Get the free CONSUMER LOAN APPLICATION (APPCENTER VERSION)

Show details

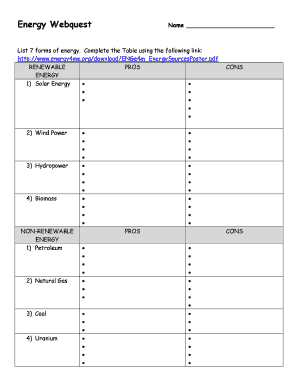

CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We intend to apply for joint credit. Amt. Requested # of Payments Preferred PMT. Amt. Preferred PMT. Day Market Survey

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer loan application appcenter

Edit your consumer loan application appcenter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer loan application appcenter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer loan application appcenter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer loan application appcenter. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer loan application appcenter

How to fill out consumer loan application appcenter:

01

Start by accessing the consumer loan application appcenter website or downloading the mobile application.

02

Create an account or log in if you already have one.

03

Provide the necessary personal information, such as your name, address, date of birth, and contact details.

04

Enter your employment details, including your current job position, company name, and income information.

05

Input your financial information, including your assets, liabilities, and any existing loans or debts.

06

Specify the loan amount you are requesting and the purpose of the loan.

07

Review all the entered information to ensure accuracy and completeness.

08

Attach any required supporting documents, such as proof of income or identification.

09

Submit the completed consumer loan application.

10

Await the loan approval decision from the lender.

Who needs consumer loan application appcenter:

01

Individuals who are seeking a consumer loan, such as a personal loan or an auto loan.

02

People who prefer the convenience of submitting their loan applications online or through a mobile application.

03

Individuals who value a user-friendly and efficient loan application process.

04

Those who want to access various loan options and compare offers from different lenders.

05

People who prefer having the ability to track the progress of their loan application online.

Fill

form

: Try Risk Free

People Also Ask about

What loans are consumer loans?

Consumer lending includes closed- and open-end credit extended to individuals for household, family, and other personal expenditures and includes credit cards, auto loans, and student loans.

Who handles loan application?

Underwriter An underwriter is a loan officer who evaluates a loan application to determine whether it is viable for the bank.

What is an example of a consumer loan in real life?

The most common examples of consumer loans are personal loans, auto loans, and home loans.

What type of loan is a consumer loan?

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

What is the most common type of consumer loan?

Credit Cards: This is the most widely used and popular consumer loan.

Is there a consumer loan?

A consumer loan is a type of loan in which you take on a personal debt to pay for goods or services. In the Philippines, common types of consumer loans that are offered by banks are auto loans, motorcycle loans, and home loans.

What are the 2 most common types of consumer loans?

The Basics of Consumer Loans. There are two primary types of debt: secured and unsecured. Your loan is secured when you put up security or collateral to guarantee it. The lender can sell the collateral if you fail to repay.

What is a consumer loan application?

A Consumer Loan Application is a form used by the applicant to request a loan to a bank or lending company. This form template has all the necessary questions in order to collect all required data when loaning money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer loan application appcenter to be eSigned by others?

When your consumer loan application appcenter is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete consumer loan application appcenter online?

Filling out and eSigning consumer loan application appcenter is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in consumer loan application appcenter without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing consumer loan application appcenter and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is consumer loan application appcenter?

Consumer loan application appcenter is an online platform designed for consumers to apply for loans.

Who is required to file consumer loan application appcenter?

Any consumer who wishes to apply for a loan through the appcenter is required to file the consumer loan application.

How to fill out consumer loan application appcenter?

To fill out the consumer loan application appcenter, users need to create an account, provide personal information, income details, credit history, and specify loan requirements.

What is the purpose of consumer loan application appcenter?

The purpose of the consumer loan application appcenter is to streamline the loan application process for consumers, making it more convenient and accessible.

What information must be reported on consumer loan application appcenter?

Consumers need to report personal information, such as name, address, contact details, as well as provide details about their income, employment, credit history, and loan requirements.

Fill out your consumer loan application appcenter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Loan Application Appcenter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.