Get the free Reducing Your Banks Risk of Wire Transfer Fraud : Articles ...

Show details

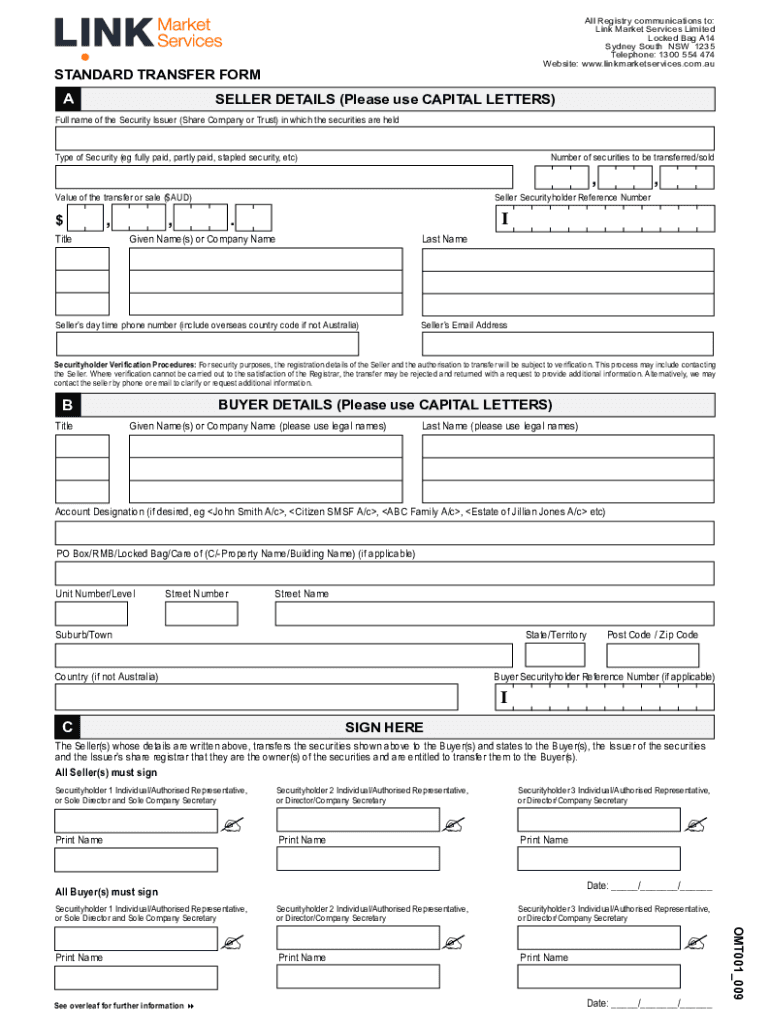

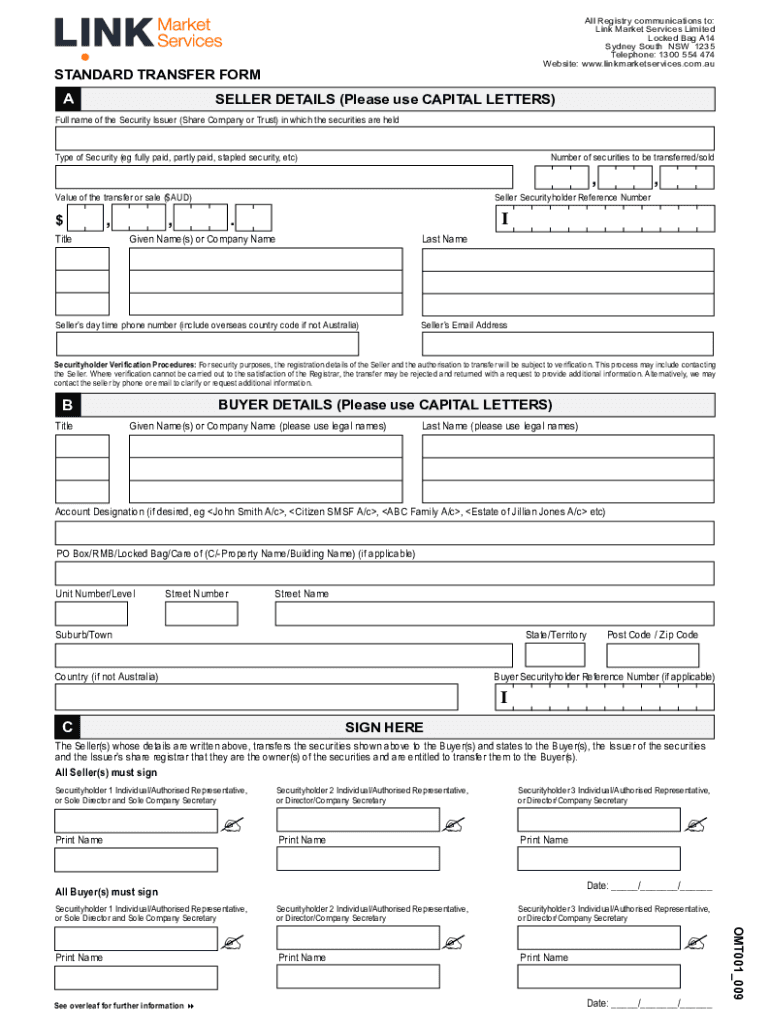

How to complete the Standard Transfer Form minimize the risk of fraud, Link has implemented a security holder verification procedure for all off market transfers of ASX listed securities. Proof of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reducing your banks risk

Edit your reducing your banks risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reducing your banks risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reducing your banks risk online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit reducing your banks risk. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reducing your banks risk

How to fill out reducing your banks risk

01

To fill out reducing your bank's risk, follow these steps:

02

- Conduct a thorough risk assessment to identify potential risks and vulnerabilities in the bank's operations.

03

- Develop and implement risk management strategies and controls to mitigate identified risks. This may involve setting up a dedicated risk management team or department.

04

- Regularly monitor and update risk management policies and procedures to ensure they remain effective and relevant.

05

- Provide ongoing training and education to bank staff to raise awareness about the importance of risk management and how to follow established protocols.

06

- Regularly review and assess the bank's risk exposure and adjust risk mitigation strategies accordingly.

07

- Establish strong internal controls and safeguards to minimize the likelihood of fraud, errors, and unauthorized activity.

08

- Stay informed about the latest industry trends, regulatory requirements, and best practices in risk management to continuously enhance the bank's risk management efforts.

09

- Periodically engage external auditors or consultants to conduct independent reviews and audits of the bank's risk management processes and controls.

10

- Foster a culture of risk awareness and accountability throughout the organization, encouraging all employees to contribute to risk identification and mitigation efforts.

11

- Continuously evaluate and improve the bank's risk management framework based on lessons learned from incidents or near misses.

Who needs reducing your banks risk?

01

Reducing your bank's risk is crucial for financial institutions such as banks, credit unions, and other financial service providers. It is particularly important for those entities that deal with large volumes of customer funds, engage in complex financial transactions, or are subject to strict regulatory requirements. By reducing risk, these organizations can safeguard their reputation, protect customer assets, ensure compliance with legal and regulatory obligations, and maintain the stability and integrity of the financial system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send reducing your banks risk for eSignature?

Once you are ready to share your reducing your banks risk, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit reducing your banks risk online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your reducing your banks risk to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit reducing your banks risk on an Android device?

You can edit, sign, and distribute reducing your banks risk on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is reducing your banks risk?

Reducing your bank's risk refers to the strategies and practices implemented by financial institutions to minimize potential losses and mitigate exposure to various types of risk, including credit risk, operational risk, market risk, and liquidity risk.

Who is required to file reducing your banks risk?

Banks and financial institutions that are regulated and wish to demonstrate their risk management practices typically are required to file documentation or reports related to reducing their banks' risk, including but not limited to information stipulated by regulatory authorities.

How to fill out reducing your banks risk?

To fill out reducing your bank's risk documentation, institutions should gather relevant data regarding risk management strategies, assess their current risk exposure, provide accurate financial information, and follow the specific guidelines set forth by regulatory agencies.

What is the purpose of reducing your banks risk?

The purpose of reducing your bank's risk is to protect the financial institution's stability, ensure compliance with regulatory requirements, and maintain trust with clients and stakeholders by implementing effective risk management practices.

What information must be reported on reducing your banks risk?

Information that must be reported typically includes risk assessment results, risk management strategies, internal controls, audit findings, financial statements, and any regulatory compliance documentation required by supervisory authorities.

Fill out your reducing your banks risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reducing Your Banks Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.