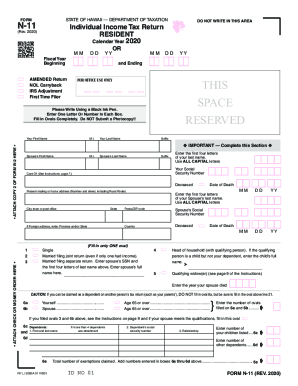

HI N-311 2020 free printable template

Show details

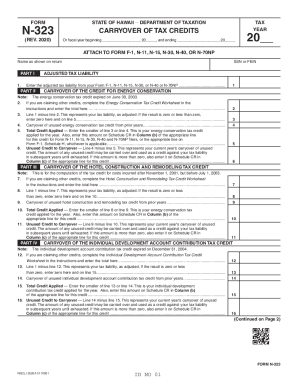

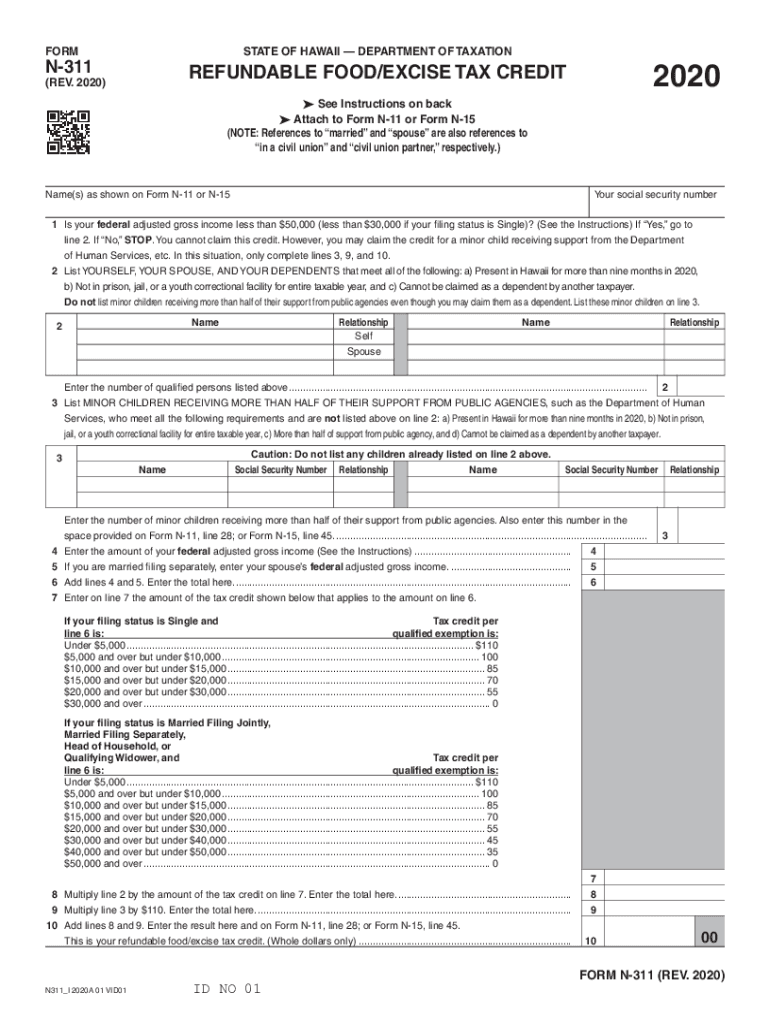

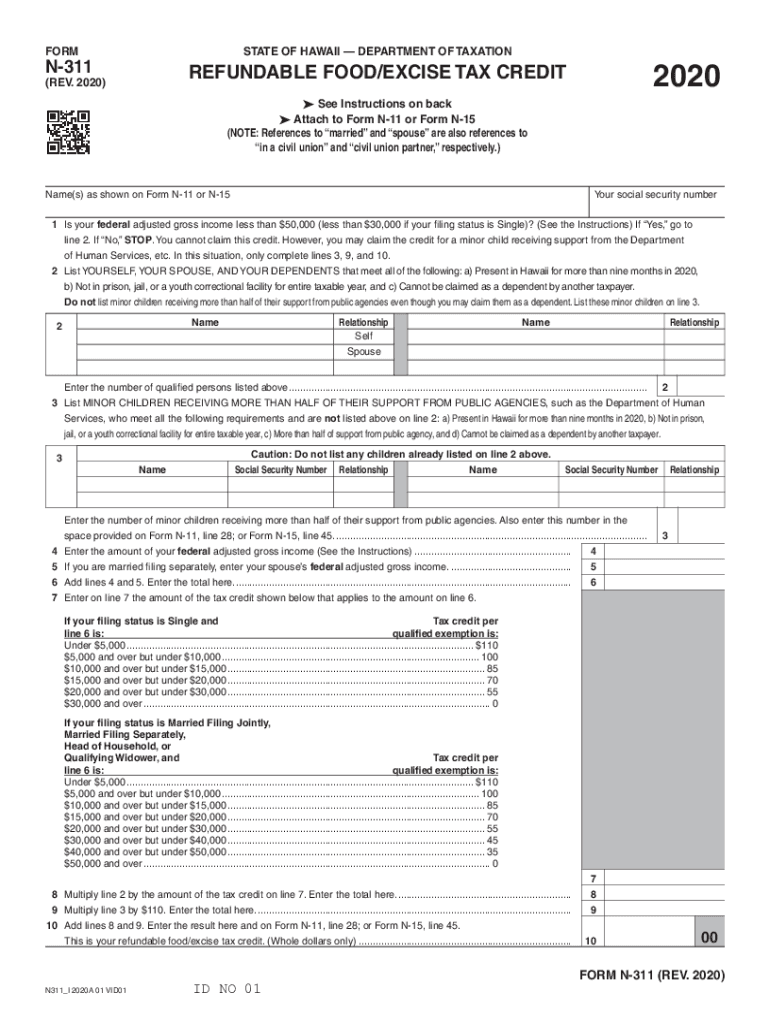

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATIONFORMN3112020REFUNDABLE FOOD/EXCISE TAX CREDIT(REV. 2020) See Instructions on back Attach to Form N11 or Form N15 (NOTE: References to married and spouse

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI N-311

Edit your HI N-311 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI N-311 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI N-311 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit HI N-311. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI N-311 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI N-311

How to fill out HI N-311

01

Obtain the HI N-311 form from the official website or local office.

02

Begin filling out the applicant's personal information at the top of the form.

03

Provide accurate contact information including phone number and address.

04

Indicate the type of request being made in the designated section.

05

If applicable, include any relevant case numbers or additional identifiers.

06

Fill out details regarding the nature of the request, ensuring clarity and detail.

07

Review the form for any missing information or errors before submission.

08

Sign and date the form at the bottom.

09

Submit the completed HI N-311 form according to the instructions provided.

Who needs HI N-311?

01

Residents seeking assistance with housing issues.

02

Individuals needing to report problems related to housing or land use.

03

Landlords or property managers addressing concerns with tenants.

04

Community members looking to access local housing resources or information.

05

Anyone requiring government intervention or guidance regarding their housing situation.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file form 720?

Who files Form 720? Whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file a Quarterly Federal Excise Tax Return on Form 720 up to four times per year, depending on the circumstances.

Do I need to fill out form 720?

Your business needs to fill out IRS Form 720 if you sell goods or services that incur excise taxes. These products and services can include, but are not limited to: Telephone communications. Air transportation.

What is an excise tax return?

Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers, and vary depending on the specific tax. Excise taxes may be imposed at the time of: Entry into the United States, or sale or use after importation.

What is form 720 used for and when must it be filed?

IRS Form 720, Quarterly Excise Tax Return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form. The form includes all items covered by excise taxes. A third party may collect the excise tax, file Form 720, and send the tax to the IRS.

Who qualifies for the food excise credit Hawaii?

You must have a federal Adjusted Gross Income (AGI) below $50,000 ($30,000 if Single) to claim the Refundable Food/Excise Credit. It's worth from $35 to $110 per person depending on your AGI.

What is form 720 used for?

Use Form 720 and attachments to report your liability by IRS No. and pay the excise taxes listed on the form. If you report a liability on Part I or Part II, you may be eligible to use Schedule C to claim a credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my HI N-311 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your HI N-311 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete HI N-311 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your HI N-311 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out HI N-311 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your HI N-311. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is HI N-311?

HI N-311 is a form used for reporting certain health information in compliance with state regulations.

Who is required to file HI N-311?

Entities such as healthcare providers, organizations, or individuals who are required to report specific health-related information to the state.

How to fill out HI N-311?

To fill out HI N-311, complete all required fields accurately, ensure all necessary documentation is included, and submit it to the appropriate state agency by the deadline.

What is the purpose of HI N-311?

The purpose of HI N-311 is to collect data for monitoring public health, ensuring compliance with health regulations, and aiding in health-related decision-making.

What information must be reported on HI N-311?

The form typically requires demographic information, details about the health condition being reported, and any relevant treatment or interventions.

Fill out your HI N-311 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI N-311 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.