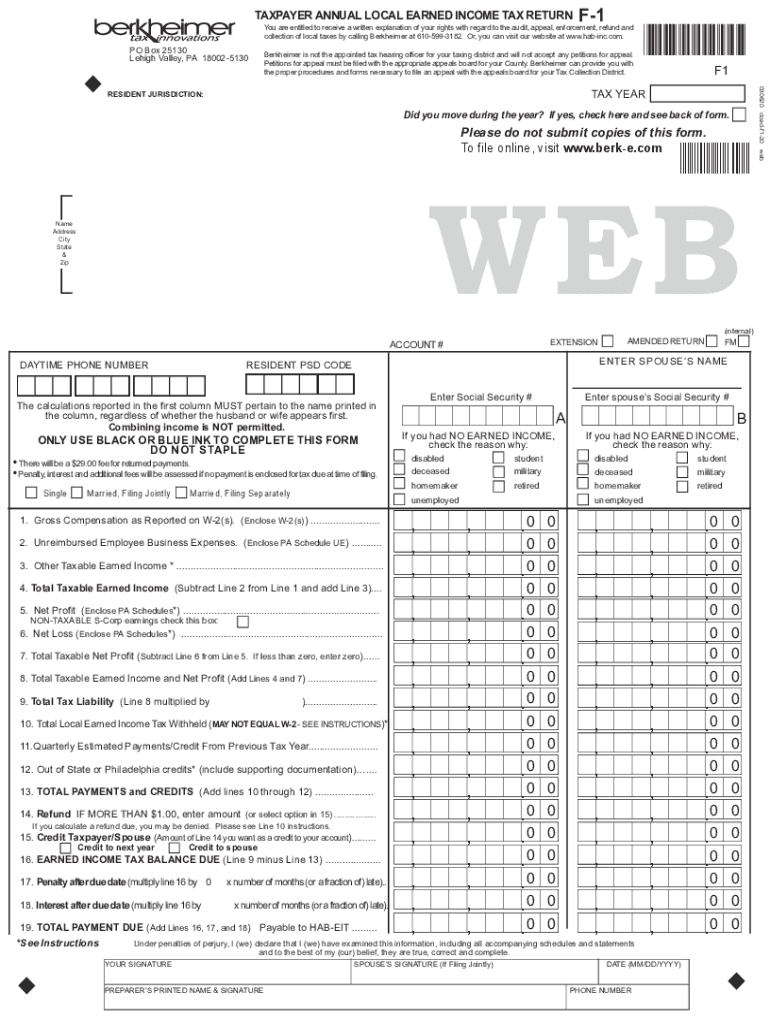

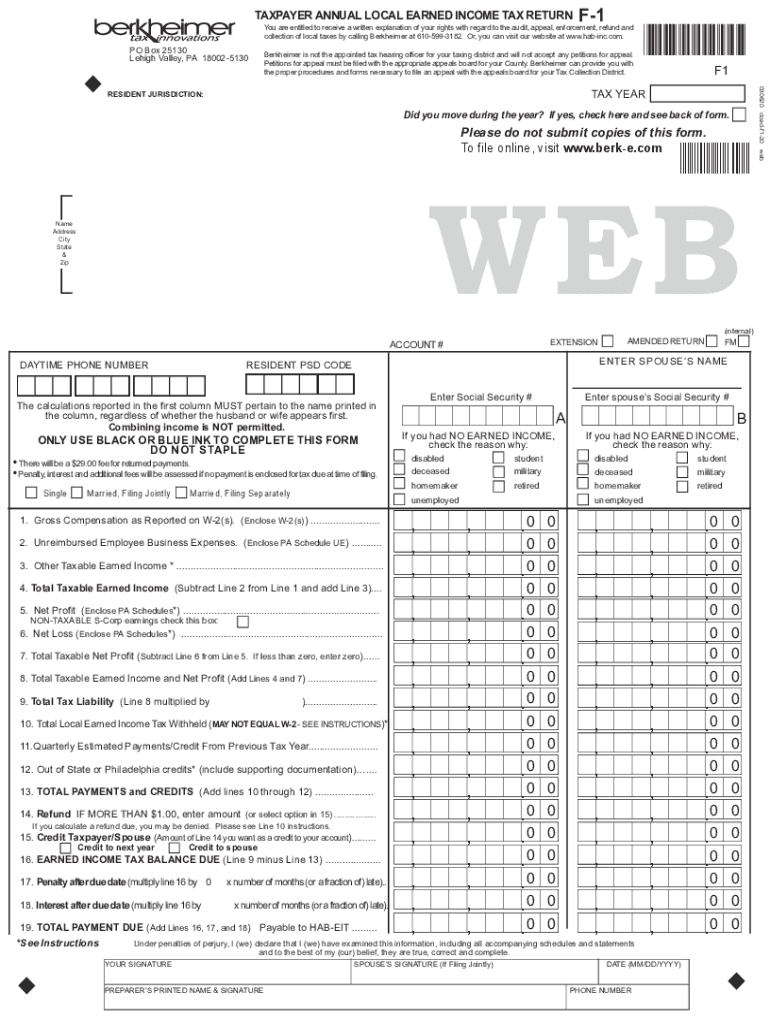

PA Berkheimer F-1 2020 free printable template

Show details

TAXPAYERANNUALLOCALEARNEDINCOMETAXRETURNF1You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and

collection of local taxes by calling

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Berkheimer F-1

Edit your PA Berkheimer F-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Berkheimer F-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA Berkheimer F-1 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA Berkheimer F-1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Berkheimer F-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA Berkheimer F-1

How to fill out PA Berkheimer F-1

01

Gather your personal information (name, address, Social Security number).

02

Collect the necessary income information (W-2s, 1099s, other income sources).

03

Fill in the taxpayer details including your filing status and residency.

04

Provide details of your income on the designated lines.

05

Complete the applicable deductions and credits sections.

06

Review your completed form for accuracy.

07

Sign and date the form before submitting it to the appropriate authorities.

Who needs PA Berkheimer F-1?

01

Individuals who reside or have income in Pennsylvania and are required to file a local income tax return.

02

Self-employed individuals or freelancers working in Pennsylvania.

03

Employees with wages subject to local taxes who need to report their earnings to Berkheimer.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file local earned income tax?

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

What is a local earned income tax residency certification form?

This form is to be used by employers and taxpayers to report essential information for the collection and distribution of Local Earned Income Taxes to the local EIT collector. This form must be used by employers when a new employee is hired or when a current employee notifies employer of a name or address change.

Do I have to file a local income tax return in PA?

Yes. State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return and supply income and withholding documentation, such as a W-2. Even if you have employer withholding or are not expecting a refund, you must file an annual tax return.

What is a local earned income tax return?

Individual Taxpayer FAQ regarding Earned Income Tax The local Earned Income Tax (EIT) was enacted in 1965 under Act 511, the state law that gives municipalities and school districts the legal authority to levy a tax on individual gross earned income/compensation and net profits.

Who pays local earned income tax in PA?

Local Income Tax Information Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax (EIT) and Local Services Tax (LST) on behalf of their employees working in PA.

What is local earned income tax in PA?

Earned Income Tax. The Local Tax Enabling Act authorizes Local Earned Income Taxes (EIT) for municipalities and school districts. This tax is . 5% of your earned income for the municipality and between . 9% and 1.5% for the school district in which you reside.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA Berkheimer F-1 to be eSigned by others?

Once you are ready to share your PA Berkheimer F-1, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete PA Berkheimer F-1 online?

pdfFiller has made it easy to fill out and sign PA Berkheimer F-1. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit PA Berkheimer F-1 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your PA Berkheimer F-1 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is PA Berkheimer F-1?

The PA Berkheimer F-1 is a local earned income tax form used by residents of certain areas in Pennsylvania to report their earnings to the Berkheimer Tax Administrator.

Who is required to file PA Berkheimer F-1?

Residents of municipalities that levy a local earned income tax and who earn income subject to that tax are required to file the PA Berkheimer F-1.

How to fill out PA Berkheimer F-1?

To fill out the PA Berkheimer F-1, individuals must provide their personal information, report their total taxable income, and calculate the local tax due based on their income.

What is the purpose of PA Berkheimer F-1?

The purpose of the PA Berkheimer F-1 is to collect local earned income taxes from individuals living in municipalities served by Berkheimer.

What information must be reported on PA Berkheimer F-1?

Individuals must report their total taxable income, any adjustments or deductions, and the local tax owed based on their income.

Fill out your PA Berkheimer F-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Berkheimer F-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.