IRS 1040 - Schedule C-EZ 2007 free printable template

Show details

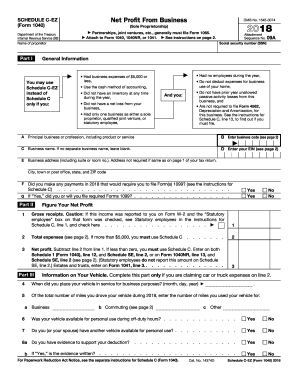

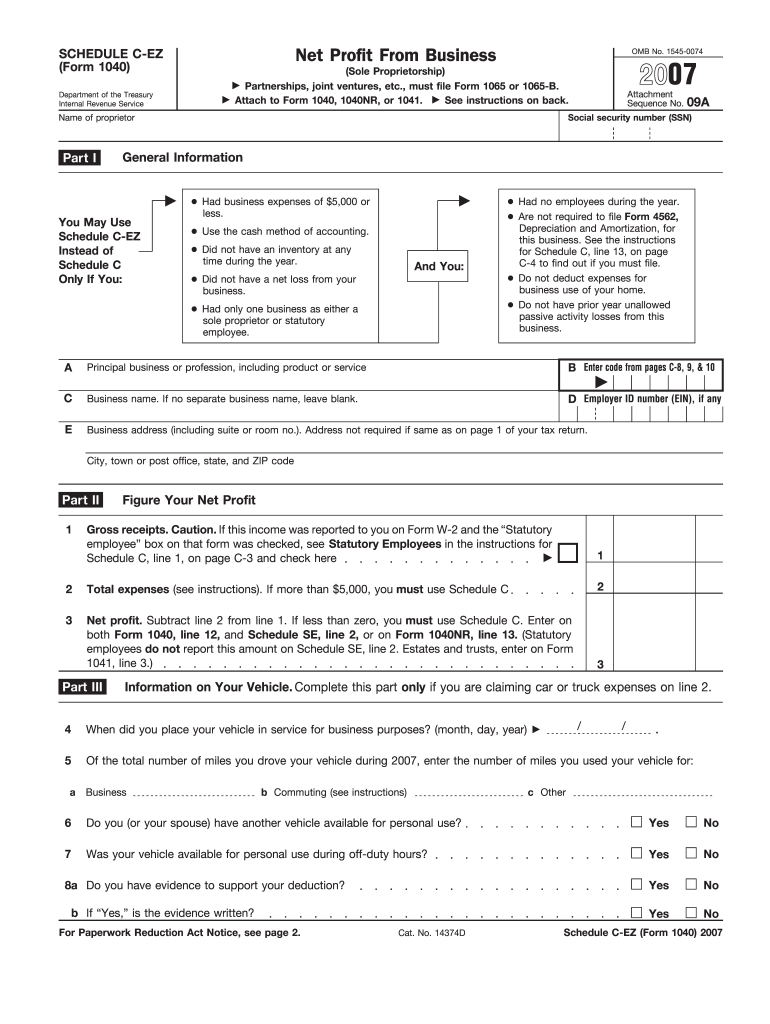

OMB No. 1545-0074 Net Profit From Business SCHEDULE C-EZ (Form 1040) 2007 (Sole Proprietorship) Partnerships, joint ventures, etc., must file Form 1065 or 1065-B. Attach to Form 1040, 1040NR, or 1041.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

How to fill out IRS 1040 - Schedule C-EZ

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

To edit IRS 1040 - Schedule C-EZ, use a PDF editor like pdfFiller, which allows for easy modifications. Start by uploading your downloaded form. You can add or remove text, make corrections, or fill in missing information. Once your edits are complete, be sure to save your changes before printing or submitting the form.

How to fill out IRS 1040 - Schedule C-EZ

To fill out IRS 1040 - Schedule C-EZ, follow these steps:

01

Download the form from the IRS website or other reputable sources.

02

Make sure you have all necessary information about your business income and expenses.

03

Fill in your name, Social Security number, and business name at the top of the form.

04

Report gross receipts or sales from your business activity.

05

Enter your expenses in the designated sections to calculate your net profit.

06

Sign and date the form before submission, ensuring you have attached any necessary documentation.

About IRS 1040 - Schedule C-EZ 2007 previous version

What is IRS 1040 - Schedule C-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule C-EZ 2007 previous version

What is IRS 1040 - Schedule C-EZ?

IRS 1040 - Schedule C-EZ is a simplified tax form used by sole proprietors to report income and expenses from a business. This form allows qualifying taxpayers to file taxes more easily than the standard Schedule C. By using Schedule C-EZ, filers can report their business activities and reduce their tax obligations without the complexity of additional forms.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule C-EZ is to simplify the reporting of business income and expense for sole proprietors. It streamlines the process, allowing small business owners to report their financials more easily than the traditional Schedule C. This is particularly beneficial for those with straightforward income and limited expenses, as it reduces the required documentation.

Who needs the form?

Individuals who operate a sole proprietorship and meet specific eligibility criteria are required to fill out IRS 1040 - Schedule C-EZ. This includes self-employed individuals who expect their gross receipts to be $50,000 or less. Additionally, those who have no inventory, no claims for business use of vehicles, and have expenses that do not exceed the amount of their gross receipts qualify to use this form.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040 - Schedule C-EZ if your business does not generate any income or if you operate a business as a corporation or partnership. Additionally, if your self-employment income exceeds $50,000 or you have substantial business expenses or inventory, you must file the standard Schedule C form instead.

Components of the form

The components of IRS 1040 - Schedule C-EZ include sections for reporting gross receipts and business expenses. There are fields to input your total income, any eligible deductions, and a summary of your net profit. The form also requires your personal information, such as name and Social Security number, ensuring proper identification for tax purposes.

What are the penalties for not issuing the form?

Filing IRS 1040 - Schedule C-EZ late or failing to file it can lead to penalties. Taxpayers may incur a failure-to-file penalty, which is typically calculated based on the amount owed and the length of delay. Additionally, you may also face interest on any unpaid taxes that accrue over time. To avoid these penalties, ensure that you file your taxes by the due date even if you cannot pay the tax in full.

What information do you need when you file the form?

When filing IRS 1040 - Schedule C-EZ, you will need specific information, including:

01

Your business name and address.

02

Your Social Security number.

03

The gross income received from your business.

04

Details of any expenses incurred in running your business.

Gathering this information before you start filling out the form will streamline the process and help ensure accuracy.

Is the form accompanied by other forms?

IRS 1040 - Schedule C-EZ is typically submitted alongside your Form 1040 when you file your personal income tax return. You may also need to include other supporting documents, such as proof of expenses if required by the IRS. It's important to check the instructions provided by the IRS for any additional forms that may need to accompany your filing.

Where do I send the form?

The submission address for IRS 1040 - Schedule C-EZ depends on your location and whether you are filing your return electronically or by mail. If you are filing a paper return, refer to the specific instructions on the IRS website. Generally, you will send your completed forms to the appropriate IRS processing center, which varies by state.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDF Filler makes it possible to do my job.

My company doesn't offer the software to do so.

Best PDF fill and sign application I have used.

See what our users say