Get the free p ivate foundation

Show details

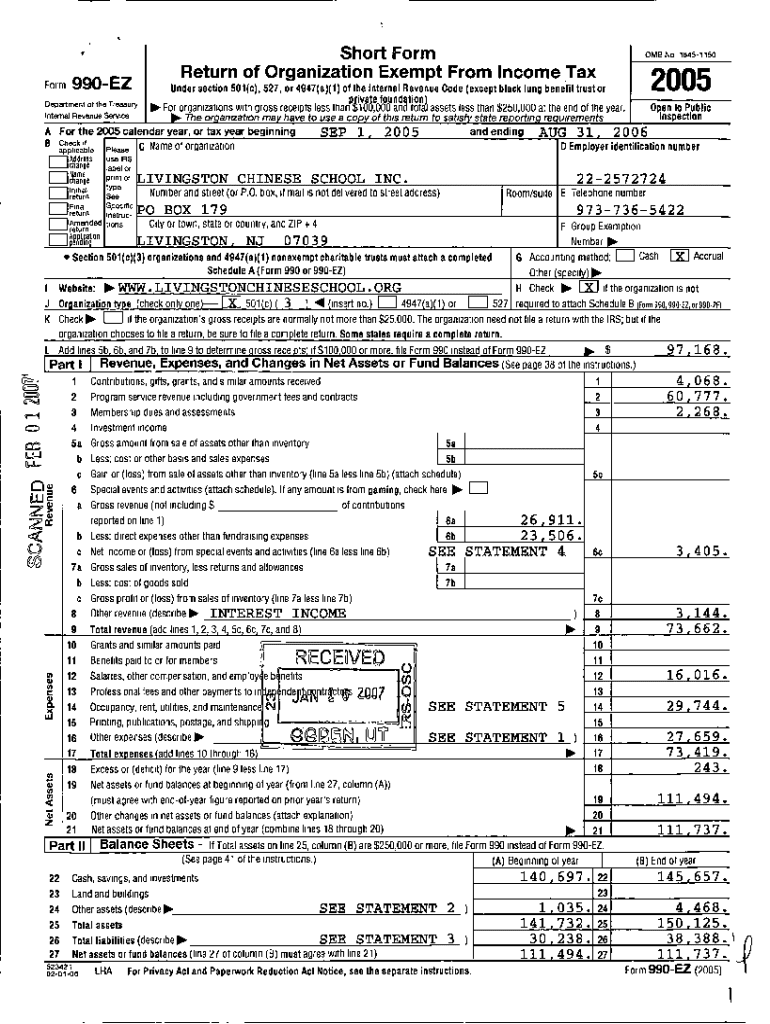

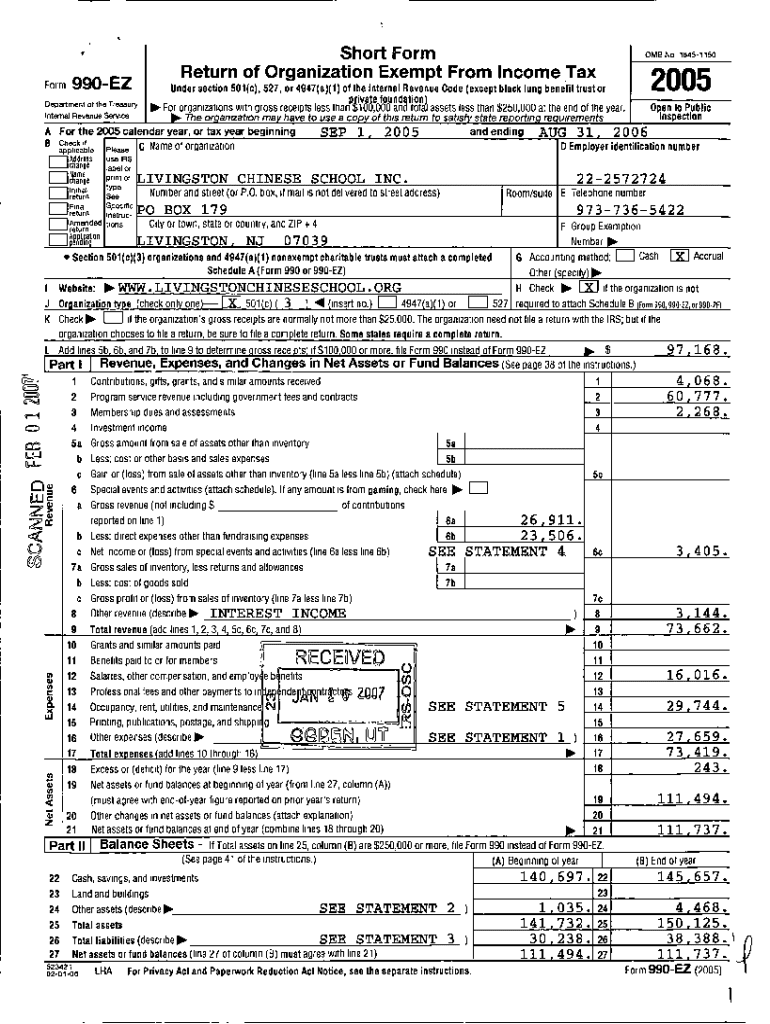

Short Form

Return of Organization Exempt From Income Tax

Form990EZDepartment of the Treasury

Internal Revenue ServiceUnder section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign p ivate foundation

Edit your p ivate foundation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your p ivate foundation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing p ivate foundation online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit p ivate foundation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out p ivate foundation

How to fill out p ivate foundation

01

Step 1: Begin by gathering all necessary documents and information, such as personal identification, financial records, and any relevant legal documents.

02

Step 2: Research the requirements and guidelines for private foundations in your jurisdiction. This may include registering with the appropriate government agency and obtaining any necessary licenses or permits.

03

Step 3: Develop a mission statement and goals for your private foundation. This will help guide your activities and determine the types of projects and organizations you will support.

04

Step 4: Create a board of directors or trustees to oversee the foundation's operations. This should include individuals with diverse backgrounds and expertise.

05

Step 5: Establish a clear governance structure and procedures for decision-making, financial management, and grantmaking.

06

Step 6: Develop an investment strategy for the foundation's assets. This may involve consulting with financial advisors or investment professionals.

07

Step 7: Begin accepting donations and fundraising to build the foundation's assets. This may include reaching out to potential donors, hosting events, or applying for grants.

08

Step 8: Create a grantmaking process to review and select projects or organizations to support. This should include criteria for eligibility, application procedures, and a transparent evaluation process.

09

Step 9: Maintain accurate records and financial reporting for the private foundation, including annual tax filings and compliance with any regulations or reporting requirements.

10

Step 10: Continuously evaluate and assess the impact of the foundation's activities and make adjustments as needed to achieve its mission and goals.

Who needs p ivate foundation?

01

Private foundations are typically established by individuals or families who wish to create a lasting charitable legacy.

02

Individuals with significant wealth or assets often choose to create private foundations as a way to give back to their communities and make a positive impact on society.

03

Private foundations also provide a vehicle for individuals or families to manage and distribute their charitable contributions in a controlled and organized manner.

04

Non-profit organizations and charities may also establish private foundations as a way to diversify their funding sources and support their long-term sustainability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my p ivate foundation directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your p ivate foundation and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for the p ivate foundation in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your p ivate foundation and you'll be done in minutes.

How do I fill out p ivate foundation using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign p ivate foundation and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is a private foundation?

A private foundation is a type of nonprofit organization that is typically funded by a single individual, family, or corporation, and which primarily makes grants to other charitable organizations rather than operating its own programs.

Who is required to file a private foundation?

Private foundations are required to file with the IRS if they are recognized as tax-exempt organizations. This includes all private foundations that meet the thresholds set by the IRS for financial reporting.

How to fill out a private foundation?

To fill out a private foundation's tax forms, one needs to gather financial records, ensure compliance with IRS regulations, and complete the relevant forms, such as Form 990-PF, accurately detailing income, expenses, and grant distributions.

What is the purpose of a private foundation?

The purpose of a private foundation is to support charitable causes and organizations, often driven by the interests and goals of its founders, and to promote philanthropy.

What information must be reported on a private foundation?

Private foundations must report their financial activities, including revenue, expenses, assets, grants made, and any compensation paid to trustees or staff, usually through Form 990-PF.

Fill out your p ivate foundation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

P Ivate Foundation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.