Get the free All Risks of Loss v. All Loss: An Examination of Broad Form ...

Show details

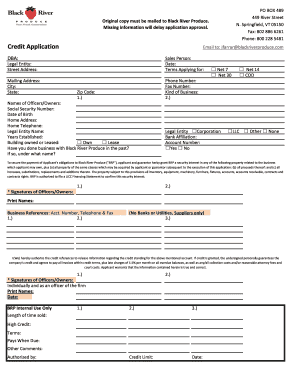

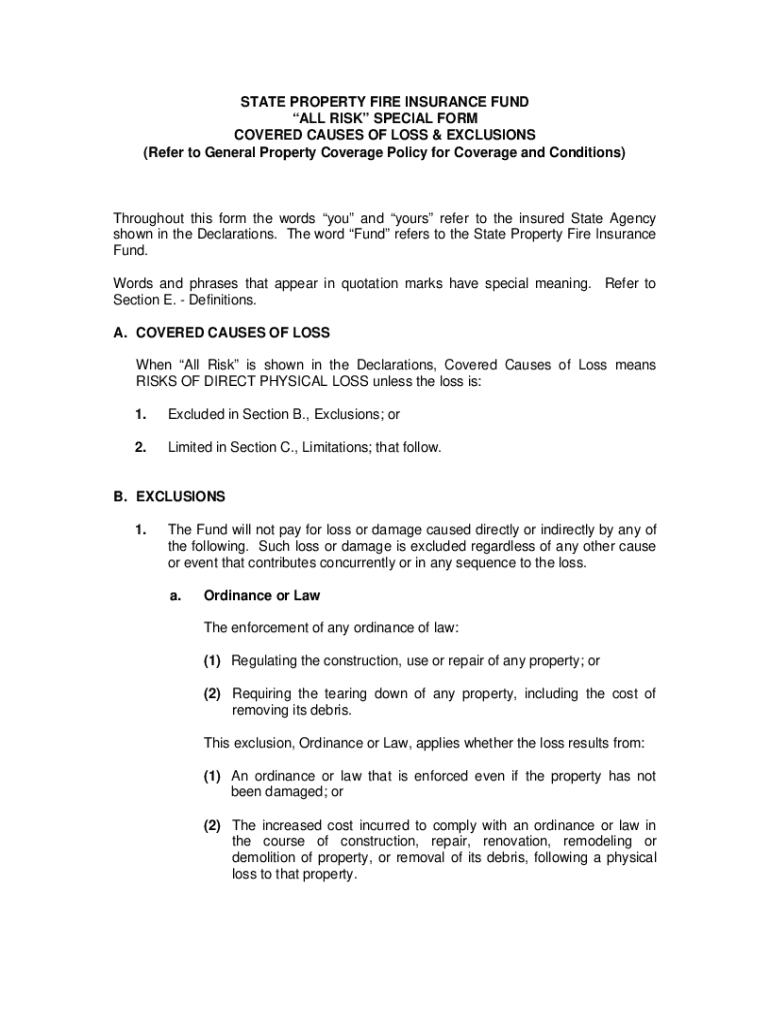

STATE PROPERTY FIRE INSURANCE FUND ALL RISK SPECIAL FORM COVERED CAUSES OF LOSS & EXCLUSIONS (Refer to General Property Coverage Policy for Coverage and Conditions)Throughout this form the words you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all risks of loss

Edit your all risks of loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all risks of loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit all risks of loss online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit all risks of loss. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all risks of loss

How to fill out all risks of loss

01

Identify all potential risks of loss that may occur in a given situation.

02

Gather relevant information and data about each risk, such as the likelihood of occurrence and potential impact on the desired outcome.

03

Assess the significance of each risk in terms of its potential impact on the project or objective.

04

Develop risk mitigation strategies that can help minimize the likelihood or impact of each identified risk.

05

Create a comprehensive risk management plan that outlines the steps to be taken in addressing and monitoring each risk.

06

Implement the risk management plan by assigning responsibilities and ensuring necessary resources are in place to execute the proposed strategies.

07

Regularly review and update the risk management plan as new risks emerge or existing risks evolve.

08

Monitor the effectiveness of the risk mitigation strategies and make adjustments as necessary to ensure the desired level of protection against potential loss is maintained.

09

Continuously communicate and educate stakeholders about the risks involved and the actions being taken to address them.

10

Keep detailed records of all risks identified, assessments made, and actions taken throughout the risk management process.

Who needs all risks of loss?

01

Any individual or organization involved in activities or projects that carry potential risks of loss can benefit from having an all risks of loss coverage.

02

This includes businesses operating in industries prone to various risks, such as construction, manufacturing, healthcare, transportation, and finance.

03

Individuals and families may also opt for all risks of loss coverage to protect their valuable assets, such as homes, vehicles, and personal belongings.

04

Insurance companies and risk management professionals also use all risks of loss policies to provide comprehensive coverage options to their clients.

05

Ultimately, anyone seeking a broad and extensive level of protection against potential losses can benefit from all risks of loss coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my all risks of loss in Gmail?

Create your eSignature using pdfFiller and then eSign your all risks of loss immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out all risks of loss using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign all risks of loss and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit all risks of loss on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign all risks of loss on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is all risks of loss?

All risks of loss is an insurance term that refers to a type of policy that covers a wide range of risks and losses, protecting the insured against loss or damage to property from any cause except for specific exclusions.

Who is required to file all risks of loss?

Typically, businesses and individuals that hold property or assets that need to be insured against potential losses are required to file for all risks of loss coverage.

How to fill out all risks of loss?

To fill out all risks of loss, one must complete an insurance application including personal or business information, details about the property to be insured, coverage limits desired, and any additional information requested by the insurance provider.

What is the purpose of all risks of loss?

The purpose of all risks of loss is to provide comprehensive protection for insured property against a wide range of unforeseen damages and losses, ensuring financial security for the insured.

What information must be reported on all risks of loss?

Information that must be reported includes the type and value of the property being insured, any previous claims history, and any relevant circumstances that might affect the risk assessment.

Fill out your all risks of loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Risks Of Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.