CA San Francisco Federal Credit Union free printable template

Show details

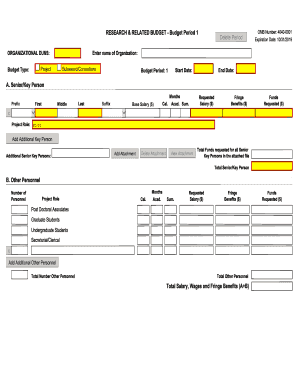

PAY ON DEATH B E N E FIDUCIARY ADD/ Update DESIGN NATION FOR M MEMBER NUMBER: NAME: DATE: For all accounts with the member number listed above or specific accounts as indicated, I authorize to: Add

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign add beneficiary form

Edit your add beneficiary form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your add beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit add beneficiary form online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit add beneficiary form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out add beneficiary form

How to fill out CA San Francisco Federal Credit Union Pay-on-Death

01

Obtain the Pay-on-Death (POD) form from CA San Francisco Federal Credit Union.

02

Fill out the necessary personal information including your name, address, and account number.

03

Designate the beneficiary by providing their name and relationship to you.

04

Specify any additional beneficiaries if desired by including their names and relationships as well.

05

Sign and date the form to validate your request.

06

Submit the completed form to the CA San Francisco Federal Credit Union either in person or through their secured online platform.

Who needs CA San Francisco Federal Credit Union Pay-on-Death?

01

Anyone who wants to ensure that their account balance will be passed directly to a specific individual upon their death should consider filling out a Pay-on-Death form.

02

Individuals looking to avoid probate for their accounts may find this beneficial.

03

Family members looking to secure financial support for loved ones after their passing can also utilize this option.

Fill

form

: Try Risk Free

People Also Ask about

Who should I put as my beneficiary if I'm single?

Most single people with no kids will name their parents or siblings as primary beneficiaries. Someone who will have to pay off your debts or your funeral is another option. You can name each as a primary beneficiary if you're responsible financially for several family members.

Can you add a beneficiary at any time?

In most cases, you may change the beneficiaries named on a life insurance policy or other financial account at any time.

How do I add a beneficiary to my account?

Most financial will require you to contact your local branch or call customer service to add a beneficiary. However, some may also let you make changes to your account through online banking. Bank account beneficiaries may be added at any time.

Who should I add as my beneficiary?

If you're married with kids, naming a spouse as a primary beneficiary is the go-to for most people. This way, your partner can use the proceeds of the policy to help provide for your kids, pay the mortgage, and ease the economic hardship that your death may bring.

What does add beneficiary mean?

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products. For life insurance coverage, that is the death benefit your policy will pay if you die. For retirement or investment accounts, that is the balance of your assets in those accounts.

What happens when you add a beneficiary?

Naming a beneficiary indicates to the executor — the person responsible for managing a deceased's assets — where you want your money to go. That could be to a relative in need, a charity or a spouse.

How do I add a beneficiary to my checking account?

Simply go into your bank branch and ask that another name be put onto the account. Make sure that person is with you, because they will have to sign all the paperwork.

Can I add beneficiary later?

Yes, the policyholder can change their beneficiaries whenever they want, for any reason.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify add beneficiary form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including add beneficiary form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit add beneficiary form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing add beneficiary form, you need to install and log in to the app.

Can I edit add beneficiary form on an Android device?

You can edit, sign, and distribute add beneficiary form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is CA San Francisco Federal Credit Union Pay-on-Death?

CA San Francisco Federal Credit Union Pay-on-Death (POD) is a type of account that allows the account holder to designate one or more beneficiaries who will receive the account's assets upon the account holder's death, without the need for probate.

Who is required to file CA San Francisco Federal Credit Union Pay-on-Death?

There is no specific requirement to 'file' a Pay-on-Death designation, but account holders at CA San Francisco Federal Credit Union should complete the paperwork to establish a POD account if they wish to designate beneficiaries.

How to fill out CA San Francisco Federal Credit Union Pay-on-Death?

To fill out a CA San Francisco Federal Credit Union Pay-on-Death form, account holders need to identify the account type, provide their personal information, and include the names and information of the designated beneficiaries.

What is the purpose of CA San Francisco Federal Credit Union Pay-on-Death?

The purpose of CA San Francisco Federal Credit Union Pay-on-Death is to simplify the transfer of assets upon the account holder's death, allowing beneficiaries to access funds without the delay or expense of probate.

What information must be reported on CA San Francisco Federal Credit Union Pay-on-Death?

Information that must be reported includes the account holder's name, account number, the names and contact information of the beneficiaries, and any specific terms associated with the POD designation.

Fill out your add beneficiary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Add Beneficiary Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.