Get the free in-kind contributions received - Campaign Finance Report

Show details

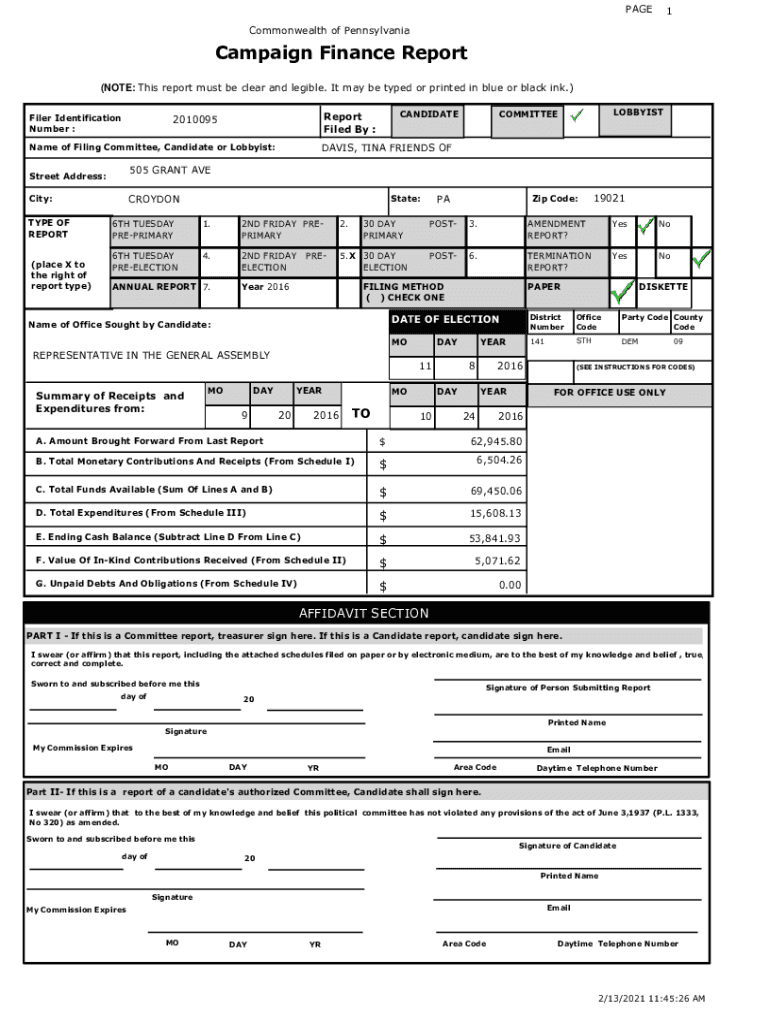

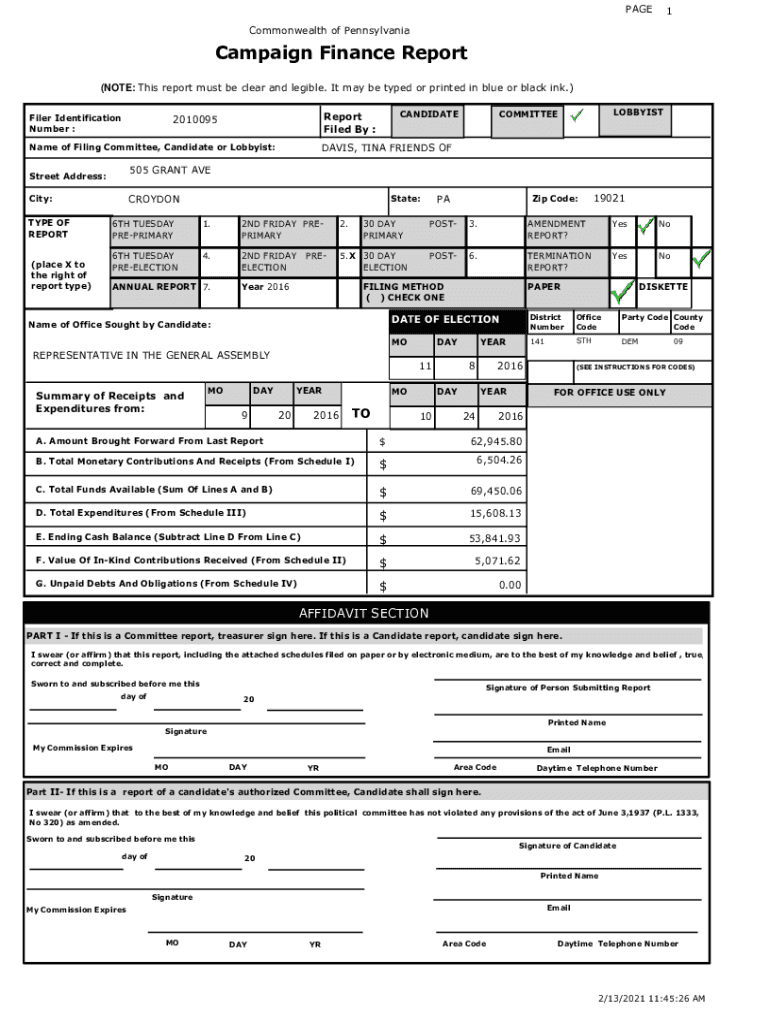

PAGE1Commonwealth of PennsylvaniaCampaign Finance Report

(NOTE: This report must be clear and legible. It may be typed or printed in blue or black ink.)

Filer Identification

Number :505 GRANT Street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-kind contributions received

Edit your in-kind contributions received form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind contributions received form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in-kind contributions received online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit in-kind contributions received. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-kind contributions received

How to fill out in-kind contributions received

01

Step 1: Calculate the value of the in-kind contribution. This can be determined by assigning a fair market value to the donated goods or services.

02

Step 2: Record the details of the in-kind contribution in your financial records. This should include the date of receipt, description of the contribution, and the assigned value.

03

Step 3: Acknowledge the donor. It is important to thank the donor for their contribution and provide them with a written acknowledgment. This can be in the form of a letter or email.

04

Step 4: Report the in-kind contribution in your financial statements. This should be done in accordance with the applicable accounting standards and regulations.

05

Step 5: Monitor and track the in-kind contributions received. Keep a record of all contributions received and ensure they are used for their intended purposes.

06

Step 6: Communicate the impact of the in-kind contributions. Share the success stories and outcomes resulting from the in-kind contributions to engage donors and attract future support.

Who needs in-kind contributions received?

01

Non-profit organizations often rely on in-kind contributions received to support their operations and programs.

02

Charitable organizations that provide services or assistance to individuals in need can benefit from in-kind contributions received.

03

Educational institutions may require in-kind contributions to support their programs and enhance the learning environment.

04

Community-based organizations and social enterprises can utilize in-kind contributions to serve their target communities.

05

Government agencies and departments may accept in-kind contributions to supplement their resources and provide better services.

06

Research institutions and scientific organizations may seek in-kind contributions to support their studies and experiments.

07

Arts and cultural organizations may rely on in-kind contributions to enhance their exhibits and events.

08

Environmental and conservation groups can make use of in-kind contributions to protect natural resources and habitats.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my in-kind contributions received directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your in-kind contributions received and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete in-kind contributions received online?

pdfFiller has made filling out and eSigning in-kind contributions received easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my in-kind contributions received in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your in-kind contributions received and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is in-kind contributions received?

In-kind contributions received refer to non-monetary donations of goods or services that are given to support an organization or campaign, rather than cash contributions.

Who is required to file in-kind contributions received?

Entities such as political campaigns, nonprofits, and organizations that receive in-kind contributions as part of their fundraising or operations are required to report these contributions.

How to fill out in-kind contributions received?

To fill out in-kind contributions received, organizations should list the value, description, and donor information of the received goods or services on the appropriate financial disclosure forms, adhering to the guidelines set by regulatory bodies.

What is the purpose of in-kind contributions received?

The purpose of in-kind contributions received is to provide support to organizations and campaigns without requiring monetary donations, enabling them to utilize resources that can help achieve their goals.

What information must be reported on in-kind contributions received?

Information that must be reported includes the name of the donor, the value of the in-kind contribution, a description of the contribution, and the date it was received.

Fill out your in-kind contributions received online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Kind Contributions Received is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.