Get the free Online Tu c s o n S y m p h o n y Fax Email Print ...

Show details

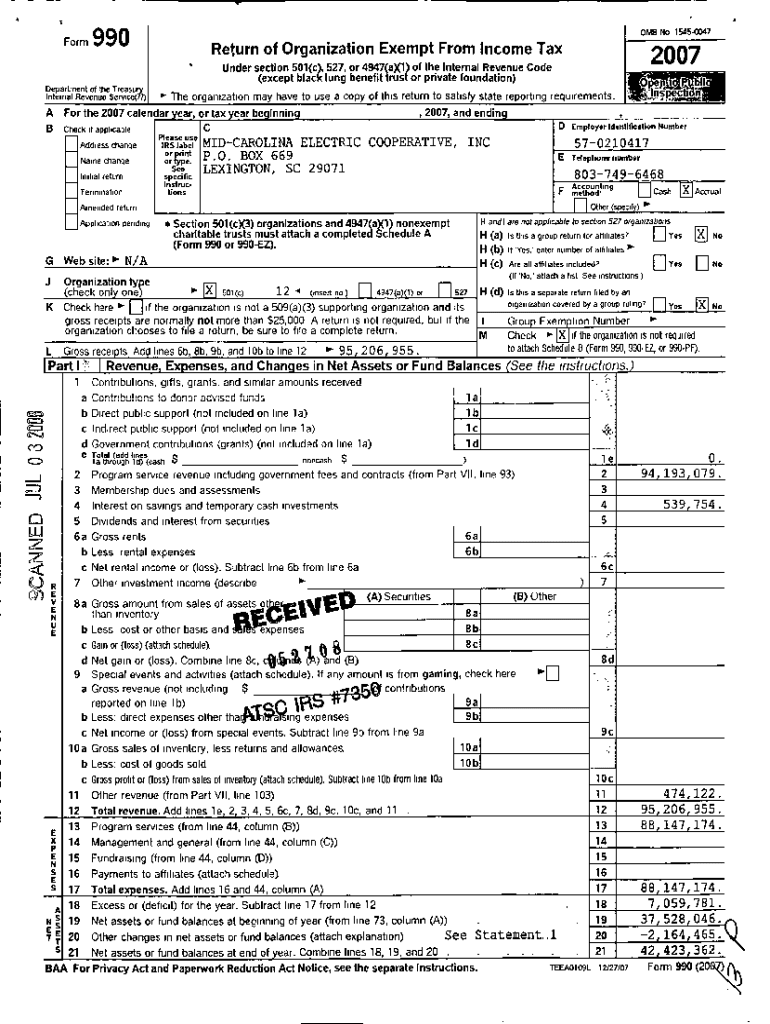

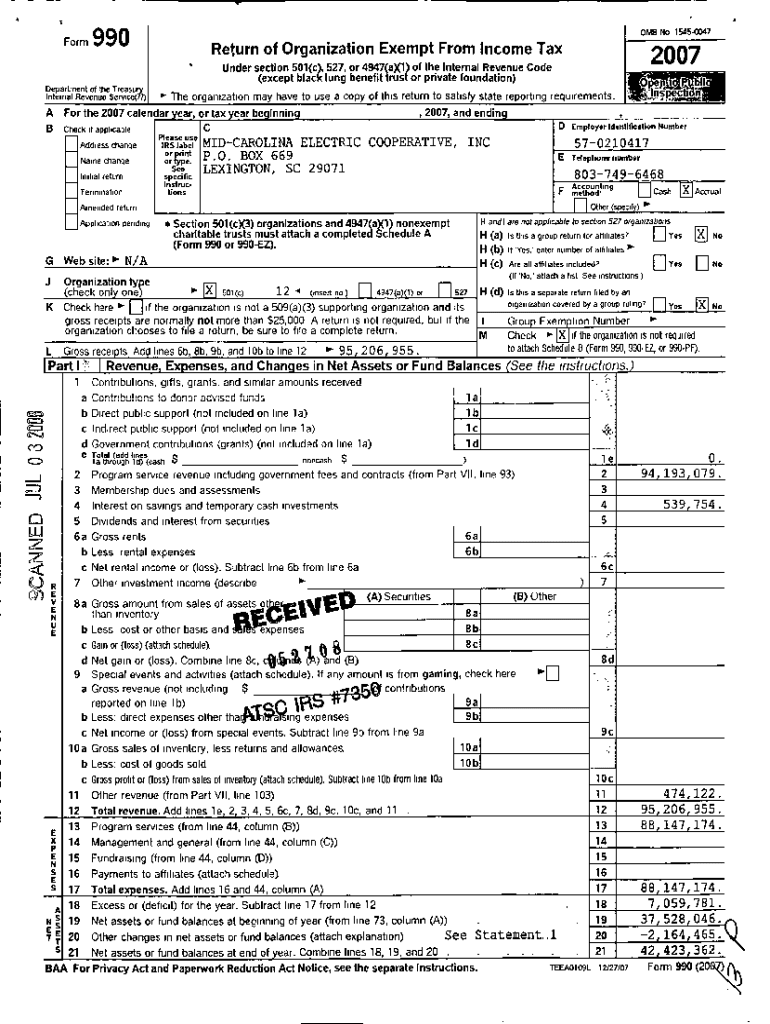

Form OMB No 15450047990Return of Organization Exempt From Income Tax2007Under section 501 (c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign online tu c s

Edit your online tu c s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online tu c s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online tu c s online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit online tu c s. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online tu c s

How to fill out online tu c s

01

Step 1: Open your web browser and go to the website of the institution or organization offering the online tu c s.

02

Step 2: Look for a link or button that says 'Apply' or 'Enroll' and click on it.

03

Step 3: Fill out the required personal information, such as your name, date of birth, and contact details, in the online application form.

04

Step 4: Provide any additional information requested, such as your educational background, previous experience, or desired course or program of study.

05

Step 5: Review the completed application form for any errors or missing information.

06

Step 6: Submit the online application by clicking on the 'Submit' or 'Apply' button.

07

Step 7: Wait for a confirmation email or notification from the institution regarding the status of your application.

08

Step 8: Follow any further instructions provided by the institution to complete the enrollment process, such as payment of fees or submission of supporting documents.

Who needs online tu c s?

01

Online tu c s can be beneficial for various individuals. It is particularly useful for:

02

- Working professionals who want to enhance their skills or knowledge without leaving their current job or location.

03

- Students who are unable to attend traditional classes due to distance, time constraints, or other commitments.

04

- Individuals with busy schedules or family responsibilities who cannot commit to regular class attendance.

05

- International students who wish to study in a different country without the need for relocation.

06

- Individuals seeking to learn or explore new subjects or areas of interest in a flexible and self-paced manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit online tu c s on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing online tu c s.

How do I edit online tu c s on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute online tu c s from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete online tu c s on an Android device?

On Android, use the pdfFiller mobile app to finish your online tu c s. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is online tu c s?

Online TUCS refers to the online submission system for the Tax Underreporting Correction Statement, used to correct any discrepancies in reported income for tax purposes.

Who is required to file online tu c s?

Individuals and businesses that have underreported their income or made errors in their tax filings are required to submit an online TUCS.

How to fill out online tu c s?

To fill out online TUCS, log into the tax authority's website, access the TUCS form, provide necessary identification information, and accurately detail the discrepancies along with supporting documentation.

What is the purpose of online tu c s?

The purpose of online TUCS is to provide a streamlined process for correcting tax record errors, ensuring compliance with tax regulations and minimizing penalties.

What information must be reported on online tu c s?

Individuals must report details including the amount of underreported income, the tax years affected, and any additional supporting documentation to justify the corrections.

Fill out your online tu c s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Tu C S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.