Get the free $50,000 DONATION

Show details

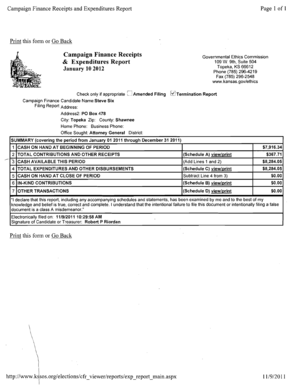

SUMMER 2017

Perry High School Alumni Association

P.O. Box 148

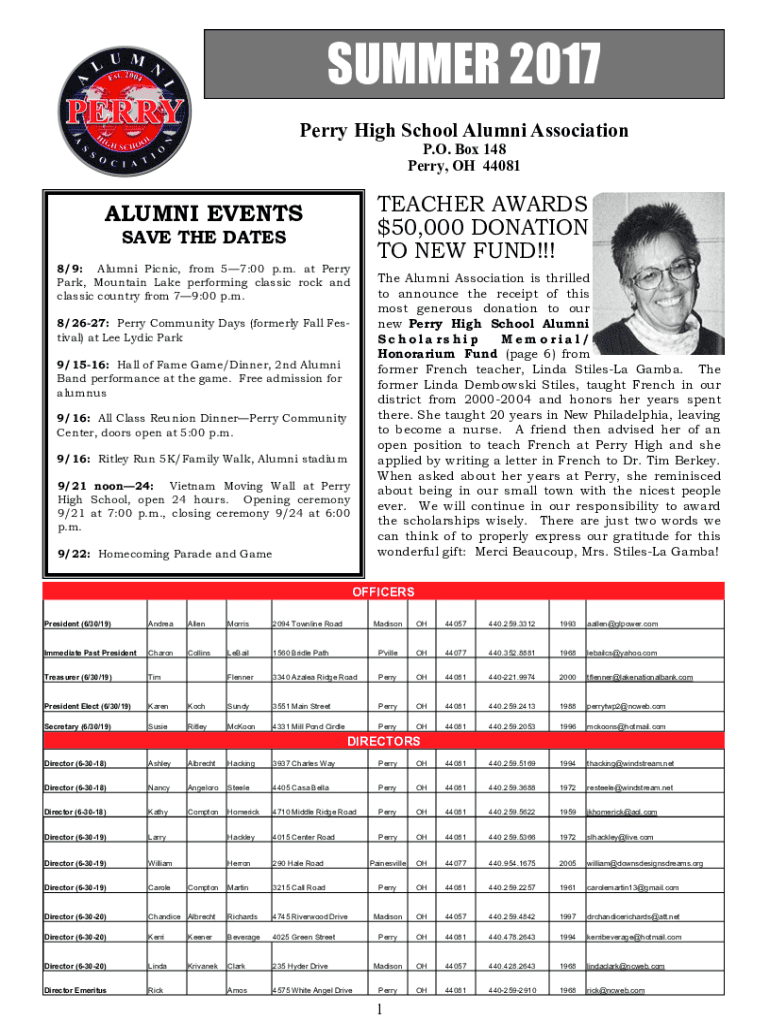

Perry, OH 44081TEACHER AWARDS

$50,000 DONATION

TO NEW FUND!!!ALUMNI EVENTS

SAVE THE DATES8/9: Alumni Picnic, from 57:00 p.m. at Perry

Park,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 50000 donation

Edit your 50000 donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 50000 donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 50000 donation online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 50000 donation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 50000 donation

How to fill out 50000 donation

01

To fill out a $50000 donation, follow these steps:

02

Determine the purpose of the donation: Decide if you want to donate the money to a specific cause, organization, or individual.

03

Research reputable charities or organizations: Find trustworthy entities that align with your chosen cause.

04

Contact the selected charity: Reach out to them to discuss the donation process and any specific requirements they may have.

05

Complete necessary paperwork: Fill out any forms or documentation required by the charity to process your donation.

06

Arrange payment: Determine the preferred method of payment and transfer the $50000 donation accordingly.

07

Retain documentation: Keep copies of all receipts and paperwork related to the donation for your records.

08

Communicate preferences: If you have any specific instructions or preferences regarding how the donation should be used, communicate them clearly to the charity.

09

Maintain contact: Stay in touch with the charity to receive updates on how your donation is being used and the impact it is making.

10

Consider tax benefits: Consult with a tax professional to understand if your donation is eligible for any tax deductions or benefits.

11

Share your experience: Consider sharing your donation story with others to inspire and encourage further giving.

Who needs 50000 donation?

01

Various individuals, organizations, and causes may benefit from a $50000 donation, including:

02

- Non-profit organizations: Many non-profit organizations rely on donations to support their operations and programs.

03

- Charities: Charitable organizations often use donations to fund their initiatives and help those in need.

04

- Individuals in crisis: Individuals facing medical emergencies, natural disasters, or financial hardships can benefit from a generous donation.

05

- Educational institutions: Schools, colleges, and universities can use donations to enhance educational opportunities and support students in need.

06

- Research initiatives: Donations can fuel important scientific research and contribute to advancements in various fields.

07

- Community projects: Funding community development projects and initiatives can create positive changes in local neighborhoods.

08

- Arts and cultural organizations: Donations can help promote and preserve art, culture, and creativity in society.

09

- Animal shelters and wildlife conservation: Supporting organizations working towards animal welfare and conservation is another worthy cause.

10

Ultimately, anyone or anything that can positively impact from a $50000 donation can potentially be a recipient.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 50000 donation directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 50000 donation and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit 50000 donation straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 50000 donation.

How do I edit 50000 donation on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 50000 donation. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is 50000 donation?

A $50,000 donation typically refers to a substantial contribution made to a charitable organization or cause, often for a specific purpose such as funding a project or initiative.

Who is required to file 50000 donation?

Individuals, corporations, or organizations that make a donation of $50,000 or more may be required to report the donation for tax purposes, particularly in the context of itemizing deductions on their tax returns.

How to fill out 50000 donation?

To fill out a $50,000 donation form, donors should provide details such as the name of the recipient organization, the date of the donation, the amount donated, and any pertinent documentation showing the contribution.

What is the purpose of 50000 donation?

The purpose of a $50,000 donation may vary, but typically it's aimed at supporting charitable causes, funding specific projects, providing scholarships, or helping non-profit organizations achieve their goals.

What information must be reported on 50000 donation?

The information that must be reported typically includes the donor's name, the recipient organization, the amount donated, the date of the donation, and any associated tax identification numbers.

Fill out your 50000 donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

50000 Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.