Get the free Employee Benefits & Payroll Taxes

Show details

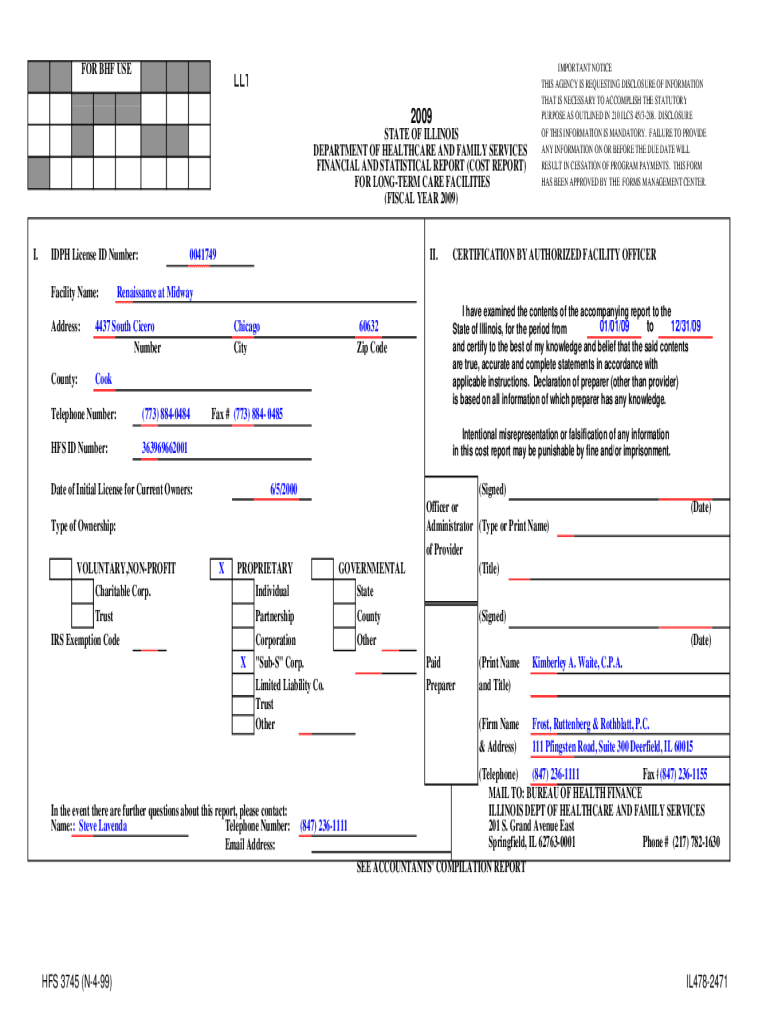

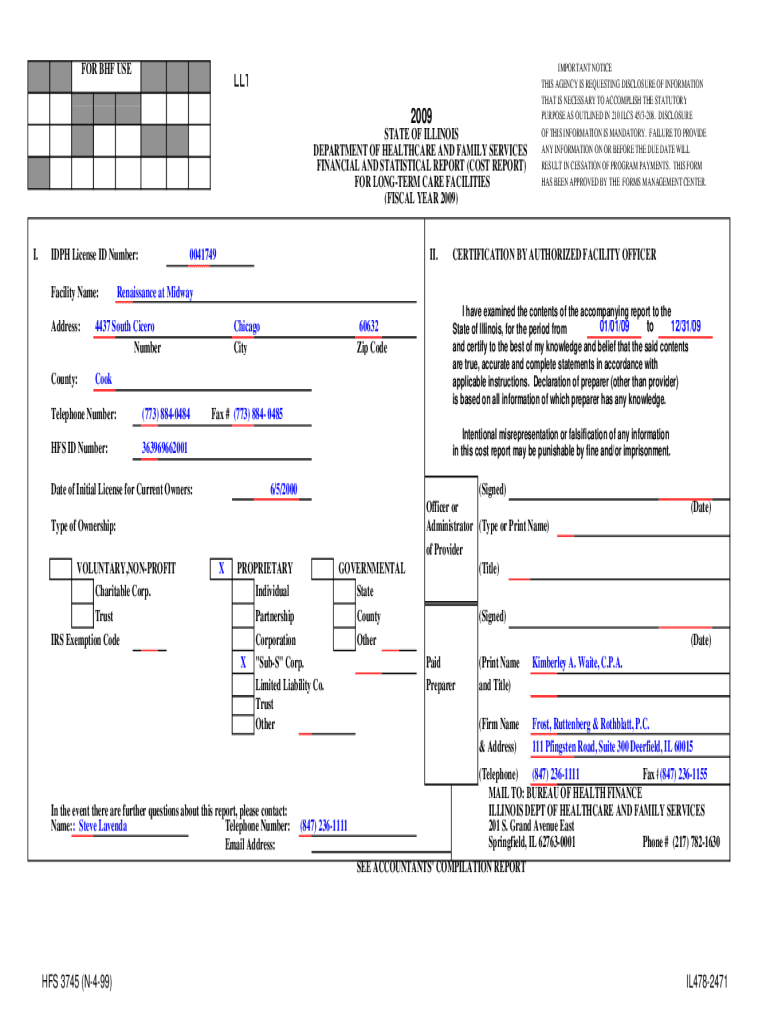

FOR BHF USELL1

2009

STATE OF ILLINOIS

DEPARTMENT OF HEALTHCARE AND FAMILY SERVICES

FINANCIAL AND STATISTICAL REPORT (COST REPORT)

FOR LONGER CARE FACILITIES

(FISCAL YEAR 2009)I.DPH License ID Number:

Facility

We are not affiliated with any brand or entity on this form

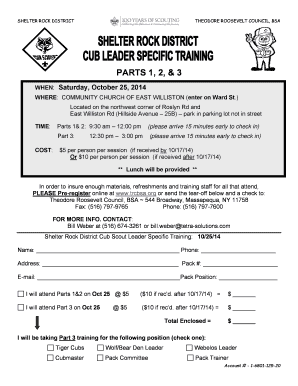

Get, Create, Make and Sign employee benefits amp payroll

Edit your employee benefits amp payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee benefits amp payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee benefits amp payroll online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit employee benefits amp payroll. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee benefits amp payroll

How to fill out employee benefits amp payroll

01

Begin by gathering all necessary information such as employee details, employment agreements, and company policies regarding benefits and payroll.

02

Set up a system to track employee hours and attendance, ensuring accurate calculation of wages and overtime pay if applicable.

03

Determine the benefits package offered by your company and ensure compliance with any legal requirements.

04

Create employee benefit and payroll forms or use existing templates to streamline the process.

05

Ensure confidentiality and security of employee information by implementing appropriate data protection measures.

06

Educate employees about their benefits entitlements and provide clear instructions on how to access and utilize them.

07

Establish a payroll schedule and ensure timely payment of wages and benefits.

08

Have a dedicated HR or payroll personnel who can handle employee inquiries and address any issues that may arise.

09

Keep accurate records of all employment-related documents and transactions for legal and auditing purposes.

10

Regularly review and update your employee benefits and payroll processes to stay compliant with any regulatory changes or company policies.

Who needs employee benefits amp payroll?

01

Any company that has employees needs to have employee benefits and payroll management.

02

This includes businesses of all sizes, from small startups to large corporations.

03

Employee benefits and payroll ensure that employees are properly compensated for their work and provided with the necessary benefits.

04

It also helps to attract and retain talented employees by offering competitive compensation and benefits packages.

05

Organizations that prioritize employee satisfaction and compliance with employment laws would greatly benefit from implementing effective employee benefits and payroll systems.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify employee benefits amp payroll without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like employee benefits amp payroll, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the employee benefits amp payroll in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your employee benefits amp payroll in seconds.

How can I edit employee benefits amp payroll on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing employee benefits amp payroll.

What is employee benefits amp payroll?

Employee benefits and payroll refer to the various forms of compensation, including wages, bonuses, health insurance, retirement plans, and other non-wage benefits provided to employees, as well as the processes involved in calculating and distributing these compensations.

Who is required to file employee benefits amp payroll?

Employers who provide benefits or compensation to employees are required to file employee benefits and payroll, including small businesses, corporations, and non-profit organizations.

How to fill out employee benefits amp payroll?

To fill out employee benefits and payroll, employers need to gather relevant employee data, calculate wages based on hours worked or salary, account for deductions and taxes, and report these details accurately on the appropriate payroll forms.

What is the purpose of employee benefits amp payroll?

The purpose of employee benefits and payroll is to compensate employees for their work, attract and retain talent, comply with tax regulations, and provide employees with non-wage benefits that enhance their overall job satisfaction.

What information must be reported on employee benefits amp payroll?

Information that must be reported on employee benefits and payroll includes employee identification details, gross wages, taxes withheld, contributions to benefits programs, and any other compensation-related information as required by law.

Fill out your employee benefits amp payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Benefits Amp Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.