Get the free SURETY BOND DEBT SETTLEMENT SERVICES PROVIDER

Show details

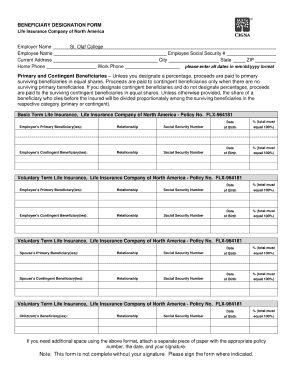

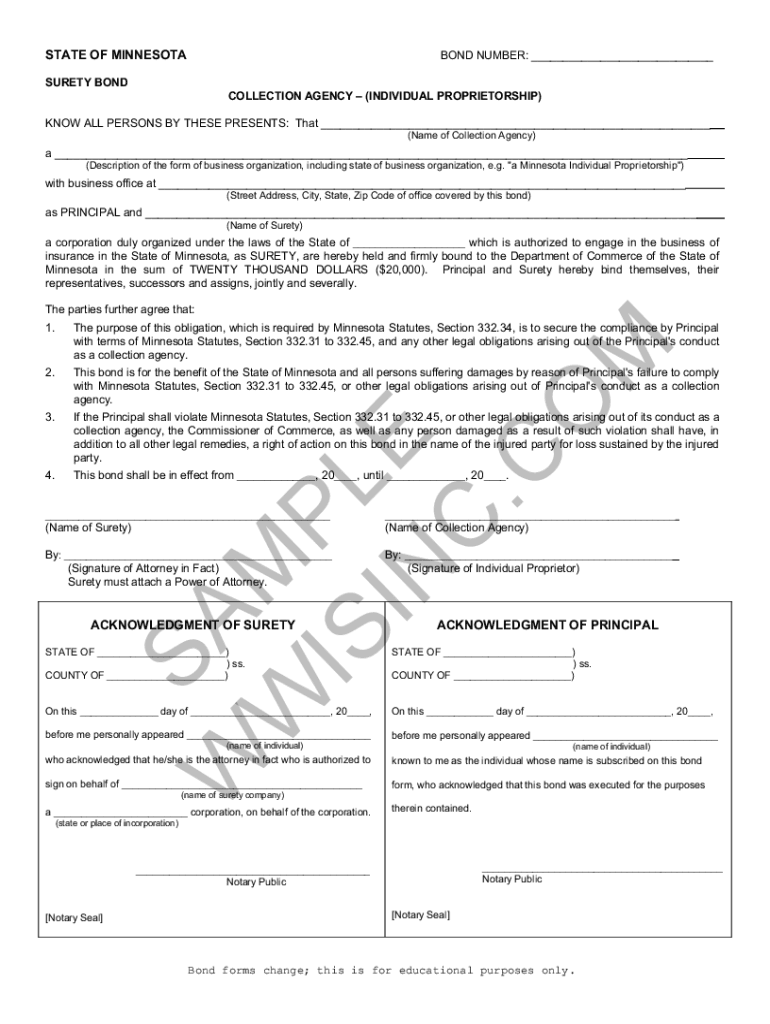

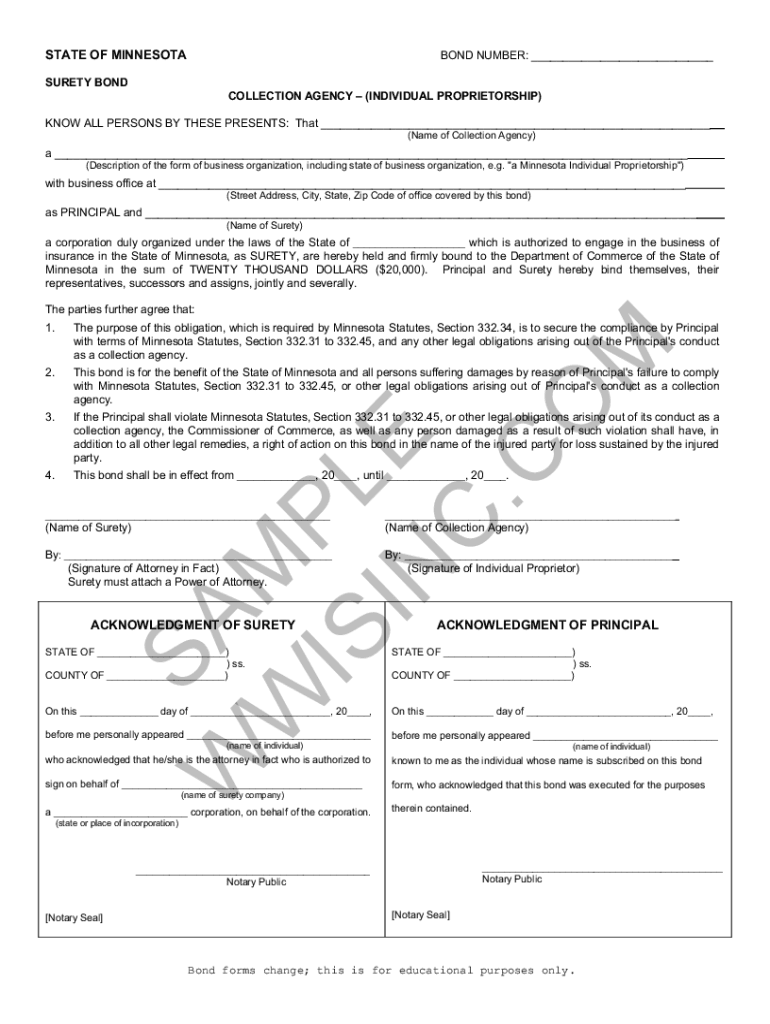

STATE OF MINNESOTAN NUMBER: SURETY BONDCOLLECTION AGENCY (INDIVIDUAL PROPRIETORSHIP)KNOW ALL PERSONS BY THESE PRESENTS: That (Name of Collection Agency)a (Description of the form of business organization,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond debt settlement

Edit your surety bond debt settlement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond debt settlement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing surety bond debt settlement online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit surety bond debt settlement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond debt settlement

How to fill out surety bond debt settlement

01

Step 1: Start by gathering all the necessary information and documents related to your debt settlement. This includes the details of the surety bond, the outstanding debt amount, and any correspondence with the creditor.

02

Step 2: Review the terms and conditions of the surety bond, as well as any applicable laws or regulations regarding debt settlement.

03

Step 3: Contact a reputable debt settlement company or attorney who specializes in surety bond debt settlement. They can guide you through the process and negotiate with the creditor on your behalf.

04

Step 4: Provide all the required information and documents to the debt settlement company or attorney. They will use this information to assess your financial situation and develop a repayment plan.

05

Step 5: If the creditor agrees to the proposed settlement, carefully review the settlement agreement before signing it. Make sure you understand all the terms and conditions, including any potential consequences or impact on your credit score.

06

Step 6: Once you've agreed to the settlement terms, follow the instructions provided by the debt settlement company or attorney to make the necessary payments. They will handle the distribution of funds to the creditor.

07

Step 7: Continue making the agreed-upon payments until the debt is fully settled. Keep records of all payments made and correspondences with the creditor for future reference.

08

Step 8: Regularly monitor your credit report to ensure that the debt settlement is accurately reflected and to identify any potential errors or discrepancies.

09

Step 9: Seek professional help or financial counseling if you encounter any challenges or difficulties during the debt settlement process. They can provide guidance and support to help you stay on track.

Who needs surety bond debt settlement?

01

Individuals or businesses who have a surety bond debt and are struggling to repay it may need surety bond debt settlement.

02

Those who are facing financial hardship, have a high debt burden, or are at risk of defaulting on their surety bond debt may benefit from debt settlement.

03

People who want to negotiate with their creditor to reach a more affordable and manageable repayment plan for their surety bond debt may also consider debt settlement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit surety bond debt settlement from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including surety bond debt settlement. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute surety bond debt settlement online?

Easy online surety bond debt settlement completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out surety bond debt settlement on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your surety bond debt settlement from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is surety bond debt settlement?

Surety bond debt settlement is a process through which individuals or businesses can negotiate and resolve debts related to surety bonds, often involving the reduction of the total debt amount owed.

Who is required to file surety bond debt settlement?

Typically, parties who have incurred debts from surety bonds, such as contractors, businesses, or individuals who are obligated under a surety agreement, are required to file for surety bond debt settlement.

How to fill out surety bond debt settlement?

To fill out a surety bond debt settlement form, individuals need to provide their personal or business information, details of the surety bond, the amount owed, and any payment proposals or settlement offers they wish to make.

What is the purpose of surety bond debt settlement?

The purpose of surety bond debt settlement is to reach an agreement on how to repay or alleviate certain debts tied to surety bonds, allowing parties to manage their financial obligations more effectively.

What information must be reported on surety bond debt settlement?

Surety bond debt settlement forms must report information such as the debtor's identification details, bond reference numbers, amounts owed, terms of repayment, and any specific circumstances surrounding the debt.

Fill out your surety bond debt settlement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond Debt Settlement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.