Get the free ct tax

Show details

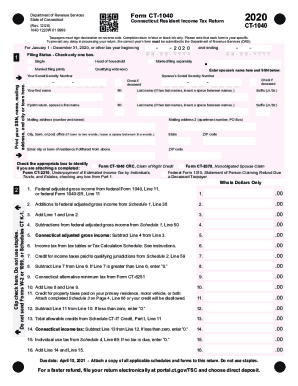

2020Form CT1040Department of Revenue Services State of Connecticut (Rev. 02/21) 1040 1220W 01 9999Connecticut Resident Income Tax ReturnCT1040Taxpayers must sign declaration on reverse side. Complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct tax

Edit your ct tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ct tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct tax

How to fill out CT DRS CT-1040

01

Gather your personal information, including your Social Security number and address.

02

Collect your income documents such as W-2s, 1099s, and any other relevant earnings.

03

Begin filling out Part I of the CT-1040 form with your personal information.

04

Proceed to Part II to report your income, making sure to accurately enter all figures.

05

Complete Part III to calculate your Connecticut tax liability based on your reported income.

06

Include any credits or deductions you may qualify for in Part IV.

07

Review the completed form for accuracy and ensure all sections are filled out correctly.

08

Sign and date the form before submission.

09

Make a copy of your completed CT-1040 for your records.

10

Submit the form to the Connecticut Department of Revenue Services via mail or e-file.

Who needs CT DRS CT-1040?

01

Residents of Connecticut who have earned income during the tax year need to fill out the CT DRS CT-1040.

02

Any individual who is required to file a tax return in Connecticut, including part-time residents and full-time residents.

03

Taxpayers seeking to claim tax credits, deductions, or refunds related to their Connecticut income tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What are NZ tax brackets 2022?

There are five PAYE tax brackets for the 2021-2022 tax year: 10.50%, 17.50%, 30%, 33% and 39%. Your tax bracket depends on your total taxable income.

Why is CT state tax so high?

Connecticut during that period created a personal income tax, something visibly absent from all three of the country's least-burdened states. Connecticut's high tax burden, the bulk of which is taxes paid to its state and local governments, stem from the state's high cost of government.

Is it tax free in CT?

This year will be Connecticut's 22nd Sales Tax Free Week. ing to state statute, Sales Tax Free Week begins on the third Sunday of August and runs until the following Saturday. 2022 Sales Tax Free Week dates are Sunday, August 21, through Saturday, August 27, 2022.

What is CT's income tax rate?

How does Connecticut's tax code compare? Connecticut has a graduated individual income tax, with rates ranging from 3.00 percent to 6.99 percent. Connecticut also has a 7.50 percent corporate income tax rate. Connecticut has a 6.35 percent state sales tax rate and levies no local sales taxes.

Where does CT rank in taxes?

Taxes by State Overall Rank (1=Lowest)StateAdjusted Overall Rank (based on Cost of Living Index)48Pennsylvania4449New York4950Connecticut5151Illinois4747 more rows • Mar 7, 2022

Is there a state tax in CT?

Connecticut has a 6.35 percent state sales tax rate and levies no local sales taxes. Connecticut's tax system ranks 47th overall on our 2022 State Business Tax Climate Index.

What is taxed at 7.35% in CT?

Taxable Meals at Gas Stations and Convenience Stores In general, every meal is taxed at 7.35% during a sale. Define a meal as a food product that is prepared, served, or furnished for immediate consumption, including take-out and to-go meals.

What is CT tax rate?

There is only one statewide sales and use tax. There are no additional sales taxes imposed by local jurisdictions in Connecticut. The statewide rate of 6.35% applies to the retail sale, lease, or rental of most goods and taxable services.

What are the tax brackets for 2022 taxes?

For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

What is CT state income tax rate 2022?

Connecticut income tax has seven tax brackets with rates ranging from 3.00% to 6.99%. The income ranges for each tax bracket vary by filing status.

What are the income tax brackets in CT?

Basis and Rate Filing StatusConnecticut Taxable IncomeRate of TaxSingle/ Married Filing SeparateNot over $10,0003%Over $10,000$300, plus 4.5% of the excess over $10,000Head of HouseholdNot over $16,0003%Over $16,000$480, plus 4.5% of the excess over $16,0002 more rows

How much do I pay in taxes in CT?

Connecticut Income Tax Calculator 2021 Your average tax rate is 11.98% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Is CT the highest taxed state?

ing to the foundation, the top five states with the highest state and local tax combinations are: New York 12.7% Connecticut 12.6% New Jersey 12.2%

What are the different tax brackets in CT?

Connecticut Tax Brackets 2022 - 2023 Tax rate of 3% on the first $10,000 of taxable income. Tax rate of 5% on taxable income between $10,001 and $50,000. Tax rate of 5.5% on taxable income between $50,001 and $100,000. Tax rate of 6% on taxable income between $100,001 and $200,000.

What is the current CT state income tax rate?

Basis and Rate Filing StatusConnecticut Taxable IncomeRate of TaxSingle/ Married Filing SeparateNot over $10,0003%Over $10,000$300, plus 4.5% of the excess over $10,000Head of HouseholdNot over $16,0003%Over $16,000$480, plus 4.5% of the excess over $16,0002 more rows

What is the Connecticut state tax rate for 2022?

Use tax rates are the same as sales tax rates (i.e., 6.35% for most taxable goods and Page 10 2022-R-0108 June 21, 2022 Page 10 of 10 services) (CGS § 12-411 et seq.; see DRS's Q&A on the Connecticut Individual Use Tax, IP 2016(19)).

What is the highest taxing state in the US?

The states with the highest income tax for 2021 include California 13.3%, Hawaii 11%, New Jersey 10.75%, Oregon 9.9%, and Minnesota 9.85%. Eight states have no personal income tax, including Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Does New York or Connecticut have higher taxes?

Taxes in New York are higher than Connecticut's for every income group except the poorest 20%, who pay more in state and local taxes in Connecticut than in New York.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct tax without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ct tax, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit ct tax in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ct tax, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the ct tax form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign ct tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is CT DRS CT-1040?

CT DRS CT-1040 is the Connecticut resident income tax return form used by individuals to report their income and calculate their tax liability for the tax year.

Who is required to file CT DRS CT-1040?

Residents of Connecticut who have a federal adjusted gross income that meets or exceeds the state's filing thresholds are required to file CT DRS CT-1040.

How to fill out CT DRS CT-1040?

To fill out CT DRS CT-1040, individuals must provide personal information, report their income, calculate deductions and exemptions, and determine their tax liability based on the provided guidelines and forms.

What is the purpose of CT DRS CT-1040?

The purpose of CT DRS CT-1040 is to assess and collect state income tax from residents based on their income and other taxable activities throughout the year.

What information must be reported on CT DRS CT-1040?

Information that must be reported on CT DRS CT-1040 includes personal identifying information, income from various sources, deductions, exemptions, tax credits, and any amounts owed or refunded.

Fill out your ct tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.