Get the free JOB ENHANCEMENT LOAN APPLICATION - treasurer mo

Show details

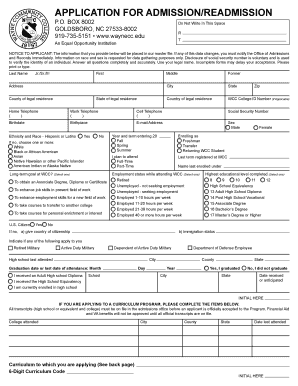

This document is an application for the Missouri Linked Deposit Program, which aims to provide loans to businesses in Missouri for job creation, retention, and expansion. It outlines the eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign job enhancement loan application

Edit your job enhancement loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your job enhancement loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing job enhancement loan application online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit job enhancement loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out job enhancement loan application

How to fill out JOB ENHANCEMENT LOAN APPLICATION

01

Begin by obtaining the Job Enhancement Loan Application form from the relevant financial institution or website.

02

Carefully read the instructions provided on the application form to understand the requirements.

03

Fill in your personal information, including your full name, address, and contact details.

04

Provide details of your current employment, including your job title, employer's name, and length of employment.

05

Specify the purpose of the loan and how it will enhance your job or career opportunities.

06

Include your financial information, such as income, expenses, and any existing debts.

07

Attach any necessary documentation, such as income statements, tax returns, or proof of employment.

08

Review the application for accuracy and completeness before submission.

09

Submit the application according to the instructions provided, either online or by mail.

10

Keep a copy of the application and any supporting documents for your records.

Who needs JOB ENHANCEMENT LOAN APPLICATION?

01

Individuals seeking to improve their job skills or career prospects.

02

Employees looking for financial assistance to pursue further education or training related to their job.

03

Workers who require funding for tools or resources that will help them in their current job.

04

Professionals aiming to relocate or transition to a higher-paying position.

Fill

form

: Try Risk Free

People Also Ask about

How to write loan application in English?

A Step-By-Step Guide To Writing A Personal Loan Application Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Highlight Your Creditworthiness. Include Any Collateral (If Applicable) Maintain a Professional and Courteous Tone.

How to convince customer to take loan in english?

Encourage them to take loan from your bank & pay later in instalments with slight higher interest rates from your fixed deposit interest rates. Advise them that due to inflation everything may be more costlier next year so purchase now from bank loan . Always make a co-operative & gentle behaviour with your customers.

What do I write to get approved for a loan?

Here are some tips to help you write a letter for loan approval: Review the loan guidelines and understand how they apply. Describe the reason for the loan in detail. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader.

What is the best reason to say when applying for a loan?

Most people borrow money to consolidate debt. Bills, home improvement projects and major expenses are other popular reasons to get a loan. You should only get a loan for necessary expenses and when you can afford the monthly payments.

How do you write a loan approval?

Answer: A Loan Approval Letter should include the borrower's name, loan amount, loan term, interest rate, and any conditions or contingencies that need to be met before the loan can be finalized. It should also include the lender's contact information and any additional instructions for the borrower.

What do I write to get a loan?

Tips For Loan Request Letter Review the loan guidelines and understand how they apply. Describe the reason for the loan in detail. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader. Be sure to include a repayment plan.

Do loan applications contact your employer?

Key Takeaways Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Most lenders only require verbal confirmation, but some will seek email or fax verification.

How to politely request for a loan?

Be Respectful and Considerate: Approach the person at a good time when they are not busy or distracted. Make Your Request Clear: Clearly state what you would like to borrow. Express Why You Need It: Briefly explain why you need the item, which can help the person feel more comfortable lending it to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is JOB ENHANCEMENT LOAN APPLICATION?

The JOB ENHANCEMENT LOAN APPLICATION is a formal request for financing aimed at supporting professional development activities or initiatives that enhance job performance and career advancement.

Who is required to file JOB ENHANCEMENT LOAN APPLICATION?

Employees seeking funding for training programs, educational courses, or professional development activities that improve their job skills may be required to file the JOB ENHANCEMENT LOAN APPLICATION.

How to fill out JOB ENHANCEMENT LOAN APPLICATION?

To fill out the JOB ENHANCEMENT LOAN APPLICATION, applicants should provide personal information, details about the desired training or development program, estimated costs, and any supporting documentation that validates the need for the loan.

What is the purpose of JOB ENHANCEMENT LOAN APPLICATION?

The purpose of the JOB ENHANCEMENT LOAN APPLICATION is to provide financial support for employees to pursue skill enhancement opportunities that will benefit their career and improve overall job performance.

What information must be reported on JOB ENHANCEMENT LOAN APPLICATION?

The information that must be reported on the JOB ENHANCEMENT LOAN APPLICATION includes the applicant's personal details, project description, cost estimates, and any existing qualifications or endorsements related to the requested enhancement.

Fill out your job enhancement loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Job Enhancement Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.