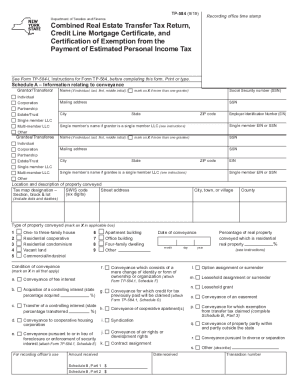

Who needs a TP-584 form?

This tax form is completed by the individual for the conveyance of real estate property from a granter to a grantee. The form consists of several schedules and the individual should choose the appropriate one depending on the nature of the conveyance.

What is the purpose of the TP-584 form?

This form is a combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of estimated personal income tax. The information provided in the form is used by the NY State Department of Taxation and Finance for the tax return.

What other documents must accompany the TP-584 form?

The list of supporting documents depends on the completed schedule. The non-resident individual may need to attach the IT-2663 form, IT-2664 form or others.

When is the TP-584 form due?

This form should be submitted within fifteen days after the delivery of the instrument effecting the conveyance.

What information should be provided in the TP-584 form?

Schedule A requirements' information about the granter (name, address, SSN, Federal EIN); grantee; location and description of the property; condition of conveyance.

In Schedule B the signer is to complete the following parts: computation of tax due; computation of additional tax due on the conveyance of residential real property for more than $1 million; explanation of exemption claimed on the previous parts.

In Schedule C the signer must check the appropriate boxes and sign it.

Schedule C is the certification of resident transferor/seller and the exemption for nonresidents transferor/seller. The transferor must sign, date the schedule and print the full name.

What do I do with the TP-584 form after its completion?

The completed and signed Schedules are forwarded to the New York State Department of Taxation And Finance. The filler should keep one copy for his personal records.