Get the free Financial Assurance Instrument- Surety Bond Fact Sheet

Show details

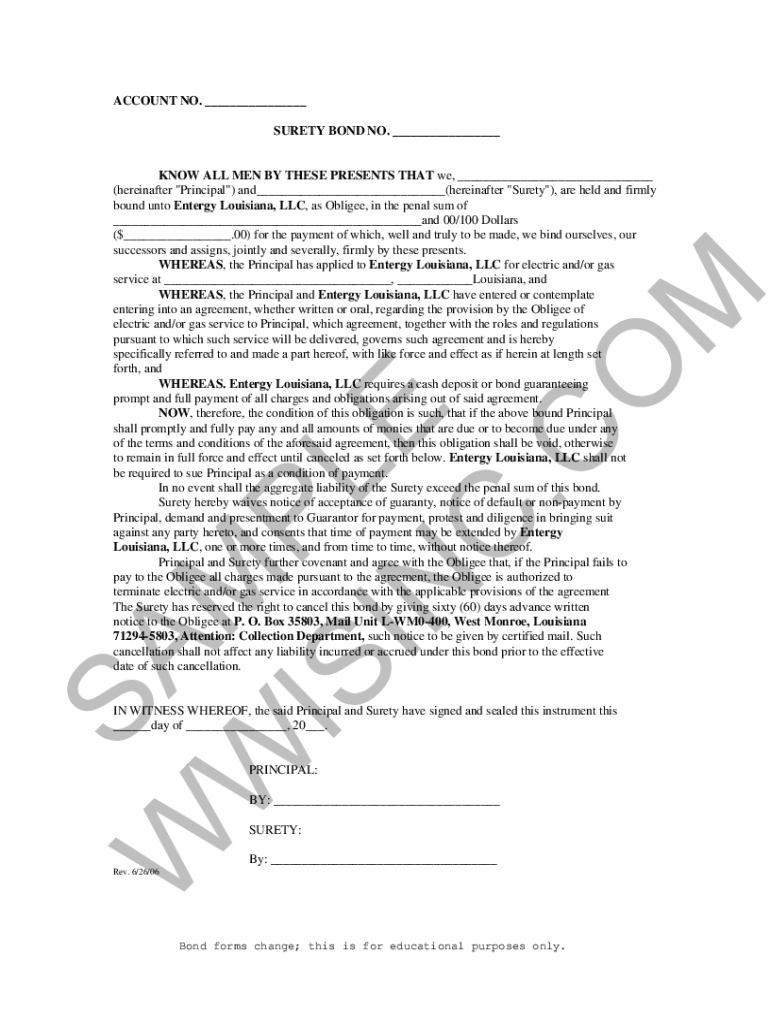

ACCOUNT NO. ___

SURETY BOND NO. ___S

W AM

W P

IS L

IN E

C. C

KNOW ALL MEN BY THESE PRESENTS THAT we, ___

(hereinafter \” Principal\”) and___(hereinafter \” Surety\”), are held and firmly

bound

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial assurance instrument- surety

Edit your financial assurance instrument- surety form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial assurance instrument- surety form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial assurance instrument- surety online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial assurance instrument- surety. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial assurance instrument- surety

How to fill out financial assurance instrument- surety

01

Obtain the financial assurance instrument form, also known as a surety bond form, from the relevant authority or agency.

02

Read and understand the instructions provided with the form to ensure compliance with the specific requirements.

03

Fill out the form accurately and completely, providing all the necessary information as requested.

04

Attach any supporting documents or evidence required by the form, such as financial statements or credit reports.

05

Review the completed form thoroughly to ensure all information is correct and there are no errors or omissions.

06

Sign and date the form as required, following any additional instructions provided.

07

Submit the filled-out financial assurance instrument to the appropriate authority or agency, along with any required fees or payments.

08

Keep a copy of the completed form and any supporting documents for your records.

09

Follow up with the authority or agency to confirm receipt of the form and to address any additional requirements or steps.

Who needs financial assurance instrument- surety?

01

Individuals or entities who require financial assurance in the form of surety may include:

02

- Contractors or construction companies participating in public or private projects

03

- Businesses or individuals applying for licenses or permits that require financial guarantees

04

- Financial institutions or lenders requiring surety bonds as a condition for extending credit

05

- Environmental or regulatory agencies that require financial security for compliance purposes

06

- Government bodies or departments overseeing certain industries or activities that mandate financial assurance

07

- Suppliers or vendors entering into contracts requiring performance bonds or guarantees

08

- Service providers or professionals seeking liability coverage as part of their professional indemnity insurance

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial assurance instrument- surety in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your financial assurance instrument- surety and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete financial assurance instrument- surety on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your financial assurance instrument- surety, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out financial assurance instrument- surety on an Android device?

Complete your financial assurance instrument- surety and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is financial assurance instrument- surety?

A financial assurance instrument, specifically a surety, is a contract among three parties: the principal (the party that needs the guarantee), the obligee (the party requiring the guarantee), and the surety (the party providing the guarantee). It ensures that the obligations of the principal will be met, and if they fail to do so, the surety will cover the costs.

Who is required to file financial assurance instrument- surety?

Entities that are required to file a financial assurance instrument in the form of a surety are typically those engaged in activities regulated by government agencies that require financial guarantees, such as companies in construction, environmental sectors, or other industries subject to specific regulatory requirements.

How to fill out financial assurance instrument- surety?

To fill out a financial assurance instrument for surety, one must provide detailed information including the identities of the principal and the surety, the obligations being secured, and the effective dates. Additionally, it may require signatures from all parties involved, ensuring all details align with the specific requirements set forth by the governing agency.

What is the purpose of financial assurance instrument- surety?

The purpose of a financial assurance instrument, such as a surety, is to provide a guarantee that a party will fulfill its contractual obligations. It serves as a financial safety net to protect the interests of the obligee in case the principal defaults.

What information must be reported on financial assurance instrument- surety?

On a financial assurance instrument of surety, information typically includes the names and addresses of the principal and surety, the bond amount, a description of the obligations covered, and the terms of the agreement. Additional documentation supporting the financial capacity of the surety may also be required.

Fill out your financial assurance instrument- surety online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Assurance Instrument- Surety is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.